Darvas, Z. (2014) “The European Investment Bank should invest more, not less – EIB played some counter-cyclical role during the crisis, but now plans to reduce investments“, Bruegel Think Tank, 24 September.

There is a growing recognition among policymakers, not least thanks to the Jackson Hole speech of ECB President Mario Draghi, that Europe faces the problem of demand shortage, in addition to various structural problems which can be resolved only with suitable supply-side reforms. A good way to stimulate more demand is to increase the investment of the European Investment Bank (EIB); see the promotion of this idea in our memo to the new ECFIN Commissioner Pierre Moscovici.

The EIB has played to some extent a counter-cyclical stabilising role by increasing its investment in 2009 and in 2013 and by investing more in harder-hit countries

In fact, the EIB has played to some extent a counter-cyclical stabilising role by increasing its investment in 2009 and in 2013 and by investing more in harder-hit countries.

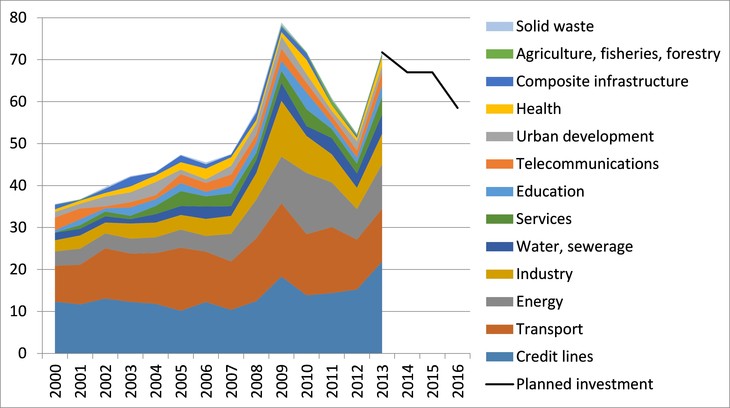

In the height of the crisis, the EIB has increased its investments from € 47.5 billion (0.38 percent of EU GDP) in 2007 to € 78.8 billion (0.67 percent of EU GDP) in 2009 (see Figure). The increased investment, about 0.3 percent of EU GDP, was non-negligible, but modest compared to fiscal stimulus in other advanced countries such as the United States and Japan. Unfortunately, there was a decline in EIB investment in 2010-12, at a time when the cyclical situation of the European economy deteriorated and most EU countries embarked on a significant fiscal consolidation path. Facing a relapsed economic situation, in 2012 EU leaders agreed to provide €10 billion of new capital to the EIB (which leads to much more investment, because the EIB leverages up its capital) and encouraged the EIB to invest more, which is reflected in the increase in EIB investments in 2013 to € 71.7 billion (0.55 percent of EU GDP).

Figure 1: Annual investment by the European Investment Bank (EIB) according to main sectors in 2000-2013 and the targets for 2014-16 (€ billions)

Relevant posts:

- Derviş, Κ. & Saraceno, F. (2014) “An Investment New Deal for Europe“, Brookings Blog, 03 September.

- Veugelers, R. (2014) “Is Europe saving away its future? European public funding for research in the era of fiscal consolidation“, VoxEU Organisation, 28 August.

- Pisani-Ferry, J. (2014) “Can Investment Save Europe?“, Project Syndicate, 30 July.