Darvas, Z. & Hüttl, P. (2015) “Why a Grexit is more costly for Germany than a default inside the euro area – Contrary to the IFO institute, we conclude that German losses on both official and private claims would be much higher if Greece exits the euro“, Bruegel Institute, 16 January.

A few days ago the influential IFO Institute published a short paper suggesting that a Greek default inside the euro-area would cost Germany €77.1 billion, while a default combined with an exit from the euro would cost €75.8 billion. The two numbers are about the same, yet unsurprisingly, media reports emphasised that a Grexit would be cheaper for Germany by €1.3 billion (see e.g. a Focus report here).

We think that the publication of such numbers falsely suggests that direct losses can be calculated precisely. Even more importantly, we noticed that the calculation did not consider three major factors:

- the different haircuts likely under the two scenarios,

- private claims,

- other second round losses.

All three factors suggest that direct losses for Germany would be much larger if Greece was to exit the euro.

“We think that a Greek default and exit are neither likely nor necessary”

Before assessing the details of the calculations, let us make our view clear: we think that a Greek default and exit are neither likely nor necessary. It is definitely in the interests of both Greece and its euro-area partners to find a comprehensive agreement that would avoid default and exit, which would make everyone much worse-off. Greece would enter another deep recession, which would push unemployment up further and reduce budget revenues, necessitating another round of harsh fiscal consolidation. Euro-area creditors would lose a lot on their Greek claims and private claims on Greece would also suffer. The new depreciating Greek drachma may not revive the Greek economy that much (see on this Guntram Wolff’s recent post here and our 2011 post here). Furthermore, a Grexit would have many broader implications beyond economic issues. What are the prospects for a comprehensive agreement?

- Concerning Greek debt sustainability, there are relatively painless options, as we recently argued.

- Agreement on fiscal policy may not be that difficult either. Greece has suffered a lot in the past few years and has implemented major fiscal adjustments. Although the outlook is not too bright, by now the trough in economic activity has perhaps been reached and some economic growth is expected. This should help fiscal accounts and it is likely that no more fiscal adjustment will be necessary. In fact, the EU Commission expects that the cyclical adjusted primary budget surplus of Greece will decline from 8% of GDP in 2014 by about 1 percentage point in both 2015-16, suggesting a fiscal easing: exactly what Greek opposition parties demand. In other words, the new Greek government will be able to reap the benefits of the adjustments made in the past few years.

- The most difficult step may be to secure an agreement on structural policies, because many of the current plans of the Greek opposition parties are in diametrical opposition to reforms agreed under the financial assistance programme. But a compromise has to be found: both sides have strong incentives to agree and structural reforms have to be part of the comprehensive agreement.

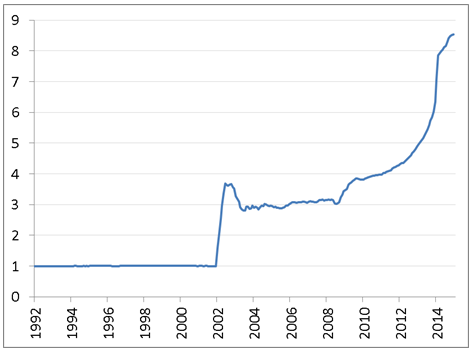

Figure 1: The exchange rate of the Argentine peso against the US dollar, January 1992 – January 2015

[…]

Relevant posts:

- Zoning out – Why leaving the euro would still be bad for both Greece and the currency area, The Economist, 17 January 2015.

- Wolff, Β. G. (2015) “Why Grexit would not help Greece – debunking the myth of exports“, Bruegel Institute, 06 January.