Edwards, S. (2015) “Sovereign default and debt restructuring: Was Argentina’s ‘haircut’ excessive?“, VoxEU Organisation, 04 Μαρτίου.

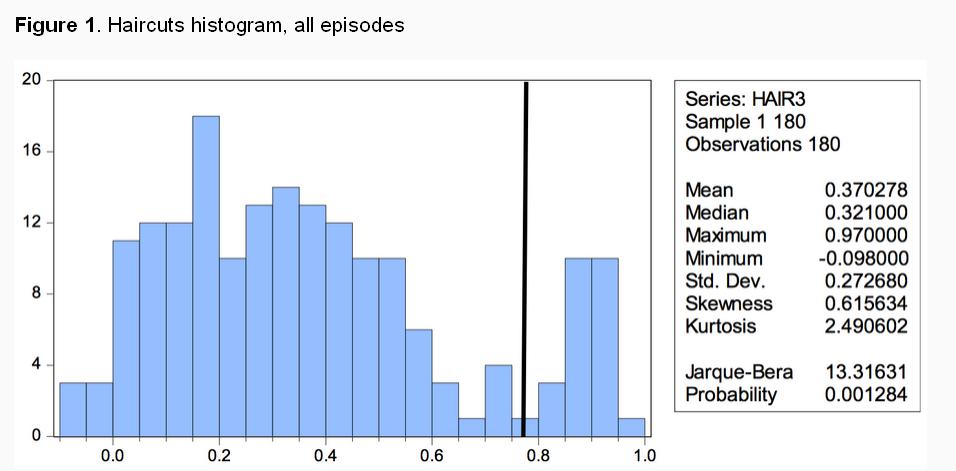

There were 24 sovereign defaults and debt restructurings between 1997 and 2013. Using data on 180 debt restructurings – for both sovereign bonds and sovereign syndicated bank loans – this column argues that the roughly 75% ‘haircut’ Argentina imposed on its creditors in 2005 was an outlier. Greece’s ‘haircut’ of roughly 64% in 2012, by contrast, was in line with previous experience.

Between 1997 and 2013 there were 24 sovereign bond defaults and debt restructurings in the global economy. According to Moody’s (2013: 6):

“[T]he losses imposed on creditors in sovereign restructurings have frequently been very large… Further, the variation around the average sovereign loss has been extremely high – losses have varied from as low as 5% to as high as 95%.”

What explains these large differences in ‘haircuts’? Why, for example, did investors in Uruguayan bonds suffer a 7% haircut in 2003, while those that had invested in neighbouring Argentina had losses in excess of 75% in 2005?

Σχετικές αναρτήσεις:

- Στράτος Δ. Καμενής: Vulture Funds and the Sovereign Debt Market: Lessons from Argentina and Greece, Παρατηρητήριο για την Κρίση, Ερευνητικό Κείμενο Νο.13, 11 Σεπτεμβρίου 2014.

- Mercille, J. (2013) “European Media Distort the Lessons of Argentina’s Crisis and Recovery“, Social Europe Journal, 07 Οκτωβρίου.

- Kiguel, M. (2011) “Argentina and Greece: More similarities than differences in the initial conditions“, VoxEU Organisation, 17 Αυγούστου.