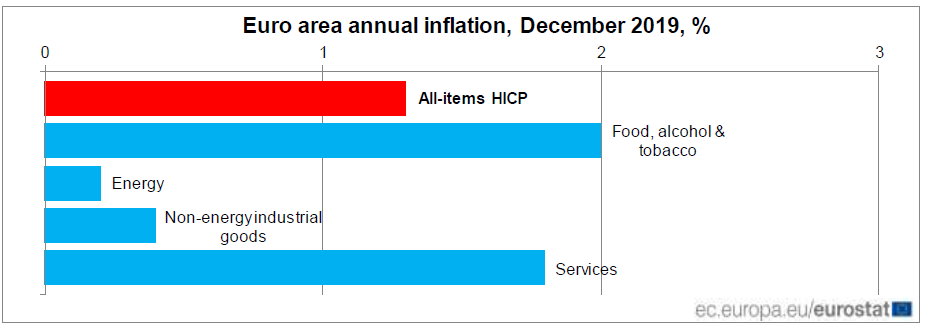

Eurostat, (2020), “Euro area annual inflation up to 1.3%“, 7 January “Euro area annual inflation is expected to be1.3% in December 2019, up from 1.0% in November according to a flash estimate from Eurostat, the statistical office of the European Union.Looking at the main components of euro area inflation,food, alcohol & tobacco is expected to have the highest annual rate in December (2.0%, compared with 1.9% in November), followed by …Read More

Annual inflation up to 1.0% in the euro area

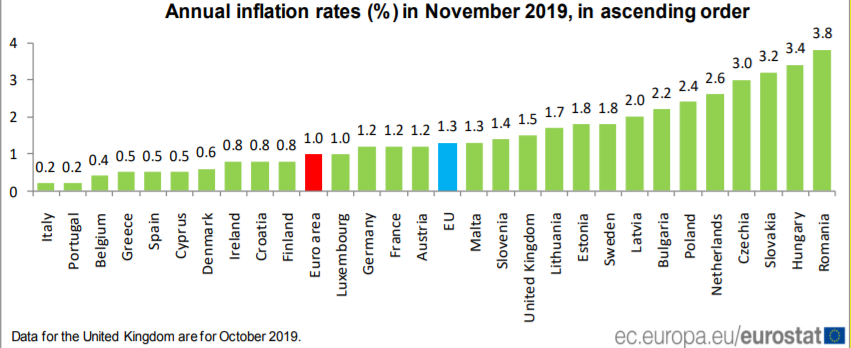

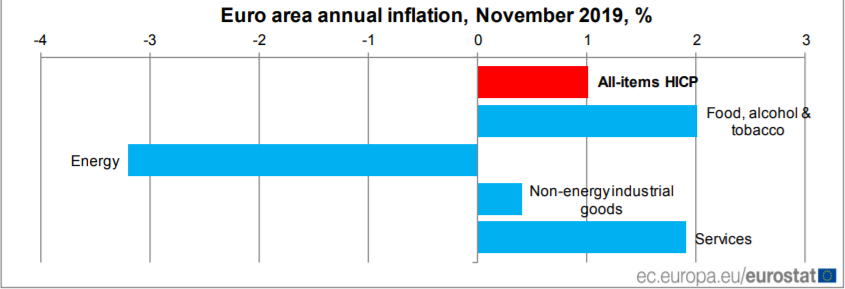

Eurostat, (2019), «Annual inflation up to 1.0% in the euro area», 18 December The euro area annual inflation rate was 1.0% in November 2019, up from 0.7% in October. A year earlier, the rate was 1.9%. European Union annual inflation was 1.3% in November 2019, up from 1.1% in October. A year earlier, the rate was 2.0%. These figures are published by Eurostat, the statistical office of the European Union. In …Read More

