Ali Abbas, S. M., Blattner, L., De Broeck, M., El-Ganainy, A. & Hu, M. (2014) “A 100-year perspective on sovereign debt composition in 13 advanced economies“, VoxEU Organisation, 27 Οκτωβρίου.

There has been renewed interest in sovereign debt since the Global Crisis, but relatively little attention has been paid to its composition. Sovereign debt can differ in terms of the currency it is denominated in, its maturity, its marketability, and who holds it – and these characteristics matter for debt sustainability. This column presents evidence from a new dataset on the composition of sovereign debt over the past century in 13 advanced economies.

Why sovereign debt composition matters

Academic, policy, and market interest in sovereign debt has spiked since the 2008 Global Crisis. Researchers have sought to place the post-Crisis synchronised build-up in sovereign debt ratios in advanced economies within a longer-term/historical context, drawing comparisons with debt surges during the Great Depression, debt consolidations in the aftermath of World War II, and more.1

However, this literature has largely abstracted from a discussion of sovereign debt ‘composition’, which, both theory and experience tell us, is central to questions of debt sustainability/management, optimal taxation, monetary policy, and even financial regulation.2 For instance, an inability to issue term debt in local currency is often described as ‘original sin’ (Eichengreen and Hausmann 2002, Eichengreen et al. 2003), which drives the high cost/riskiness of (higher yields on) emerging-market sovereign debt. Arslanalp and Tsuda (2012) have linked the holder profile of sovereign debt to countries’ ability to weather financial market stress. Reinhart and Sbrancia (2011) highlight the amenability of non-marketable debt to ‘liquidation’ during periods of financial repression. The recent wave of European sovereign debt crises has underscored the importance of debt maturity – countries with longer debt duration registered lower sovereign risk premia than others, despite higher debt and deficit levels (Abbas et al. 2014a).

The biggest obstacle to a proper historical treatment of sovereign debt composition, in our view, has been a lack of data. Debt structure data are simply not available in an easily accessible format across countries over long stretches of time. Our recent paper (Abbas et al. 2014c) seeks to address this data gap. Using official sources for individual countries – as well as some published cross-country datasets – we assemble a debt structure database spanning the period 1900–2011 and 13 advanced economies: Australia, Austria, Belgium, Canada, France, Germany, Ireland, Italy, the Netherlands, Spain, Sweden, the UK, and the US.

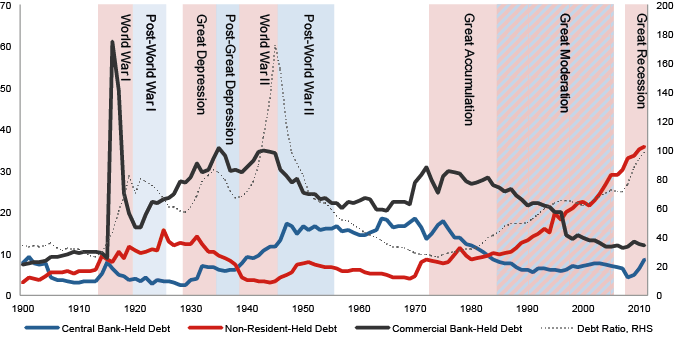

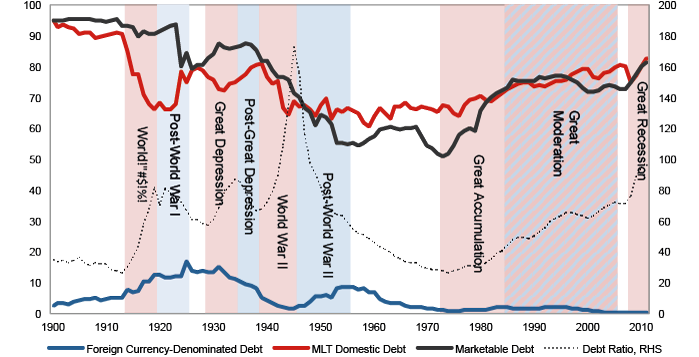

The dataset slices the sovereign debt pie along four dimensions: currency (foreign vs. local); maturity (local currency debt subdivided into short-term and medium-to-long-term); marketability; and holders (non-residents, national central bank, domestic commercial banks, and the rest). Because this is a first effort, we still report a number of gaps in our data, which reflect, in most cases, the lack of coverage on certain categories of debt (such as debt held by non-residents) or during certain stress periods (such as around the World Wars). Notwithstanding the gaps, the dataset offers insights into the evolution of debt structure over the past 11 decades, including around major sovereign stress events.

Figure 1. Central government debt composition by instrument and currency

Figure 2. Holder composition of central government debt

Σχετικές αναρτήσεις:

- Durden, D. (2014) “The Scariest Number Revealed Today: $1.114 Trillion In Eurozone Bad Debt“, ΘZeroHedge, 26 Οκτωβρίου.

- Reinhart, M. C., Trebesch, C. (2014) “Sovereign-debt relief and its aftermath: The 1930s, the 1990s, the future?“, VoxEU Organisation, 21 Οκτωβρίου.

- Joyce, P. J. (2014) “International Debt and Financial Crises“, Economonitor, 09 Οκτωβρίου.