European Commission (2014) “Tax reforms in EU Member States 2014 – Tax policy challenges for economic growth and fiscal sustainability – 2014 Report“, Directorate General for Economic and Financial Affairs (ECFIN) and Directorate General for Taxation and Customs Union (TAXUD), European Economy 6/2014, Νοέμβριος.

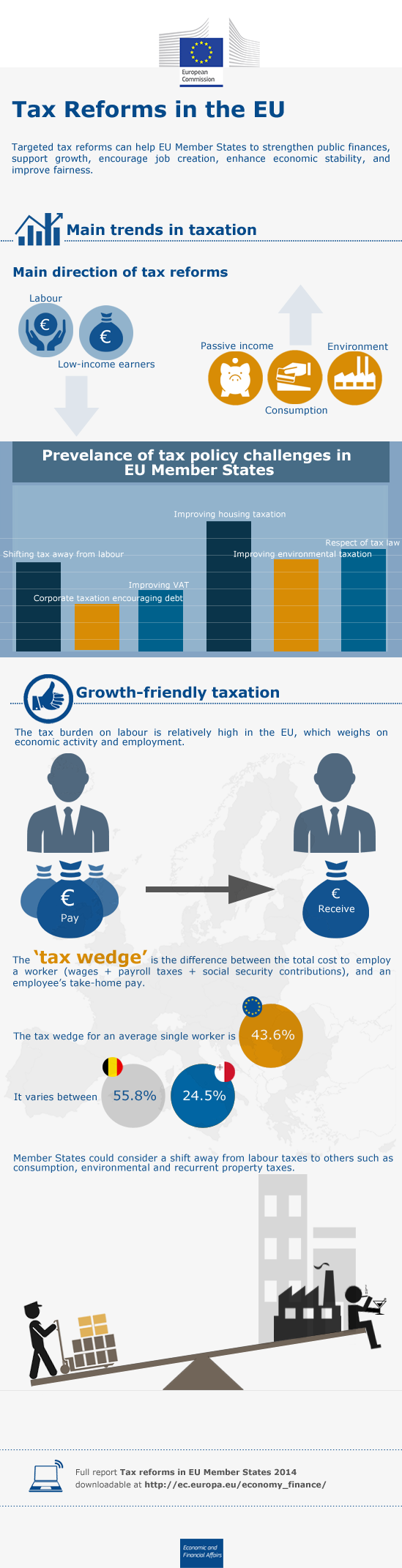

Tax reforms in EU Member States to improve the effectiveness and efficiency of tax systems can contribute to the stability of public finances; boost economic growth, employment and competitiveness; and improve social fairness.

Applying an indicator-based approach, this report identifies the tax policy challenges faced by the EU’s Member States. First, it examines the role that taxation can play in addressing consolidation needs and explores ways to make tax structures more growth-friendly. The tax burden on labour in the EU is relatively high. Reducing this burden, for example by shifting to other revenue bases less detrimental to growth, can have positive consequences on growth and employment.

Second, it takes an in-depth look at the size of tax bases, analysing housing taxation, the debt bias in corporate taxation, tax expenditures in direct taxation and the VAT base.

The report also assesses three specific areas of tax policy – environmental taxes, tax compliance and governance, and the link between the tax system and income equality – and points to opportunities to improve them.

Prepared jointly by the European Commission’s Directorate General for Economic and Financial Affairs and the Directorate General for Taxation and Customs Union ‘Tax Reforms in EU Member States’ is an annual review of the most important tax reforms recently implemented by EU governments.

Σχετικές αναρτήσεις:

- Doing Business 2015: Going Beyond Efficiency, Comparing Business Regulations for Domestic Firms in 189 Economies, A World Bank Group Flagship Report, 29 Οκτωβρίου.

- Turrini, A., Koltay, G., Pierini, F., Goffard, C. & Kiss, A. (2014) “European Economy: a Decade of Labour Market Reforms in the EU – Insights from the LABREF Database“, Economic Papers 522, European Commission – Economic and Financial Affairs, Ιούνιος.

- Hatzis, A. (2013) “Greece’s Reforms Have Only Cracked the Surface“, The Wall Street Journal, 05 December.