Xifré, R. (2014) “No miracles in southern Eurozone without resource reallocation“, VoxEU Organisation, 12 September.

As the most acute phase of the Eurozone crisis is over, the current-account balances of France, Italy, and Spain have improved. This column warns against complacency about this improvement, pointing at some structural factors that impede growth and damage competitiveness. Resources should be relocated towards the tradeable sectors and to those firms most prepared to grow and compete. If not, these three countries are likely to aggravate the dysfunctional duality of their economies.

The most acute phase of the Global Crisis appears to be over in the Eurozone. Prospects for growth are still moderate but no recession is foreseen in the short-run and sovereign debt markets seem to be getting out of the turbulences. The prevailing view is that the countries that have been under the Economic Adjustment Programmes (EAP) have drastically improved their conditions with the recovery extending to large, non-EAP but ‘vulnerable’ member states like Spain, Italy, and France. The latest IMF’ vision on Spain, which since 2010 has been intermittently considered as a possible trigger of the Eurozone implosion, is that the country “has turned the corner” (IMF 2014).

The merit in this stabilisation process is credited to a policy mix that includes financial sector reform, budget discipline, internal devaluations, and ‘structural reforms’. On the monetary policy side, a series of incremental expansions of the ECB objective function have finally led the institution to provide a liquidity backstop. Apparently, it is this very specific ECB move what best explains the decline in sovereign spreads since 2012 in the peripheral countries (De Grauwe 2014) and, one could confidently argue, what paved the way for the Eurozone recovery.

Although it is common knowledge that many roadblocks still need to be removed (the crux of the matter being how to engineer a job-rich recovery), the improvement in several headline indicators has led to a sort of policy complacency in certain circles. Perhaps the most notorious case is the improvement in the current-account balances, which is often interpreted as a sign of increasing competitiveness and, furthermore, considered not to be short-lived but rather of a more fundamental nature (Auer 2014).

In this column, we disagree with this complacent account by pointing at some structural limitations that the three largest southern Eurozone countries (France, Italy, and Spain) face both from a macro and micro perspective. This is based on a recent working paper (Xifré 2014) with data being updated whenever possible and combined with other work in progress. The main policy implication is that it might be the case that the toughest tasks have not yet been done:

These three countries still need structural reforms that facilitate the reallocation of resources (human and financial) to tradable sectors and to those firms better prepared to grow and compete.

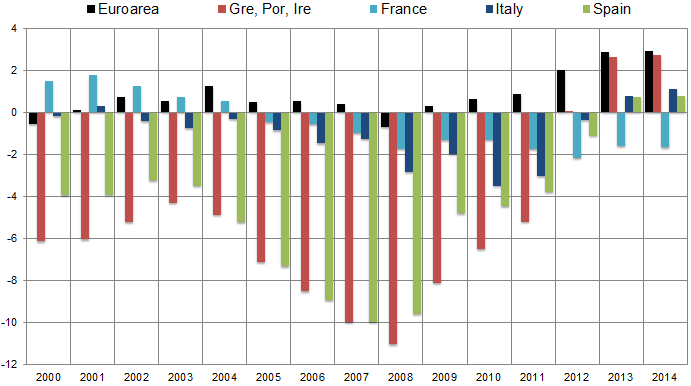

Source: IMF.

Notes: Estimates after 2012 for Ireland, Italy, and Portugal and after 2013 for France, Greece, and Spain. For Greece, Portugal, and Ireland, the non-weighted average is represented.

Relevant posts:

- Gropas, R. & Triandafyllidou, Α. (2014) “’Voting With Their Feet’, Highly Skilled Emigrants From Southern Europe”, American Behavioral Science (ABS), June.

- Bowles, J. (2014) “Southern Europe is suspicious: the evolution of trust in the EU“, Bruegel Think Tank, 14 May.

- Minas, C., Jacobson, D., Antoniou, E. & McMullan, C. (2014) “Welfare regime, welfare pillar and southern Europe“, Journal of European Social Policy, Vol. 24, No. 2, May, pp.135-149.