Holter, H., Krueger, D. & Stepanchuk, S. (2015) “Tax progressivity and the government’s ability to collect additional tax revenue“, VoxEU Organisation, 20 February.

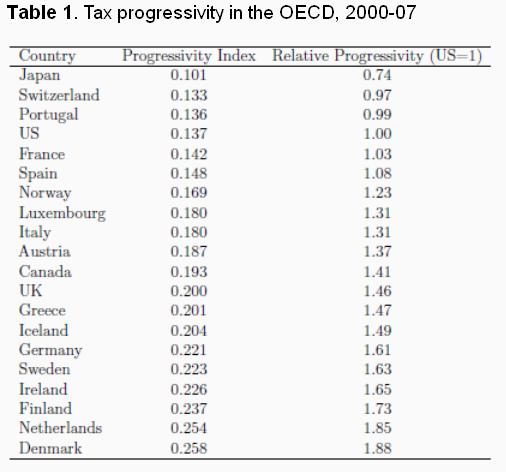

Since the Global Crisis, debt sustainability has received increasing attention. This column argues that the maximum sustainable debt level depends negatively on the progressivity of the tax system. The authors estimate that the US is still relatively far from the peak of its Laffer curve and from its maximally sustainable debt level. However, adopting a flat tax would raise the maximum sustainable debt from 330% to more than 350% of benchmark GDP, whereas adopting Danish-style progressivity would lower it to less than 250%.

The recent massive expansion of public debt around the world during the Great Recession raises the question how much debt a government can maximally service by raising the level of taxes. Or, to phrase this classic public finance question differently, how much additional tax revenue can the government generate by increasing income taxes? The idea that total tax revenues are a single-peaked function of the level of tax rates dates back to at least Arthur Laffer, and the plot of total tax revenues against the average tax has been known as the ‘Laffer curve’ ever since.

Deriving the Laffer curve for a specific economy (a country or collection of countries) is difficult on purely empirical grounds, since the time-series variation of the tax rate for a given country is typically small, and might not include tax rates close to the one maximising tax revenue. Therefore economists have typically relied on using models of the macroeconomy as laboratories in which the level of taxes can be varied in counterfactual experiments and the relationship between tax rates and tax revenues can be traced out, either analytically or with the use of computer simulations.

In a recent influential paper, Matthias Trabandt and Harald Uhlig (2011) numerically characterise Laffer curves for the US and the EU14. They find that the peak of the labour income tax Laffer curve in both regions is located between an average tax rate of 50% and 70%, depending on the country and the parameterisations of the model. They also find that the US can increase labour income tax revenues by 30%, and the EU14 only by 8%. According to their analysis, some of the European countries, such as Denmark and Sweden, find themselves very close to the top of their respective Laffer curves, and can increase their labour income tax revenues only by 1%.

Relevant posts:

- Gaillard, E. & Straathof, B. (2015) “Will R&D tax incentives get Europe growing again?“, VoxEU Organisation, 20 January.

- Mitchell, B. (2014) “Solving tax avoidance will not cure the Eurozone of stagnation“, Bill Mitchell Blog, 15 December.

- European Commission (2014) “Tax reforms in EU Member States 2014 – Tax policy challenges for economic growth and fiscal sustainability – 2014 Report“, Directorate General for Economic and Financial Affairs (ECFIN) and Directorate General for Taxation and Customs Union (TAXUD), European Economy 6/2014, November.