Kaletsky, Anatole, (2017), “A “Macroneconomic” Revolution?”, Project Syndicate, 19 Ιουλίου Next month will mark the tenth anniversary of the global financial crisis, which began on August 9, 2007, when Banque National de Paris announced that the value of several of its funds, containing what were supposedly the safest possible US mortgage bonds, had evaporated. From that fateful day, the advanced capitalist world has experienced its longest period of economic stagnation …Read More

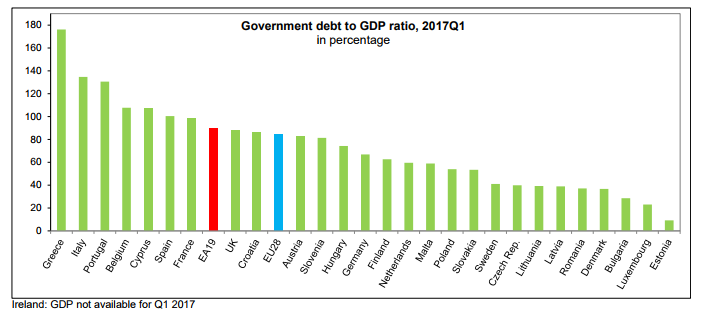

Government debt up to 89.5% of GDP in euro area

Eurostat/Government debt up to 89.5% of GDP in euro area/20 Ιουλίου 2017 At the end of the first quarter of 2017, the government debt to GDP ratio in the euro area (EA19) stood at 89.5%, compared with 89.2% at the end of the fourth quarter of 2016. In the EU28, the ratio also increased from 83.6% to 84.1%. Compared with the first quarter of 2016, the government debt to GDP …Read More

Change Is Coming at the ECB. Just Not Quickly.

Moss, Daniel, (2017), “Change Is Coming at the ECB. Just Not Quickly.”, Bloomberg View, 18 Ιουλίου The European Central Bank is wrestling with how to exit the super-accommodative policy that’s dominated Mario Draghi’s tenure as president. In trying to determine the path of this off-ramp, it might be instructive to look backward. To December of last year, to be precise. That’s when the ECB took what looks in retrospect like …Read More

The Re-Emerging Privilege of Euro Area Membership

Wiegand, Johannes, (2017), “The Re-Emerging Privilege of Euro Area Membership”, IMF Working Paper No. 17/162, 18 Ιουλίου When the euro was introduced in 1998, one objective was to create an alternative global reserve currency that would grant benefits to euro area countries similar to the U.S. dollar’s “exorbitant privliege”: i.e., a boost to the perceived quality of euro denominated assets that would increase demand for such assets and reduce euro …Read More

Workers of the Euro Area Rise Up and Ask for More Pay, Maybe

Tadeo, Maria, Look, Carolynn, (2017), “Workers of the Euro Area Rise Up and Ask for More Pay, Maybe”, Bloomberg Markets, 13 Ιουλίου Euro-area labor representatives are about to test whether the broadest economic growth in years can finally deliver a decent pay rise. Unions in the currency bloc’s largest nations, interviewed by Bloomberg this month, blame lackluster pay gains on dampened expectations among workers since the region’s financial crises, and …Read More

The Politics of Germany’s External Surplus

Fuest, Clemens, (2017), “The Politics of Germany’s External Surplus”, Project Syndicate, 17 Ιουλίου The debate about global macroeconomic imbalances is increasingly focusing on Germany’s current-account surplus and economic policy. Despite the vitality of the German economic engine, and the role it plays in fueling growth and maintaining stability in the eurozone, criticism of the country’s massive external surplus is mounting. As the Economist put it recently, Germany “saves too much and spends too little,” …Read More

Euro area international trade in goods surplus €21.4 bn

Eurostat/Euro area international trade in goods surplus €21.4 bn/14 Ιουλίου 2017 The first estimate for euro area (EA19) exports of goods to the rest of the world in May 2017 was €189.6 billion, an increase of 12.9% compared with May 2016 (€167.8 bn). Imports from the rest of the world stood at €168.1 bn, a rise of 16.4% compared with May 2016 (€144.4 bn). As a result, the euro area …Read More

Credit misallocation during the European financial crisis

Schivardi, Fabiano, Sette, Enrico, Tabellini, Guido, (2017), “Credit misallocation during the European financial crisis”, VoxEU, 18 Ιουλίου There is a widespread perception that under-capitalised banks can prolong crises by misallocating credit to weaker firms and restraining credit to healthy borrowers. This column explores the extent and consequences of credit misallocation in Italy during and after the Eurozone Crisis. Bank undercapitalisation may have been costly in terms of misallocation of capital and …Read More

EU Foreign Direct Investment flows

Eurostat, (2017), “EU Foreign Direct Investment flows”, 18 Ιουλίου According to preliminary results, Foreign Direct Investment (FDI) from the European Union (EU) to the rest of the world amounted to €186 billion in 2016, a sharp drop (-68%) compared with the €585 bn recorded in 2015. In the opposite direction, investment from the rest of the world into the EU stood at €280 bn, down by 41% compared with 2015 …Read More

Europe’s Junk-Bond Boom Triggers Alarm as Safety Nets Weakened

Linsel, Katie, (2017), “Europe’s Junk-Bond Boom Triggers Alarm as Safety Nets Weakened”, Bloomberg Markets, 17 Ιουλίου Europe’s booming junk bond market is provoking alarm among analysts who say investors are letting down their guard and risking future losses. Dutch department store operator Hema BV, home improvement retailer Maxeda DIY Holding BV and supercar maker McLaren Group are the latest in a string of companies that have sold bonds with weaker investor protections, known …Read More