Gaspar, V. (2015) “Fiscal Policy And Structural Reform“, iMFdirect, 27 March.

One of the big questions to emerge from the global financial crisis, especially in the euro area, is how to raise a country’s potential growth while restoring healthy public finances. For example, the euro area— despite some favorable news recently — faces marked-down growth prospects alongside high levels of public debt. The combination of high debt and tepid potential growth underscores the importance of improving prospects for sustained growth and safe and resilient public finances. A fundamental question then arises: what is the relation between fiscal consolidation and structural reform?

Clearly, fiscal structural reform can help build sound, strong, resilient and growth-friendly fiscal institutions. One example is provided by letting automatic stabilizers – the fiscal automatic shock absorbers – work in both directions to help smooth fluctuations in economic activity. Increased stability, in turn, has a surprisingly strong impact on economic growth (look for our spring edition of the IMF’s Fiscal Monitor, to be issued on April 8 for more details). But, more generally, fiscal frameworks are a crucial part of macroeconomic risk management, as discussed in my recent blog on “Dams and Dikes for Public Finances”. Prudent conduct of fiscal policy is a cornerstone for stable and sustainable growth.

There are at least three further roles that fiscal policy can play in supporting growth. First, structural reform may rely on fiscal instruments for its implementation. Second, fiscal policy can help bring about political consensus for structural reform. Third, fiscal policy can help manage the timing of the benefits of reform, facilitating the transition. Labor market reform illustrates these three roles.

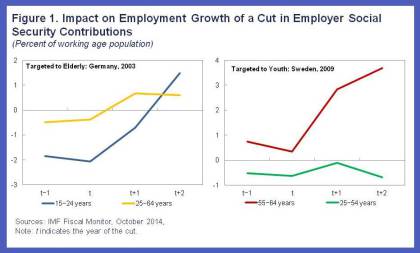

Labor market reform may use fiscal instruments. Reducing labor taxes and social security contributions can positively impact employment and economic activity. While there are direct budgetary costs, these can be reduced by targeting reductions to specific groups. Figure 1 illustrates the effectiveness of targeted employer social security contributions—for the elderly in the case of Germany and youth in the case of Sweden—as employment growth in the targeted segments outpaced that of the broader population.

Relevant posts:

- Buti, Μ. & Carnot, Ν. (2015) “What is a ‘responsible’ fiscal policy today for Europe?“, VoxEU Organisation, 24 February.

- Mitchell, B. (2014) “The inexact science of calibrating fiscal policy“, Bill Mitchell Blog: Modern Monetary Theory … macroeconomic reality, 02 December.

- Wren-Lewis, S. (2014) “Why We Need Our Fiscal Policy Instrument Back, Social Europe Journal, 24 November.