Rebecca Christie, (2019), «Scholz’s improved plan to complete the banking union», Bruegel, 14 November Olaf Scholz wrote in the Financial Times of an “undeniable” need to deepen the euro area banking union. With London on the verge of departure, the European Union will lose its biggest financial hub and come face to face with the shortcomings of its homegrown financial architecture. Related Posts Voxeu, (2019), «Potential output and EU fiscal surveillance», 23 …Read More

The impact of negative interest rates on banks and firms

Carlo Altavilla, Lorenzo Burlon, Mariassunta Giannetti, Sarah Holton, (2019), «The impact of negative interest rates on banks and firms», VoxEU, 8 November Economists and policymakers continue to question the effectiveness of monetary policy when an economy faces near-zero or sub-zero interest rates. Sceptics argue that central banks cannot stimulate lending, and may indeed decrease the loan supply, by setting negative interest rates. Related Posts Καθημερινή, (2019), «Αδιέξοδο για κεντρικές τράπεζες …Read More

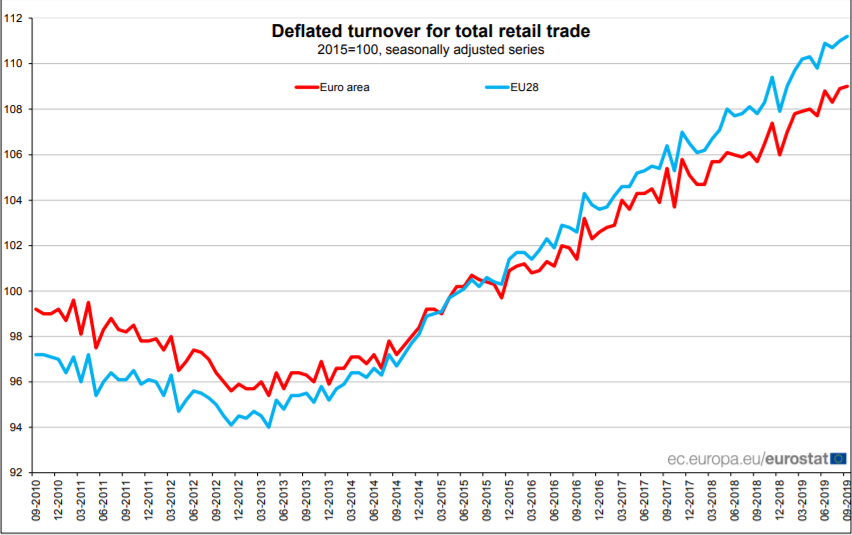

Volume of retail trade up by 0.1% in euro area

Eurostat, (2019), «Volume of retail trade up by 0.1% in euro area», 6 November In September 2019 compared with August 2019, the seasonally adjusted volume of retail trade increased by 0.1% in the euro area (EA19) and by 0.2% in the EU28, according to estimates from Eurostat, the statistical office of the European Union. In August 2019, the retail trade volume increased by 0.6% in the euro area and by …Read More

A digital euro to save EMU

Thomas Mayer, (2019), «A digital euro to save EMU», VoxEU, 6 November The desire to avoid credit and investment boom-bust cycles has led some to advocate replacing money creation through bank credit extension with direct money issuance by the central bank or a private entity, or linking money to an existing asset. Related Posts Project Syndicate, (2019), «The Monetarist Era is Over», 31 October Voxeu, (2019), «Right here, right now: The quest …Read More

Taming the global financial cycle: Central banks and the sterilisation of capital flows in the first era of globalisation

Guillaume Bazot, Eric Monnet, Matthias Morys, «Taming the global financial cycle: Central banks and the sterilisation of capital flows in the first era of globalisation», VoxEU, 2 November Countries wish to reap the benefits of financial integration while shielding themselves from the vagaries of international financial markets. Can they have it both ways? A large body of work acknowledges the constraints of a trilemma, pointing out that a fixed-exchange rate regime …Read More

Liquidity linkages in European sovereign bond markets can amplify fundamental economic shocks

Daragh Clancy, Peter G Dunne, Pasquale Filiani, (2019), «Liquidity linkages in European sovereign bond markets can amplify fundamental economic shocks». VoxEU, 4 November Stable sovereign bond markets are crucial to a well-functioning economy and financial system. But despite the importance of amplifications of sovereign bond market tensions related to flights-to-safety and sudden liquidity contractions, there is little direct empirical evidence of the transmission channels through which such catalysts for amplification …Read More

