Marcello Minenna, (2018), “A look back: what Eurozone “risk sharing” actually meant”, Financial Times Alphaville, 10 Οκτωβρίου The common narrative is that rescue programs have helped deeply troubled countries avoid sovereign bankruptcy or widespread bank failures. But, by avoiding extreme outcomes, these programs also protected the banks of the core countries — Germany and France, in particular — that had accumulated huge exposures to the periphery before the crisis. At …Read More

The Long and Winding Road to Italy’s Budget

Fergal O’ Brien, (2018), “The Long and Winding Road to Italy’s Budget”, Bloomberg Europe, 13 Οκτωβρίου Italy’s government is sticking to its budget plans, ignoring the concerns of investors and a bond selloff that’s pushed its yield premium to a five-year high. Since announcing that the deficit ratio will widen to 2.4 percent of GDP next year, Deputy Prime Ministers Matteo Salvini and Luigi di Maio have rejected criticism by …Read More

One size does not fit all: European integration by differentiation

Maria Demertzis, Jean Pisani-Ferry, Andre Sapir, Thomas Wieser, and Guntram B. Wolff, (2018), “One size does not fit all: European integration by differentiation”, Bruegel, 19 Σεπτεμβρίου Reforming the governance of the European Union has become urgent for three reasons: to better deal with politically-sensitive topics, to manage greater external challenges and because future EU enlargement will increase the diversity of the bloc’s membership. The answer to disagreement typically has been …Read More

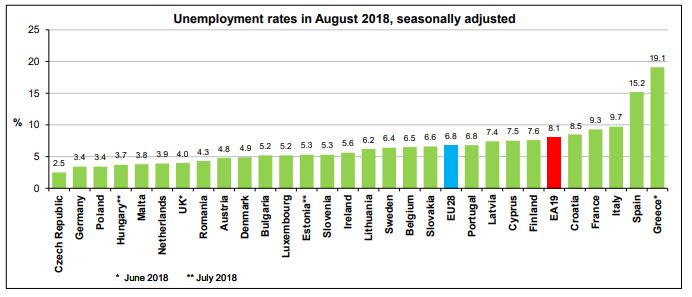

Euro area unemployment at 8.1%

Eurostat/Euro area unemployment at 8.1%/Οκτώβριος 2018 The euro area (EA19) seasonally-adjusted unemployment rate was 8.1% in August 2018, down from 8.2% in July 2018 and from 9.0% in August 2017. This is the lowest rate recorded in the euro area since November 2008. The EU28 unemployment rate was 6.8% in August 2018, stable compared with July 2018 and down from 7.5% in August 2017. This remains the lowest rate recorded in the EU28 …Read More

Fiscal Freedom in the Eurozone?

Lucrezia Reichlin, (2018), “Fiscal Freedom in the Eurozone?”, Project Syndicate, 1 Οκτωβρίου The budget represents the victory of Italy’s two deputy prime ministers – M5S’s Luigi Di Maio and the League’s Matteo Salvini – over the country’s independent, technocratic finance minister, Giovanni Tria, who had presented a more conservative proposal. Any illusion that the populist coalition could be kept in check by moderate cabinet members has now been destroyed. Italy’s …Read More

QE: A User’s Guide

Joseph E. Gagnon, Joseph E. Gagnon, (2018), “QE: A User’s Guide”, Policy Brief, PIIE, Οκτώβριος In recent years several major central banks have conducted large-scale purchases of long-term bonds and other financial assets to stimulate economic growth, boost employment, and raise inflation towards its targeted level. These policies have come to be known as quantitative easing (QE). Central banks turned to QE when they believed that further reductions in their conventional short-term policy interest rates were …Read More

Excess liquidity and bank lending risks in the euro area

Darvas Z. & D. Pichler, (2018), “Excess liquidity and bank lending risks in the euro area”, Bruegel, 26 Σεπτεμβρίου Excess liquidity (defined as all kinds of commercial bank deposits held by the Eurosystem minus the minimum reserve requirements) in the euro area exceeded €1,900 billion, or 17 percent of euro-area GDP, in September 2018. Holding such excess liquidity is costly for commercial banks, given that the currently negative (-0.4 percent) …Read More

The EU’s Multiannual Financial Framework and some implications for CESEE countries

Darvas Z., Wolff G., (2018), “The EU’s Multiannual Financial Framework and some implications for CESEE countries”, 12 Σεπτεμβρίου The European Union’s budget – which is fundamentally different from the budgets of federal countries and amounts to only about 1% of the EU’s gross national income – continues to be heavy on agricultural and cohesion spending. The literature shows that the EU’s common agricultural policy (accounting for 38% of EU spending …Read More

Η ΕΚΤ αναμένεται να χαμηλώσει τον πήχυ για την ανάπτυξη

Kathimerini.gr “Η ΕΚΤ αναμένεται να χαμηλώσει τον πήχυ για την ανάπτυξη”, 13 Σεπτεμβρίου Σύμφωνα με πληροφορίες του Bloomberg, στη σημερινή συνεδρίαση της ΕΚΤ οι οικονομολόγοι της κεντρικής τράπεζας θα αναθεωρήσουν ελαφρώς προς το χειρότερο την πρόβλεψη για την ανάπτυξη το διάστημα 2018-2020. Ως αιτία για την επιβράδυνση η ΕΚΤ προσδιορίζει την υποχώρηση της εξωτερικής ζήτησης λόγω της αβεβαιότητας που έχει προκαλέσει η αντιπαράθεση ΗΠΑ – Κίνας για το εμπόριο. Η …Read More

Monetary developments in the euro area: July 2018

ECB/Monetary developments in the euro area/Ιούλιος 2018 Annual growth rate of broad monetary aggregate M3 decreased to 4.0% in July 2018 from 4.5% in June (revised from 4.4%) Annual growth rate of narrower aggregate M1, comprising currency in circulation and overnight deposits, decreased to 6.9% in July from 7.5% in June Annual growth rate of adjusted loans to households stood at 3.0% in July, unchanged from previous month Annual growth …Read More