David Einhorn on Pireus Bank: now I know what He thinks, ViennaCapitalist Blog, 05 November.

I am grateful to reader IAthinker who commented on my recent Pireus bank post providing a link to David Einhorn’s presentation he gave at the recent Robin Hood conference, an annual gathering of Hedge Fund managers. At the conference, Einhorn reiterated his bullish stance on Pireus and Alpha bank, two of the biggest banks in Greece. As regular readers know, I have always wanted to understand Einhorn’s (Seth Klarman and John Paulson are long this stock too) thesis and I read the presentation with great interest.

As most presentations or writings by Einhorn they are fun to read, full of interesting charts and thoughts. He starts with the bullish case (40 slides) for Sun Edison (SUNE) – a solar company he thinks undervalued. The next 40 slides are reserved for the Greek recovery and said bank investments. He finishes by noting that France is in a mess and its bonds overvalued.

To sum it up: the solar case sounds interesting and I agree 100% with him on France. I disagree, however, with his bullish view on Pireus bank. In the following analysis I will present my view on the main bullish points made by Einhorn. Since this is a lengthy post, I have decided to divide it up: The first post analyses his macroeconomic arguments, whereas in the second post I proceed to the microeconomic, i.e. bank specific aspects of the case. For that reason I will not follow the order of the arguments in the presentation, so do not be confused.

Point Nr. 1: Improved Competitiveness of the Greek Economy

At the beginning, David Einhorn points out how the hard reform measures the Greek government has undertaken, such as slashing the minimum wage and reducing pensions, have increased competitiveness and improved business climate, a fact which has been duly mentioned in the World Bank’s recent “Doing Business Report” (via. Klaus Kastner’s blog). According to the World Bank, Greece has improved its ranking by 40 notches since the beginning of the crisis, albeit it still ranks at the bottom among EU countries.

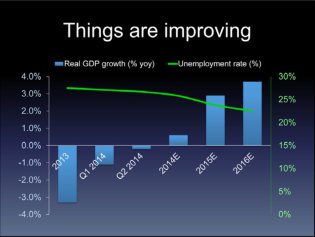

Einhorn underlines his argument by pointing at charts such as this one:

Now, if you ask me, the chart still shows a contraction in the actual figures with unemployment (a lagging indicator!) merely levelling off, not improving! All the positive figures are merely forecasts. And we all know that most government/IMF forecasts are – better: have to be – skewed to the positive for political reasons (politicians want to have an excuse not to undertake reforms) – in agreement with their Keynesian in-house advisors who do not want to shatter “confidence”. This, and the fact that currently all major European economies are slashing their growth forecasts, makes me somewhat sceptical.

Listen, I generally agree that the Greek government has undertaken steps in the right direction. After all, they faced what awaits all socialists at the end of the road: the end of other people’s money. This is why I have been long two Greek stocks (OPAP and Mettka) for the better part of the past two years. Under normal circumstances it might be straightforward to conclude that a more competitive economy means great prospects for the banking sector and there is the notion on Wall Street that you best “play” the economy by investing in banks. However: whoever came up with that idea (a long time ago, as it is old) did not face the current debt problem that still plagues Greek economy, as I will discuss next.

Point Nr. 2: Greece is better than France (Debt problem solved?)

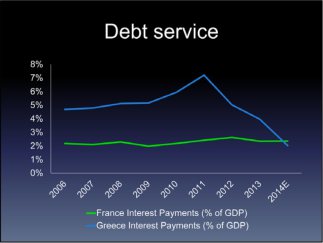

Einhorn seems to think that Greece’s high debt load (public debt @ 175% of GDP) is not an issue as it is owed to supranational (ECB; IMF, Euro zone countries) at below market rates and with long tenors. He then pulls out this chart that shows Greece’s interest rate burden steadily declining and compares this to the French figure. No doubt: it suggests substantial impressive improvements ahead.

Now, the question before us: how can Greece reduce its interest burden by almost 50% without repaying anything – it still has a budget deficit, remember – and absent any new debt restructuring?

Relevant posts:

- Richter, W. (2014) “The Wrath of Draghi: First German Bank Hits Savers with Negative Interest Rate“, ΘZeroHedge, 30 October.

- STRATFOR (2014) “Europe: Building a Banking Union“, Europe’s Economic Crisis Timeline, 30 October.

- Jassaud, Ν. (2014) “The role of corporate governance in strengthening banks“, VoxEU Organisation, 30 October.