Gilbert, M. (2014) “ECB Gets a Small Win“, Bloomberg View, 10 October.

The European Central Bank has been justifiably criticized for its claim that the magic of asset-backed bonds can reverse Europe’s slump back into recession. It got some support, though, from an unlikely source this week — the market for car loans in Finland.

By the end of the year, Spain’s Banco Santander plans to bundle together a bunch of loans it made to motorists in the Nordic country to create a securitized bond worth about 500 million euros ($635 million). Presumably, the bank will use the cash it gets from selling the bonds to make more loans. It’s a small but significant victory for the the central bank’s campaign to reverse the demonization of asset-backed debt, which got a bad rap for its part in the financial crisis because banks were selling what ECB President Mario Draghi’s refers to as “sausages full of derivatives.” He’s proposing a revival of the market for simple debt, which he says has been unfairly tarnished.

The ECB plans to start buying asset-backed securities by year-end. It’s a broad effort to recycle cash into the banking system and revive growth. ECB Vice President Vitor Constancio said yesterday that the region has 1 trillion euros of securities that will be eligible for the program. He noted, though, that “the amounts that we will be able to buy are lower than the theoretical amount.”

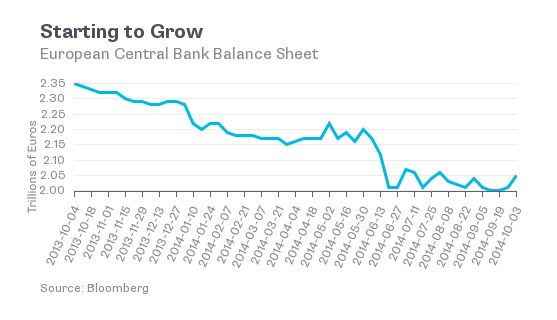

Obviously, not all bondholders will want to sell, and the ECB may struggle to meet its goal of expanding its balance sheet back to the 2012 level of about 3 trillion euros. Still, the balance sheet has posted two consecutive weeks of growth for an increase of 3.3 percent to 2.05 trillion euros, which is a start:

Relevant posts:

- Gros, D. (2014) “The ECB’s Faulty Weapon“, Project Syndicate, 07 October.

- Kirkegaard, F. J. (2014) “ECB Sovereign Bond Purchases Remain Unlikely“, Peterson Institute for International Economics, 01 October.

- Wyplosz, C. (2014) “Is the ECB doing QE?“, VoxEU Organisation, 12 September.