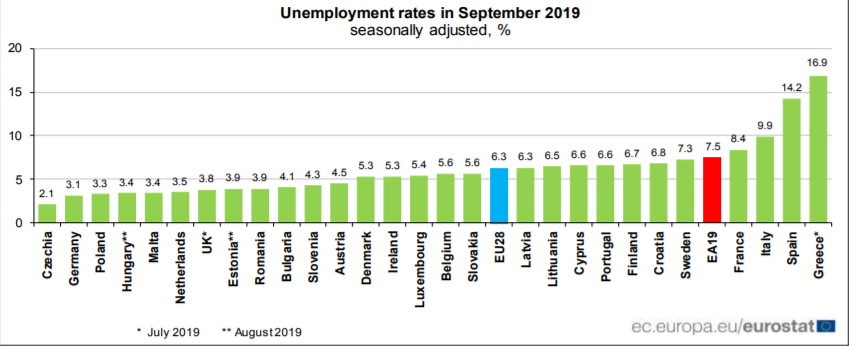

Euro area unemployment at 7.5%

Eurostat, (2019), «Euro area unemployment at 7.5%», 31 October The euro area (EA19) seasonally-adjusted unemployment rate was 7.5% in September 2019, stable compared with August 2019 and down from 8.0% in September 2018. This is the lowest rate recorded in the euro area since July 2008. The EU28 unemployment rate was 6.3% in September 2019, stable compared with August 2019 and down from 6.7% in September 2018. This remains the …Read More

The Monetarist Era is Over

Anatole Kaletsky, (2019), «The Monetarist Era is Over», Project Syndicate, 31 October Central bankers have been the first to recognize that the effectiveness of monetary policy in managing demand and stabilizing economic cycles has reached its limits. The problem is that many politicians and academic economists remain in denial. Related Posts Project Syndicate, (2019), «The Allure and Limits of Monetized Fiscal Deficits» 28 October Voxeu, (2019), «Right here, right now: The quest …Read More

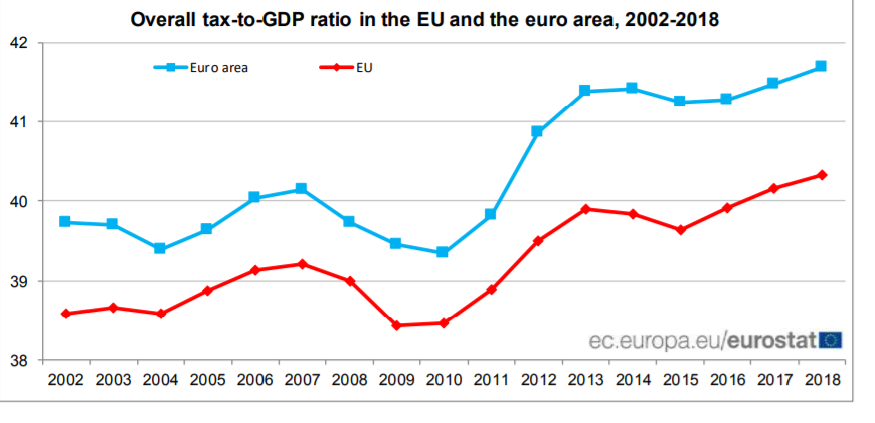

Tax-to-GDP ratio up to 40.3% in EU

Eurostat, (2019) «Tax-to-GDP ratio up to 40.3% in EU», 30 October The overall tax-to-GDP ratio, meaning the sum of taxes and net social contributions as a percentage of Gross Domestic Product, stood at 40.3% in the European Union (EU) in 2018, a slight increase compared with 2017 (40.2%). In the euro area, tax revenue accounted for 41.7% of GDP in 2018, up from 41.5% in 2017 Σχετικές Αναρτήσεις Eurostat, (2018) «Tax-to-GDP ratio …Read More

Draghi leaves Lagarde to heal rift at European Central Bank

Balazs Koranyi, Francesco Canepa, (2019), «Draghi leaves Lagarde to heal rift at European Central Bank», Reuters, 29 October Mario Draghi will leave a more united euro zone when he steps down as president of the European Central Bank this week, but he hands over a body more publicly divided than ever on how best to resurrect an ailing regional economy. The 72-year-old Italian banker is widely credited with saving the euro zone …Read More