Aksoy, Y., Basso, H., Grasl, T. & Smith, R. (2015) “Demographic structure and the macroeconomy“, VoxEU Organisation, 08 April.

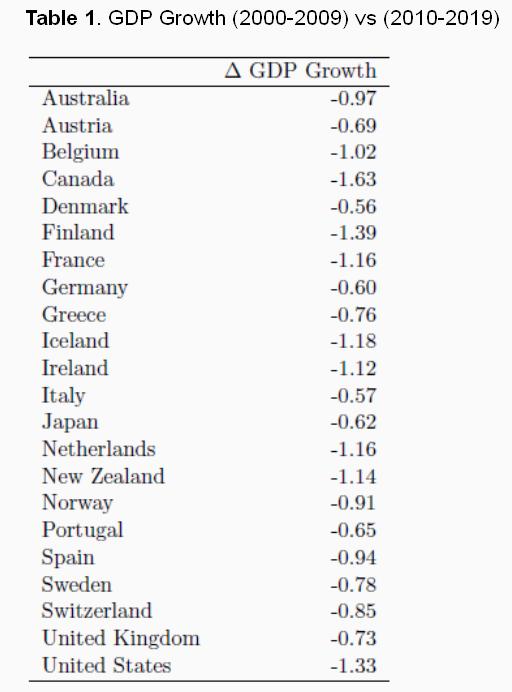

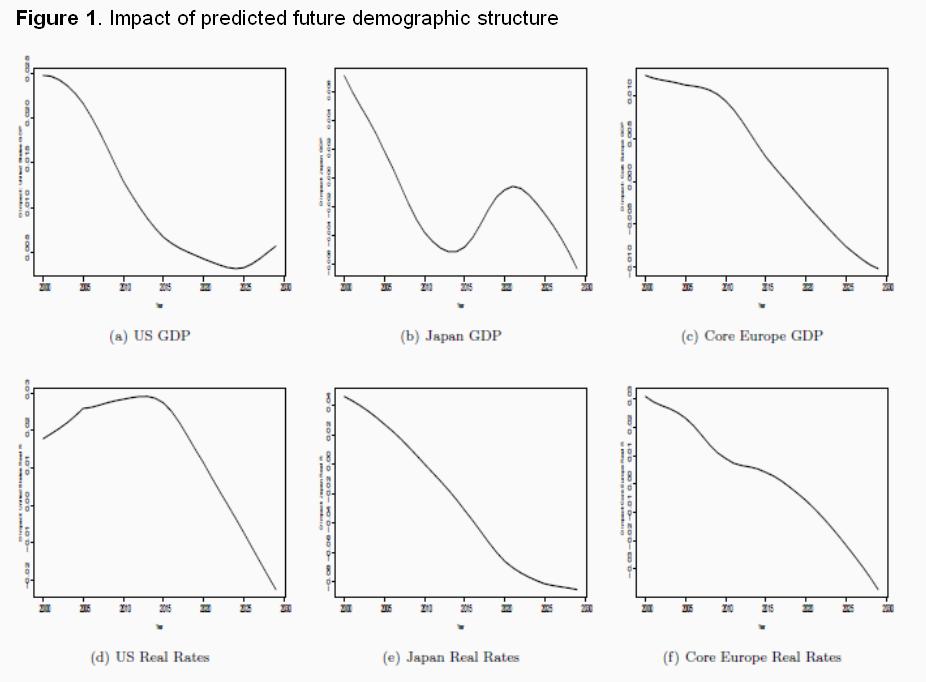

The disappointing recovery after the crisis has sparked renewed interest in the medium-run outlook of advanced economies. Lower population growth and its impact on labour supply gained widespread prominence. This column takes a more general view identifying the impact of the evolution of demographic structure, or the entire age profile, on the macroeconomy. Age profile changes have significant implications for savings, investment and growth but also affect innovation activities. The population aging predicted for the next decades is found to be a significant factor in reducing output growth and real interest rates across OECD countries.

The demographic age profiles in OECD economies are significantly changing. The average proportion of the population aged 60+ is projected to increase from 16% in 1970 to 29% in 2030, with most of the corresponding decline experienced in the 0-19 age group. Demographic changes, in particular their effect on labour supply, are often mentioned as one of the ‘headwinds’ of the observed slowdown in macroeconomic performance in advanced economies (Gordon 2012, 2014; Fernald and Jones 2014). Although important, this narrow interpretation may restrict the impact of demographic changes on the macroeconomy. In this column we take a more general view, arguing that changes in the demographic structure, defined as the variations in proportions of the population in each age group from year to year, matters for macroeconomic activity and may also be related to innovation.

How is the demographic structure relevant?

The demographic structure may affect the long- and short-term macroeconomic conditions through several channels. Different age groups (i) have different savings behaviour, according to the lifecycle hypothesis; (ii) have different productivity levels, according to the age profile of wages; (iii) work different amounts – the very young and very old tend not to work, with implications for labour input; (iv) contribute differently to the innovation process, with young and middle age workers contributing the most; and (v) provide different investment opportunities, as firms target their different needs. Thus, demographic structure changes can be expected to influence real interest rates, inflation and real output in the long and short-term either directly or via their effects on expectations on the future course of key variables.

Relevant posts:

- Katsikas, D., (2013), “Brain drain, a new challenge for the Eurozone”, EurActiv, Opinion Article, 25 November.

- Hugh, E., (2013), “Can demography explain Portugal’s growth slump before the crash?”, A Fistful Of Euros Blog, 06 October.