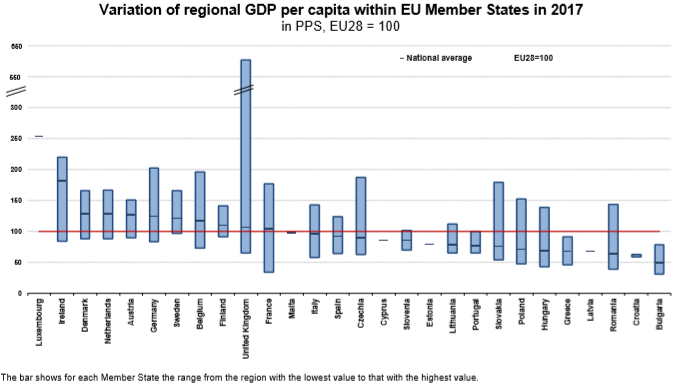

Eurostat/Regional GDP per capita ranged from 31% to 626% of the EU average in 2017/26 February 2019 In 2017, regional GDP per capita, expressed in terms of purchasing power standards, ranged from 31% of the European Union (EU) average in the Bulgarian region of North-West, to 626% of the average in Inner London – West in the United Kingdom. Relevant Posts Daniel Gros, Roberto Musmeci and Marta Pilati, (2018), «The …Read More

Greece Has Just Days to Fix Things Before Its Next Cash Payment

Viktoria Dendrinou and Sotiris Nikas, (2019), “Greece Has Just Days to Fix Things Before Its Next Cash Payment” Bloomberg, 27 February Greece’s foot-dragging on some key economic reforms is raising creditor concern, putting at risk a planned debt relief measure next month and a rebound in its stock and bond markets. Relevant Posts Sotiris Nikas, (2019), «Risks at Home Mount for Greece in Its First Post-Bailout Year», Bloomberg Economics, 3 …Read More

The ECB has reached its political limits. Its consequences in eight charts

Ashoka Mody, (2019), “The ECB has reached its political limits. Its consequences in eight charts”, VoxEU, 11 February In this post, Ashoka Mody documents the costs of ECB timidity, which, he argues, arises from the political limits on its actions. Relevant Posts Ferdinando Giugliano, (2019), «The ECB Has Policy Makers, Not Superheroes», Bloomberg, 22 February Marcus Ashworth, (2019) «ECB Is Awake and Asleep at the Same Time», Bloomberg Opinion, 19 …Read More

The financial transmission of housing bubbles: evidence from Spain

Alberto Martín, Enrique Moral-Benito and Tom Schmitz, (2019), “The financial transmission of housing bubbles: evidence from Spain”, ECB Working Paper Series No 2245, February How do housing bubbles affect other economic sectors? We show that in the presence of collateral constraints, a bubble initially raises housing credit demand and crowds out credit to non-housing firms. If the bubble lasts, however, housing credit repayments raise banks’ net worth and expand credit …Read More

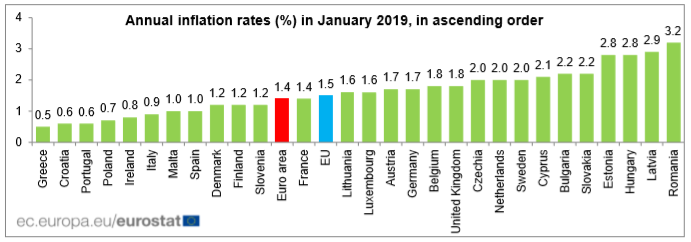

Annual inflation down to 1.4% in the euro area

Eurostat/Annual inflation down to 1.4% in the euro area /22 February 2019 The euro area annual inflation rate was 1.4% in January 2019, down from 1.5% in December. A year earlier, the rate was 1.3%. European Union annual inflation was 1.5% in January 2019, down from 1.6% in December. A year earlier, the rate was 1.6%. These figures are published by Eurostat, the statistical office of the European Union. Relevant …Read More

Solidarity in the Eurozone

Pavlos Eleftheriadis, (2019), “Solidarity in the Eurozone”, Bank of Greece Working Paper 256, January Proposals for Eurozone reform aim to complete its institutional architecture by securing stability without creating moral hazard. Such policy arguments inevitably rely, however, on implicit assumptions about justice, or on what is owed to whom. A common assumption is that member states are solely responsible for what happens to them. This paper, written from the point …Read More

Should the ECB care about the euro’s global role?

Benoît Coeuré, (2019), “Should the ECB care about the euro’s global role?”, VoxEU, 25 February There is a growing debate in Europe as to whether recent shifts in global governance should be seen as a reason to strengthen the global role of the euro. This column explains that while the ECB does not take a view on foreign policy questions, the alignment between policies that will strengthen the euro’s global …Read More

Interest rate risk in the euro area

Peter Hoffmann, (2019), “Interest rate risk in the euro area”, ECB Research Bulletin No. 55, 22 February Challenging conventional wisdom, recent research shows that, collectively, euro area banks have limited exposure to interest rate risk, but that their individual exposures vary significantly from institution to institution. Differences in interest-rate setting conventions for loan contracts, especially mortgages, across euro area countries have been shown to be an important driver of this …Read More

The ECB Has Policy Makers, Not Superheroes

Ferdinando Giugliano, (2019), “The ECB Has Policy Makers, Not Superheroes”, Bloomberg, 22 February Spare a thought for the European Central Bank. The minutes of the last Governing Council, published on Thursday, show the central bank is in a bind over the state of the euro zone recovery and the next steps to take. Relevant Posts Marcus Ashworth, (2019) «ECB Is Awake and Asleep at the Same Time», Bloomberg Opinion, 19 …Read More

The euro crisis showed the limits of using market integration and free trade as vehicles for development

Andreas Bieler, Jamie Jordan and Adam David Morton, (2019), “The euro crisis showed the limits of using market integration and free trade as vehicles for development”, LSE EUROPP, 18 February The crisis that hit members of the Eurozone a decade ago has often been attributed to design flaws in Europe’s Economic and Monetary Union. Drawing on a new study, Andreas Bieler, Jamie Jordan and Adam David Morton argue that this …Read More