IMF Country Report No. 15/72: ICELAND – STAFF REPORT FOR THE 2014 ARTICLE IV CONSULTATION AND FIFTH POST-PROGRAM MONITORING DISCUSSIONS, 16 Μαρτίου 2015.

KEY ISSUES

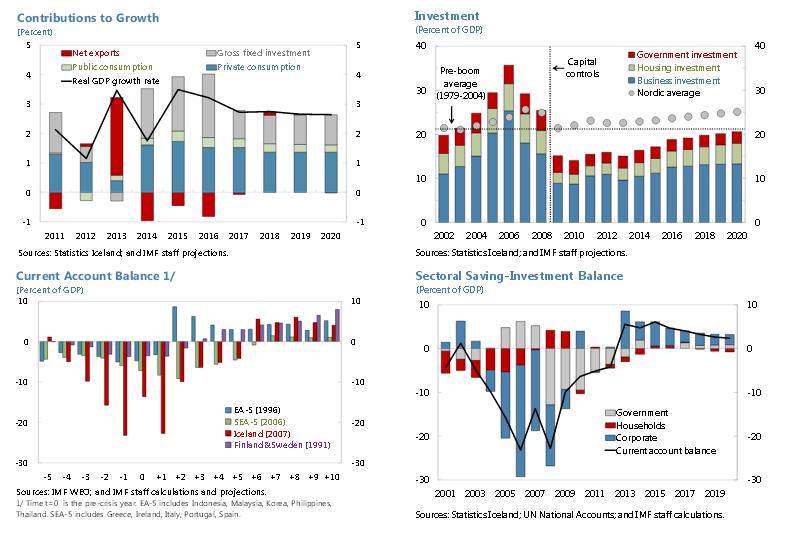

Iceland has reached a relatively strong macroeconomic position with good growth prospects. But crisis legacies are still being unwound, including high debt and a large balance of payments (BOP) overhang contained by capital controls. Amidst public pressure for a return to normalcy, policies remain geared towards addressing vulnerabilities, rebuilding buffers, and further strengthening key institutions.

The monetary policy stance has struck an appropriate balance, but is at a difficult juncture. The Central Bank of Iceland (CBI) will need to carefully balance deflationary pressures evident in goods prices against a closing output gap and potentially large wage increases in the upcoming bargaining round. The CBI should continue FX accumulation as conditions permit to smooth eventual BOP outflows. The CBI legislative framework review needs to support independence, accountability, and policy credibility.

With Iceland on-track to achieve core public finance objectives, fiscal policy is well positioned for a transition from consolidation to supporting higher potential growth. The budget is in surplus and public debt is on a downward sustainable path. The government is appropriately aiming to institutionalize its objectives with a proposed budget framework law. With crisis-legacy issues gradually subsiding, the medium-term fiscal policy mix should aim for higher growth, while considering distributional and external sector impacts.

Banking sector buffers have been rebuilt but gaps remain in bank supervision and financial safety nets. Faster progress is needed to strengthen deposit insurance, bank resolution, and emergency liquidity assistance frameworks. A permanent solution is needed for the loss-making government-owned Housing Financing Fund (HFF).

Progress in these areas will provide supportive conditions for successful capital account liberalization and external financial reintegration. The authorities expect significant progress in the coming months in finalizing and implementing an updated liberalization strategy. The updated strategy should aim to preserve stability and be backed by supportive macroeconomic and financial sector policies.

Σχετικές αναρτήσεις:

- Joyce, P. J. (2014) “The IMF and Sovereign Debt“, Economonitor–A Roubini Global Economics Project, 09 Σεπτεμβρίου.

- Mitchell, B. (2014) “IMF attacks the Stability and Growth Pact“, Bill Mitchell Blog, 26 Ιουνίου.

- Schadler, S. (2014) “The IMF’s preferred creditor status: Questions after the Eurozone crisis”, VoxEU Organisation, 28 Απριλίου.