Szczurek, M. (2014) “Investing for Europe’s Future“, VoxEU Organisation, 05 September.

The ‘lost decade’ is not a scenario for the EU, it’s the baseline forecast. In this column, Polish Finance Minister Mateusz Szczurek calls for an EU-wide public investment programme of 5.5% of GDP to overcome the constraints behind Europe’s ‘secular stagnation’. He calculates that €700 billion of capital expenditures could close the output gap in the short term while increasing long-term productivity growth. Funded by EU members and private leverage, it could operate as a special-purpose vehicle under the EIB.

Europe is at risk

We are meeting here at the time when Europe is facing a great threat. It is not the danger of sovereign debt crisis or of the collapse of the euro area. We have managed to decisively avert those risks through a coordinated effort at the European level. Unfortunately, neither is it the threat of the so-called “lost decade” because the “lost decade” is already Europe’s baseline scenario. Remember, six years have already passed since the start of the financial crisis and European GDP is still well below its pre-crisis level and around 10% below the level consistent with trend growth prior to the crisis. As a continent we are doing worse than Japan in the aftermath of the financial meltdown of the 80s and worse than during the Great Depression in the 30s. The timid recovery, which gave us so much hope, has recently stalled. Unemployment and the negative output gap are at record highs and we are on the verge of deflation. Even Poland, with its continuing economic expansion, still faces elevated unemployment and below-potential growth.

You may ask: what risk could be added to such a gloomy baseline? It is the threat of secular stagnation, the trap of permanently depressed demand and meagre long-term growth rates. It is also the threat of a lost generation: a generation of young people who will never find their way into quality employment and will never reach their full human and economic potential. To realize that such a gloomy scenario may already be unfolding, look no further than our labour market. Almost a quarter of all young people in Europe are without work. Persistent unemployment, inequality, and a debt burden increasing with each month of stagnant income and near-deflation not only threaten Europe’s economic development, but risk unravelling the entire social structure of the European Union. The radical parties are gaining strength, and as Europeans we should never forget that it was depression and deflation, and not hyperinflation, that brought to power the totalitarian regime that devastated our continent through the World War and unspeakable atrocities 75 years ago.

…

Quantifying the Macroeconomic Impact of the European Fund for Investments

Introduction: The European Fund for Investments

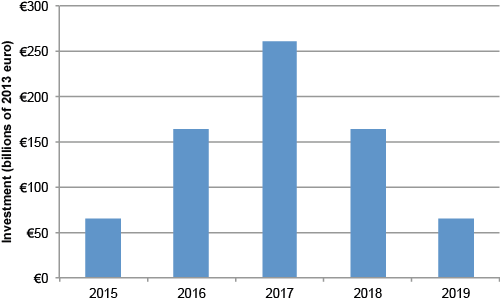

In his keynote address at the 2014 Bruegel Institute annual dinner, Poland’s Minister of Finance Mr. Mateusz Szczurek laid out a proposal for jumpstarting the EU economy, avoiding a prolonged stagnation and building solid foundations for long run growth. This proposal is based on a European-level program of scaling up public investment by around 5.5% of European Union GDP or 700 billion euros within the next 5 years. The capital spending would start at 0.5% of European GDP in 2015, peak at 2% in 2017, and be gradually phased out afterwards (Figure 1). The gradual path reflects the nature of large-scale public investment projects and gives policymakers time to react and adjust the size of the program to changing economic conditions. In order to mobilize such considerable investments, a European Fund for Investments (EFI) would be established. A gradual injection of paid-in capital and guarantees by all EU Member States would be leveraged by borrowing in the financial market. The Fund capital would be directly invested in selected infrastructure projects, with a particular focus on energy, transportation and ICT.

This note presents the background calculations of the program’s potential effects on EU GDP and justifies its proposed size of 5.5% of EU-28 GDP.

Figure 1. Proposed path of EU-28 public investment under the EFI

Relevant posts:

- Veugelers, R. (2014) “Is Europe saving away its future? European public funding for research in the era of fiscal consolidation“, VoxEU Organisation, 28 August.

- Crafts, N. (2014) “What Does the 1930s’ Experience Tell Us about the Future of the Eurozone?“. JCMS: Journal of Common Market Studies, 52: 713–727, July.

- Chen et al. (2014) “Globalisation and the Future of the Welfare State“, Institute for the Study of Labor, IZA Policy Paper No. 81, March.