De Mooij, R., Keen, M. & Perry, V. (2014) “Taking a bite out of Apple? Fixing international corporate taxation“, VoxEU Organisation, 14 Σεπτεμβρίου.

Multinational companies’ ability to pay little corporate income tax has grabbed headlines recently. This column argues that the details of international tax rules matter for macroeconomic performance – especially in low-income countries. This emphasises the importance of the G20–OECD Action Plan on Base Erosion and Profit Shifting. However, dealing properly with tax spillovers will require a deeper global debate about the international tax architecture itself.

It’s hard to pick up a newspaper these days (or, more likely for those reading this, do the digital equivalent) without reading about Apple, Amazon, Google, or a host of others managing, by some magic, to pay little corporate income tax – and the consequent outrage of duly shocked and horrified politicians. Entertaining though all this is, understanding the rules that make such tax avoidance possible is a dull task that many of us are happy to leave to the tax nerds – detail really matters (just ask an international tax lawyer). But the complexity of the underlying tax rules risks blinding us to their wider importance. A recent paper of ours with our colleagues at the IMF (IMF 2014) concludes that these seemingly impenetrable issues are not just fodder for good headlines, but also matter for macroeconomic performance (IMF 2014). And this is especially so for low-income countries – somewhat ironically, since these have been less to the fore in recent news headlines and policy actions. At one level, this further emphasises the importance of the current G20–OECD Action Plan on Base Erosion and Profit Shifting (OECD 2013). But the analysis also points to the need for a deeper rethinking of current tax policy designs – and for a deeper global debate about the international tax architecture itself.

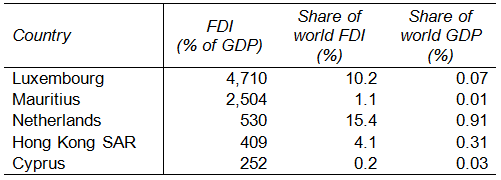

Table 1. FDI stocks relative to GDP – the world’s top five (2012)

Σχετικές αναρτήσεις:

- Bacchetta, P. & Benhima, K. (2014) “The role of corporate saving in global rebalancing“, VoxEU Organisation, 24 Αυγούστου.

- ICAP (2014) “Corporate Insolvencies in Europe, 2013/14“, Creditreform, Wirtschaftsforschung, Ιούλιος.

- Laeven, L. & Ratnovski, L. (2014) “Corporate governance of banks and financial stability“, VoxEU Organisation, 21 Ιουλίου.