OECD tax burdens on wages rising without tax rate increases, OECD Publications, April 2015.

Taxes on wages have risen by about 1 percentage point for the average worker in OECD countries between 2010 and 2014 even though the majority of governments did not increase statutory income tax rates, according to a new OECD report.

Taxing Wages 2015 says the tax burden has increased in 23 OECD countries and fallen in 10 during this period.

Most of the increased tax resulted from wages has resulted from wages rising faster than tax allowances and credits. In 2014, only seven countries had higher statutory income tax rates for workers on average earnings than in 2010, and in six countries they were lower.

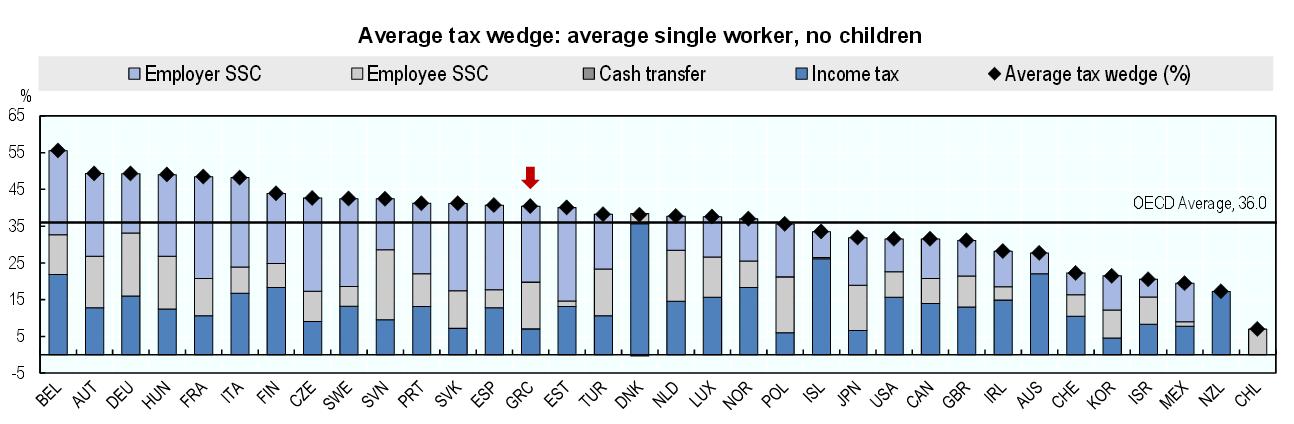

In 2014, the tax burden on the average worker across the OECD increased by 0.1 of a percentage point to 36.0%, even though no OECD country increased its statutory income tax rates on the average worker. The tax burden increased in 23 of the 34 OECD countries, fell in nine and remained unchanged in two.

Taxing Wages 2015, provides cross-country comparative data on income tax paid by employees as well as the associated social security contributions made by employees and employers; both are key factors when individuals consider their employment options and businesses make hiring decisions.

The tax and social security contribution burden is measured by the ‘tax wedge’ – or the total taxes paid by employees and employers, minus family benefits received as a percentage of the total labour costs of the employer.

This year’s report contains a special chapter on labour income in five major non-OECD economies: Brazil, China, India, Indonesia and South Africa. The analysis shows that there is significant variation between these countries. In 2013, tax wedges in Brazil and China for the average single worker were similar to those observed in many OECD countries. In contrast, employees in India, Indonesia and South Africa faced tax wedges that were much lower than in the vast majority of OECD economies.

The mix of labour taxes also varies across these non-OECD countries with social security contributions comprising the bulk of the tax burden measures for the model households that are covered in four of the five countries, with South Africa being the exception.

One of the most striking findings of this analysis is that unlike the vast majority of OECD countries, family payments play very little or no role in reducing the tax burden on workers with children in these non-OECD economies.

Tax burden trends between 2000 and 2014 – Data on Greece

- In Greece, the tax wedge for the average single worker increased by 1.3percentage points from 39.1% to 40.4% between 2000 and 2014. During the same period, the average tax wedge across the OECD decreased by 0.7 percentage points from 36.7% to 36.0%.

- In Greece, there has been considerable volatility in the tax wedge for the average single worker since 2010. Most notably, there was an increase of 3.1percentage points between 2010 and 2011 and there has been a subsequent decrease of 2.8 percentage points since 2011.

Relevant posts:

- Organisation for Economic Co-operation and Development (OECD) PHASE 3bis Report on Implementing the OECD Anti-Bribery Convention in Greece, March 2015.

- OECD: Interim Global Economic Assessment, OECD Publications, September 2014.