Gros, Daniel, (2017), “Implications of the Expanding Use of Cash for Monetary Policy”, Centre for European Policy Studies (CEPS), 20 June Financial innovation seems to have had little impact on the oldest medium of transaction, namely cash. The ratio of currency in circulation to GDP has increased in most countries, independently of the continuing spread of cashless transactions. Currency is part of the monetary base. Its increase thus leads to …Read More

When do countries implement structural reforms?

Da Silva, Antonio Dias, Givone, Audrey, Sondermann, David, (2017), “When do countries implement structural reforms?” , ECB, June The objective of this paper is to investigate which factors ‐ macroeconomic, policy‐related or institutional ‐ foster the implementation of structural reforms. To this objective, we look at episodes of structural reforms over three decades across 40 OECD and EU countries and link them to such factors. Our results suggest that structural reforms implementation is more …Read More

Domestic and global drivers of inflation in the euro area

ECB, (2017), “Domestic and global drivers of inflation in the euro area” , ECB, June This article discusses the role of domestic and global drivers of inflation in the euro area and whether and how their relative importance has changed over time. Domestic price pressures result mainly from wage and price-setting behaviour, which is closely linked to the domestic business cycle. In respect of external drivers, import prices – especially of …Read More

The leverage ratio, risk-taking and bank stability

Smith, Jonathan Acosta, Grill, Michael, Lang, Jan Hannes, (2017), “The leverage ratio, risk-taking and bank stability” , ECB, June This paper addresses the trade-off between additional loss-absorbing capacity and potentially higher bank risk-taking associated with the introduction of the Basel III Leverage Ratio. This is addressed in both a theoreti-cal and empirical setting. Using a theoretical micro model, we show that a leverage ratio requirement can incentivise banks that are bound …Read More

Deepening the Economic and Monetary Union: What the Commission missed in its reflection paper

Marelli, Enrico, Signorelli, Marcello, (2017), “Deepening the Economic and Monetary Union: What the Commission missed in its reflection paper”, LSE EUROPP, 20 June The European Commission’s recent reflection paper on deepening economic and monetary union raises several key questions about the past and future of the Eurozone. The paper certainly represents a positive contribution to the ongoing process of European integration, after the impasse caused by the deep and prolonged …Read More

Income inequality and growth in Europe: key role for national policies

Darvas, Zsolt, (2017), “Income inequality and growth in Europe: key role for national policies”, Bruegel, 29 May The literature is inconclusive whether income inequality is good or bad for growth and job creation. Offering opportunity for all segments of the population is crucial and income inequality might reduce social mobility. Income inequality in the EU is at a much lower level than in most other parts of the world, but …Read More

Turning Germany’s ‘bad’ trade surplus into a good experience for all (including Germans)

Mattern, Frank, Mischke, Jan, (2017), “Turning Germany’s ‘bad’ trade surplus into a good experience for all (including Germans)”, VoxEU, 21 June Germany’s large trade surplus is once again at the centre of controversy. This column argues that instead of being on the defensive about its competitive exports, Germany should look to reduce its current account surplus by making itself more competitive in the long term through smart investment in digital …Read More

A new approach to governance and integration in EMU for an optimal use of economic policy framework – priority to financial union

Papaspyrou, Theodoros, S., (2017), “A new approach to governance and integration in EMU for an optimal use of economic policy framework – priority to financial union”, Bank of Greece Working Paper 229, June This paper proposes a new approach to EMU governance and integration consisting of the following elements: (i) an optimal use of the existing EU institutional framework for economic, fiscal and financial policies is necessary and possible at …Read More

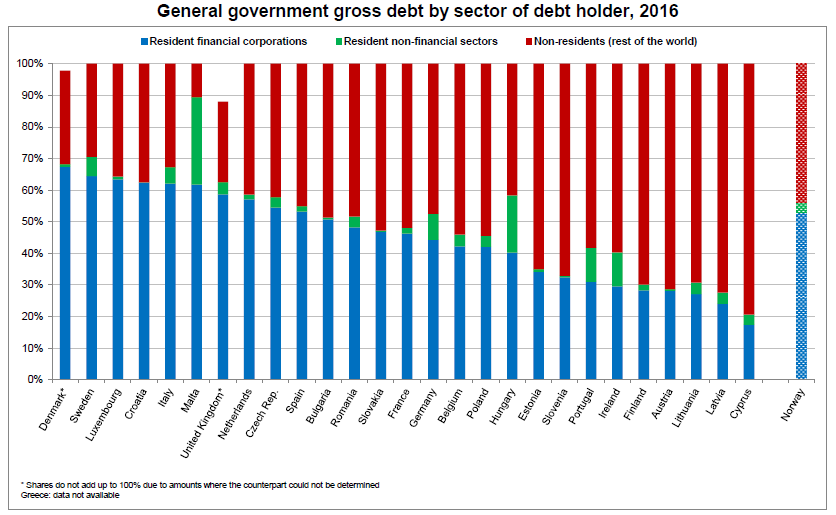

Debt mainly held by non-residents in half of the EU Member States

Eurostat/Debt mainly held by non-residents in half of the EU Member States/20 June 2017 Significant differences can be observed across the European Union (EU) regarding the sector in which government debt is held. Among Member States for which data are available, the share of public debt held by non-residents in 2016 was highest in Cyprus (79%), followed by Latvia (72%), Austria (71%), Finland (70%) and Lithuania (69%). In contrast, the …Read More

Estimating the impact of shocks to bank capital in the euro area

Kanngiesser, Derrick, Martin, Reiner, Maurin, Laurent, Moccero, Diego, (2017), “Estimating the impact of shocks to bank capital in the euro area”, ECB, June We contribute to the empirical literature on the impact of shocks to bank capital in the euro area by estimating a Bayesian VAR model identified with sign restrictions. The variables included in the VAR are those typically used in monetary policy analysis, extended to include aggregate banking …Read More