Jordana, J. & Rosas, G. (2014) “Making regulatory agencies independent is not always a recipe for better decision-making“, LSE EUROPP, 16 October.

The principle of making certain bodies independent from government, such as regulatory agencies or central banks, has become popular in a number of contexts over recent decades. As Jacint Jordana and Guillermo Rosas write, the basic assumption underpinning the principle is that electoral pressures can have a negative effect on decision-making in certain policy areas. However, using evidence from a study of banking regulatory agencies across 81 countries, they illustrate that the benefits of independence depend largely on the political context within a given state. This suggests that while independence can be beneficial in some cases, greater attention should be paid to the individual circumstances within particular countries.

It is not uncommon to hear experts claim that many public policy problems could be solved by granting more independence to the professionals in the public sector who are responsible for managing these policies. They sometimes suggest that the best way to solve the complex problems of democracy is to completely separate ‘technical’ policy decisions from the political process.

The implicit assumption is that the quality of public decisions is improved when they are removed from the political sphere. From a democratic legitimacy perspective, these suggestions are certainly debatable, and are only warranted, at least partially, when adequate control and accountability mechanisms are in place. We would argue, however, that independence does not solve everything, and sometimes serves no purpose at all.

We do not argue against the safeguards of independence in any entity or public organisation. In many instances there are reasonable grounds for introducing independence. Politicians and legislators can protect non-elected civil servants to allow them to make demanding decisions if they feel this is the best way to get good results in terms of public policy.

[…]Independence of banking regulators

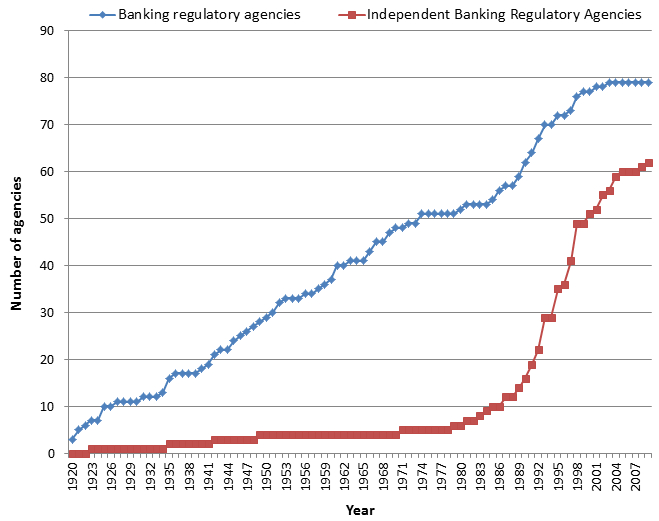

We have recently conducted a research project which helps to illustrate our argument. First, we confirmed the extraordinary diffusion of the banking regulation model based on the separation of banking agencies from government (regardless of whether the agency is set up within or outside the central bank). The Chart below illustrates how this model spread throughout the 20th century and the beginning of this century, and how independent agency status was adopted in many cases. The blue line shows the growth in banking regulatory agencies across the world, while the red line shows the number of these banking regulatory agencies which were independent from government.

Chart: Creation of banking regulatory agencies in a sample of 81 countries (1920-2009)

Relevant posts:

- Oomsels, P. (2014) Better together – a new hope for a federal Europe, EU Observer, 08 October.

- Tierney, S. (2014) “Europe is entering the ‘age of the referendum’, but there is nothing to fear for European democracy if referendums are properly regulated“, LSE EUROPP, 02 September.

- Aizenman, J. (2014) “The euro crisis: Muddling through, or on the way to a more perfect euro union?“, VoxEU Organisation, 03 July.