GDP up by 0.2% and employment up by 0.1% in the euro area

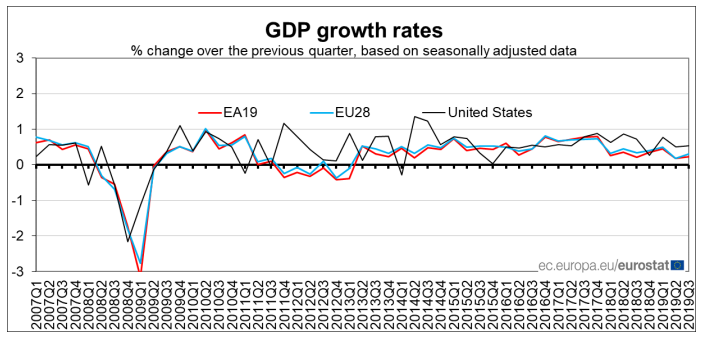

Eurostat/GDP up by 0.2% and employment up by 0.1% in the euro area/5 December 2019 Seasonally adjusted GDP rose by 0.2% in the euro area (EA19) and by 0.3% in the EU28 during the third quarter of 2019, compared with the previous quarter, according to an estimate published by Eurostat, the statistical office of the European Union. In the second quarter of 2019, GDP had grown by 0.2% in both …Read More

Euro area annual inflation up to 1.0%

Eurostat, (2019), « 2019 Euro area annual inflation up to 1.0%», 29 November Euro area annual inflation is expected to be 1.0% in November 2019, up from 0.7% in October according to a flash estimate from Eurostat, the statistical office of the European Union. Looking at the main components of euro area inflation, food, alcohol & tobacco is expected to have the highest annual rate in November (2.0%, compared with 1.5% …Read More

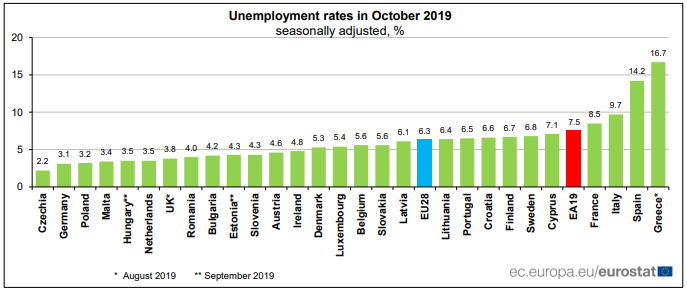

Euro area unemployment at 7.5%

Eurostat/Euro area unemployment at 7.5%/29 November 2019 The euro area (EA19) seasonally-adjusted unemployment rate was 7.5% in October 2019, down from 7.6% in September 2019 and from 8.0% in October 2018. This is the lowest rate recorded in the euro area since July 2008. The EU28 unemployment rate was 6.3% in October 2019, stable compared with September 2019 and down from 6.7% in October 2018. This remains the lowest rate …Read More

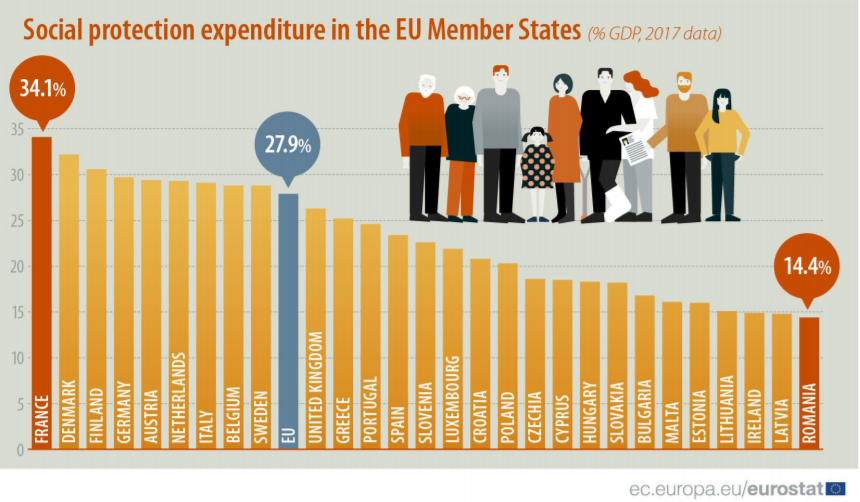

Share of EU GDP spent on social protection slightly down

Eurostat, (2019), «Share of EU GDP spent on social protection slightly down», 22 November Social protection expenditure in the European Union (EU) stood at 27.9% of GDP in 2017, slightly down compared with 28.7% in 2012, according to data from Eurostat, the statistical office of the European Union. The two main sources of funding of social protection at EU level were social contributions, making up 55% of total receipts, and …Read More

