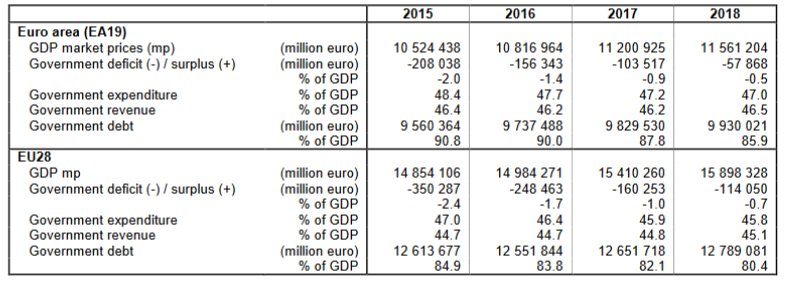

Eurostat/Euro area government deficit at 0.5% and EU28 at 0.7% of GDP/21 October 2019 In 2018,the government deficit and debt of both the eur oarea(EA19)and the EU28 decreased in relative terms compared with 2017.In the euro area the government deficit to GDP ratio fell from 0.9% in 2017to 0.5% in 2018,and in the EU28 from1.0%to 0.7%. In the euro area the government debt to GDP ratio declined from 87.8% at …Read More

Right here, right now: The quest for a more balanced policy mix

Laurence Boone, Marco Buti, (2019), «Right here, right now: The quest for a more balanced policy mix», Voxeu, 18 October After years of solid growth, worldwide economic activity has slowed down sharply in 2019 while global trade has stalled. At October’s annual meeting of the IMF, policymakers have the difficult task of addressing the immediate policy challenges to support economic growth while also preparing our economies for the future. This …Read More

Brexit and Finance: Brace for No Impact?

Nicolas Veron, (2019), «Brexit and Finance: Brace for No Impact?», Bruegel, 14 October Amid the daily high drama of Brexit, it is easy to lose track of the structural shifts, or lack thereof, that may be associated with the UK’s possible departure from the European Union. One of them, and not the least, is the potential impact on the European and global financial system. London is currently the undisputed financial hub of …Read More

With or without you: are central European countries ready for the euro?

Zsolt Darvas, (2019), «With or without you: are central European countries ready for the euro?», Bruegel, 10 October Southern European euro-area members suffered from unsustainable developments after they joined the euro in 1999 and up to 2008, and have had great difficulties since. Inadequate national policies were the main causes of these unsustainable developments, but euro membership played a role before 2008 by leading to low real interest rates (which …Read More

Rethinking fiscal policy choices in the euro area

Paul De Grauwe qnd Yuemei Ji, (2019), «Rethinking fiscal policy choices in the euro area», Voxeu, 14 October With the spectre of a recession looming in the euro area, and elsewhere, the policy question that arises is how much leeway the fiscal authorities in the euro area have to follow counter-cyclical fiscal policies aimed at providing some stimulus. The conclusion must be that the burden of business cycle stabilisation in the euro …Read More

France’s eurozone budget ambitions hit Hanseatic wall

Bjarke Smith-Meyer and Hannah Brenton,(2019), «France’s eurozone budget ambitions hit Hanseatic wall», Politico, 11 October EU finance ministers agreed on the general structure of a scaled-back eurozone budget after eight hours of talks Wednesday night. On the way to agreement, they put in safeguards requested by Nordic countries. France was pushing for a credible cash pot to support reforms in eurozone countries and ultimately help absorb sudden economic shocks across …Read More

Greece Sees Growth in 2020, Putting It on Track for Fiscal Goals

Sotiris Nikas (2019), «Greece Sees Growth in 2020, Putting It on Track for Fiscal Goals» Bloomberg, 7 October Greece’s government is forecasting 2.8% economic growth in 2020, which it says puts it on track to meet a budget target agreed with creditors while still enacting tax relief measures.The creditors, however, have warned that the cost of polices to which Prime Minister Kyriakos Mitsotakis’s government has committed will create a shortfall of …Read More

Challenges ahead for the European Central Bank: Navigating in the dark?

Gregory Claeys, Maria Demertzis and Francensco Papadia (2019), “Challenges ahead for the European Central Bank: Navigating in the dark?” Bruegel, 25 September Since the second half of 2018, signs of a slowdown have been piling up in the euro area. The ECB will face major challenges in this potentially difficult period: its main tools are nearly exhausted, the monetary union in which it operates is still incomplete, and it lacks …Read More

Potential output and EU fiscal surveillance

Marco Buti, Nicolas Carnot, Atanas Hristov, Kieran Mc Morrow , Werner Roeger and Valerie Vandermeulen, (2019), “Potential output and EU fiscal surveillance”, VoxEU, 23 September Criticisms have recently been raised on the usefulness of the EU’s commonly agreed methodology for estimating potential output and output gaps. Whilst mindful of the uncertainty which inevitably surrounds an unobservable variable such as potential output, this column argues that much of the criticism is …Read More

Macroprudential policy could have reduced imbalances in the euro area

Marcin Bieleki, Michał Brzoza-Brzezina, Marcin Kolasa and Krzysztof Makarski, (2019), “Macroprudential policy could have reduced imbalances in the euro area”, VoxEU, 18 September The boom-bust cycle in the euro area periphery has almost toppled the euro. This column suggests that region-specific macroprudential policy could have substantially smoothed the credit cycle in the periphery and reduced the build-up of external imbalances. In contrast, common monetary policy could have stabilised output in …Read More