Pastore, Francesco, (2017), “Getting It Right: Youth Employment Policy within the EU”, IZA Institute of Labor Economics, Policy Paper Series, IZA Policy Paper No.127, May This essay discusses the determinants of youth unemployment within the EU and then the alternative policy options currently at stake. We argue that youth unemployment regards especially some peripheral EU countries and is due to a mix of factors that should be addressed more vigorously, …Read More

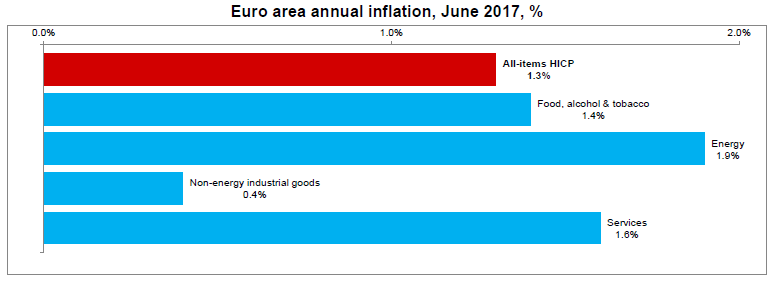

Euro area annual inflation down to 1.3%

Eurostat/Euro area annual inflation down to 1.3%/30 June 2017 Euro area annual inflation is expected to be 1.3% in June 2017, down from 1.4% in May 2017, according to a flash estimate from Eurostat, the statistical office of the European Union. Looking at the main components of euro area inflation, energy is expected to have the highest annual rate in June (1.9%, compared with 4.5% in May), followed by services …Read More

A Complementary Tool to Monitor Fiscal Stress in European Economies

Pamies Sumner, Stéphanie, Berti, Katia, (2017), “A Complementary Tool to Monitor Fiscal Stress in European Economies”, European Commission, Directorate-General for Economic and Financial Affairs Discussion Paper No 049, June This paper presents an indicator of fiscal distress for European economies based on a multivariate regression analysis (logit modelling, the L1 indicator) and on a recently updated dataset of fiscal stress episodes. This indicator presents some interesting features: relying on a …Read More

Economic Bulletin Issue 4

European Central Bank, (2017), “Economic Bulletin”, Issue 4, June At its monetary policy meeting on 8 June 2017, the Governing Council concluded that a very substantial degree of monetary accommodation is still needed for underlying inflation pressures to build up and support headline inflation in the medium term. The information that has become available since the previous monetary policy meeting in late April confirms a stronger momentum in the euro …Read More

Financial globalisation, monetary policy spillovers and macro-modelling: tales from 1001 shocks

Georgiadis, Georgios, Jančoková, Martina, (2017), “Financial globalisation, monetary policy spillovers and macro-modelling: tales from 1001 shocks”, ECB, June A salient feature of the global economy since the 1990s has been the dramatic rise of financial globalisation. Whether measured by capital flows or indicators reflecting the extent of legal capital account restrictions, economies’ financial markets have been exhibiting an increasing degree of interdependence. As a result, the global economy has become …Read More

Implications of the Expanding Use of Cash for Monetary Policy

Gros, Daniel, (2017), “Implications of the Expanding Use of Cash for Monetary Policy”, Centre for European Policy Studies (CEPS), 20 June Financial innovation seems to have had little impact on the oldest medium of transaction, namely cash. The ratio of currency in circulation to GDP has increased in most countries, independently of the continuing spread of cashless transactions. Currency is part of the monetary base. Its increase thus leads to …Read More

When do countries implement structural reforms?

Da Silva, Antonio Dias, Givone, Audrey, Sondermann, David, (2017), “When do countries implement structural reforms?” , ECB, June The objective of this paper is to investigate which factors ‐ macroeconomic, policy‐related or institutional ‐ foster the implementation of structural reforms. To this objective, we look at episodes of structural reforms over three decades across 40 OECD and EU countries and link them to such factors. Our results suggest that structural reforms implementation is more …Read More

The leverage ratio, risk-taking and bank stability

Smith, Jonathan Acosta, Grill, Michael, Lang, Jan Hannes, (2017), “The leverage ratio, risk-taking and bank stability” , ECB, June This paper addresses the trade-off between additional loss-absorbing capacity and potentially higher bank risk-taking associated with the introduction of the Basel III Leverage Ratio. This is addressed in both a theoreti-cal and empirical setting. Using a theoretical micro model, we show that a leverage ratio requirement can incentivise banks that are bound …Read More

Income inequality and growth in Europe: key role for national policies

Darvas, Zsolt, (2017), “Income inequality and growth in Europe: key role for national policies”, Bruegel, 29 May The literature is inconclusive whether income inequality is good or bad for growth and job creation. Offering opportunity for all segments of the population is crucial and income inequality might reduce social mobility. Income inequality in the EU is at a much lower level than in most other parts of the world, but …Read More

A new approach to governance and integration in EMU for an optimal use of economic policy framework – priority to financial union

Papaspyrou, Theodoros, S., (2017), “A new approach to governance and integration in EMU for an optimal use of economic policy framework – priority to financial union”, Bank of Greece Working Paper 229, June This paper proposes a new approach to EMU governance and integration consisting of the following elements: (i) an optimal use of the existing EU institutional framework for economic, fiscal and financial policies is necessary and possible at …Read More