A digital euro to save EMU

Thomas Mayer, (2019), «A digital euro to save EMU», VoxEU, 6 November The desire to avoid credit and investment boom-bust cycles has led some to advocate replacing money creation through bank credit extension with direct money issuance by the central bank or a private entity, or linking money to an existing asset. Related Posts Project Syndicate, (2019), «The Monetarist Era is Over», 31 October Voxeu, (2019), «Right here, right now: The quest …Read More

Liquidity linkages in European sovereign bond markets can amplify fundamental economic shocks

Daragh Clancy, Peter G Dunne, Pasquale Filiani, (2019), «Liquidity linkages in European sovereign bond markets can amplify fundamental economic shocks». VoxEU, 4 November Stable sovereign bond markets are crucial to a well-functioning economy and financial system. But despite the importance of amplifications of sovereign bond market tensions related to flights-to-safety and sudden liquidity contractions, there is little direct empirical evidence of the transmission channels through which such catalysts for amplification …Read More

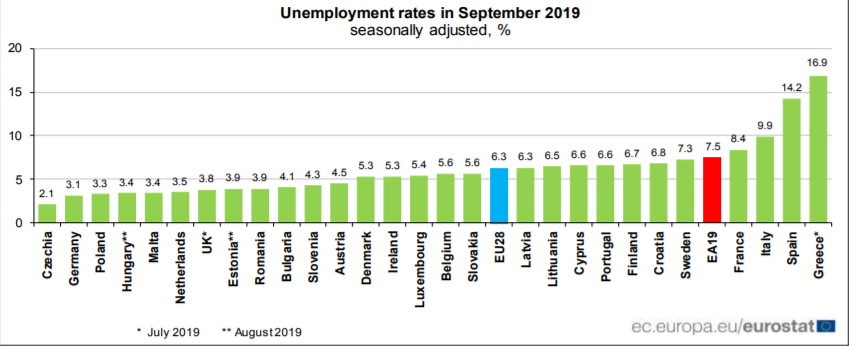

Euro area unemployment at 7.5%

Eurostat, (2019), «Euro area unemployment at 7.5%», 31 October The euro area (EA19) seasonally-adjusted unemployment rate was 7.5% in September 2019, stable compared with August 2019 and down from 8.0% in September 2018. This is the lowest rate recorded in the euro area since July 2008. The EU28 unemployment rate was 6.3% in September 2019, stable compared with August 2019 and down from 6.7% in September 2018. This remains the …Read More

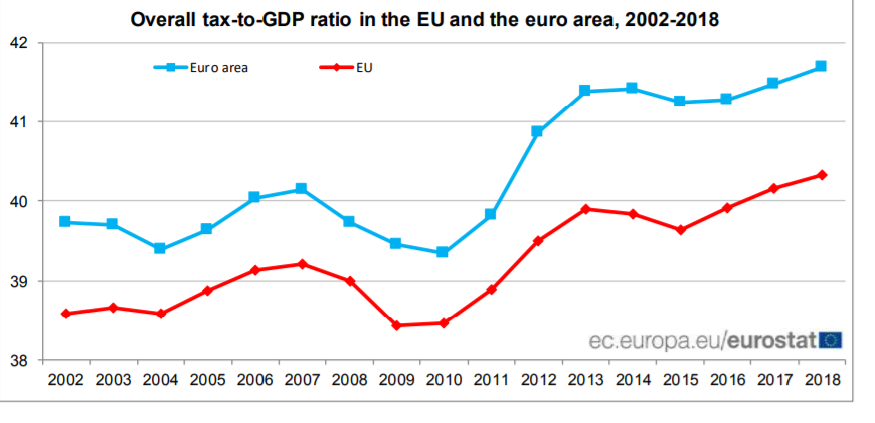

Tax-to-GDP ratio up to 40.3% in EU

Eurostat, (2019) «Tax-to-GDP ratio up to 40.3% in EU», 30 October The overall tax-to-GDP ratio, meaning the sum of taxes and net social contributions as a percentage of Gross Domestic Product, stood at 40.3% in the European Union (EU) in 2018, a slight increase compared with 2017 (40.2%). In the euro area, tax revenue accounted for 41.7% of GDP in 2018, up from 41.5% in 2017 Σχετικές Αναρτήσεις Eurostat, (2018) «Tax-to-GDP ratio …Read More