Andrew Watt, (2020), “Europe needs a strong macroeconomic policy core—but not a Six (or Two) Pack“, Social Europe, 6 February A conceptual and institutional solution is required to permit member states to finance through borrowing those expenditures that raise potential output and create publicly owned assets, particularly where these are clearly in line with common EU goals. There are more or less ambitious ways to achieve this, ranging from a …Read More

A Green Deal will not work without refocusing productivity

Karl Aiginger, (2020),” A Green Deal will not work without refocusing productivity “, VoxEU, 20 January The new president of the European Commission, Ursula von der Leyen, has announced a ‘European Green Deal’ and the Commission has asserted Europe’s need to develop a new growth model to achieve climate neutrality. However, the Commission’s limited view of ‘productivity’ ignores the fact that raising labour productivity can raise emissions and accelerate climate change. …Read More

Household saving rate nearly stable at 13.0% in the euro area

Eurostat, (2020), “Household saving rate nearly stable at 13.0% in the euro area“, 14 January The household saving rate in the euro area was 13.0% in the third quarter of 2019, compared with 13.1% in the second quarter of 2019. The household investment rate in the euro area was 9.1% in the third quarter of 2019, compared with 9.0% the previous quarter. These data come from a first release of …Read More

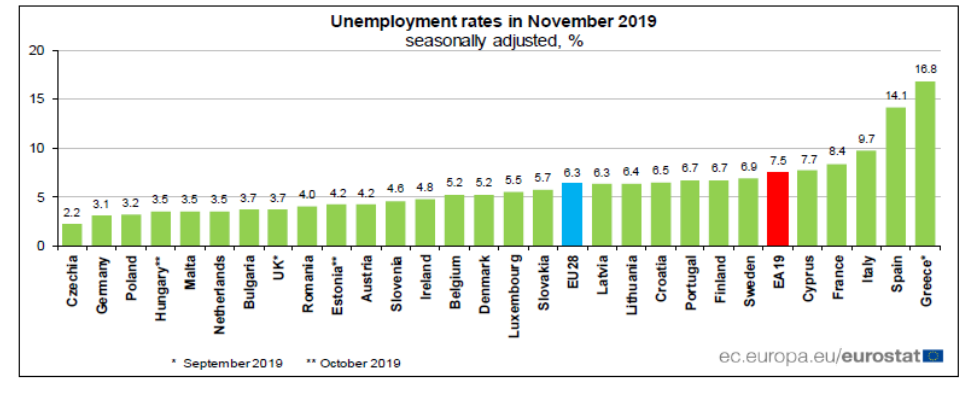

Euro area unemployment at 7.5%

Eurostat, (2020), ” Euro area unemployment at 7.5% “, 9 January The euro area (EA19) seasonally-adjusted unemployment rate was 7.5% in November 2019, stable compared with October 2019 and down from 7.9% in November 2018. This remains the lowest rate recorded in the euro area since July 2008. The EU28 unemployment rate was 6.3% in November 2019, stable compared with October 2019 and down from 6.6% in November 2018. This …Read More

European green finance is expanding, a discount on bank capital would discredit it

Alexander Lehmann, (2020), “European green finance is expanding, a discount on bank capital would discredit it“, Bruegel, 15 January If EU banks are to mobilise a greater share of loans for sustainable projects they will need a reliable policy framework, clear internal performance targets and the relevant skills. A discount on bank capital underlying such assets is neither justified nor likely effective. A comprehensive review of how climate risks are …Read More

Central banks and climate change

Markus K. Brunnermeier, Jean-Pierre Landau, (2020), Central banks and climate change, VoxEU, 15 January Central banks have been called on to contribute to fighting climate change. This column presents a framework for thinking about the issue and identifies some major trade-offs and choices. It argues that climate should be a major part of risk assessments and that capital ratios could be used in a proactive way by applying favourable regimes …Read More

The European Green Deal: will the ends, will the means?

Andrew Watt, (2020), ” The European Green Deal: will the ends, will the means?”, Social Europe, 14 January Carbon pricing will foster climate-friendly investment by the private sector but the investment gap if climate goals are to be reached is huge: the commission estimates it at €260 billion (around 1.5 per cent of 2018 gross domestic product) annually until 2030, not including mitigating the social costs of transition. Public-sector involvement …Read More

Riding through the storm: Lessons and policy implications for policymaking in EMU

Marco Buti, (2020), “Riding through the storm: Lessons and policy implications for policymaking in EMU“, VoxEU, 12 January In December 2019, Marco Buti left the position of Director General for Economic and Financial Affairs at the European Commission at the end of a rough journey through the crisis and its aftermath. In this column, he draws the main lessons out of five key moments in the crisis for the completion of EMU …Read More

Zombification is a real, not a monetary phenomenon: Exorcising the bogeyman of low interest rates

Ulrich Bindseil, Jürgen Schaaf, (2020), “Zombification is a real, not a monetary phenomenon: Exorcising the bogeyman of low interest rates” , VoxEU, 10 January Low nominal interest rates have worried central bank critics for different reasons over the last decade. First, calls for pre-emptive interest rate increases were motivated by fears of a return of excessive inflation. Then, they were said to fuel financial bubbles, and therefore to eventually lead …Read More

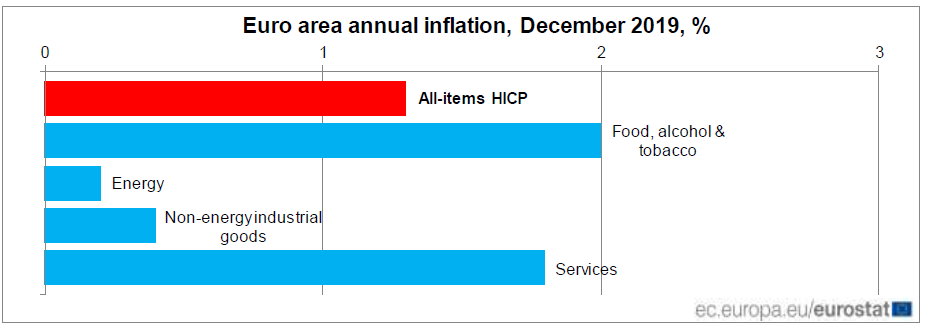

Euro area annual inflation up to 1.3%

Eurostat, (2020), “Euro area annual inflation up to 1.3%“, 7 January “Euro area annual inflation is expected to be1.3% in December 2019, up from 1.0% in November according to a flash estimate from Eurostat, the statistical office of the European Union.Looking at the main components of euro area inflation,food, alcohol & tobacco is expected to have the highest annual rate in December (2.0%, compared with 1.9% in November), followed by …Read More