iMFBlog, (2017), “Chart of the Week: Inequality and the Decline in Labor Share of Income”, 20 March As discussed in the IMF’s G20 Note, and a blog last week by IMF Managing Director Christine Lagarde, a forthcoming chapter of the World Economic Outlook seeks to understand the decline in the labor share of income (that is, the share of national income paid in wages, including benefits, to workers) in many countries …Read More

Carving out legacy assets: a successful tool for bank restructuring?

Lehmann, Alexander, (2017), “Carving out legacy assets: a successful tool for bank restructuring?”, Bruegel, 21 March Separating ‘legacy assets’ from banks’ core business is central to the rehabilitation of Europe’s banking system. How can Europe progress in its ongoing effort to rid the financial system of legacy assets, and equip it with renewed growth? Relevant Posts Honohan, Patrick, (2017), “Management and Resolution of Banking Crises: Lessons from Recent European Experience Patrick …Read More

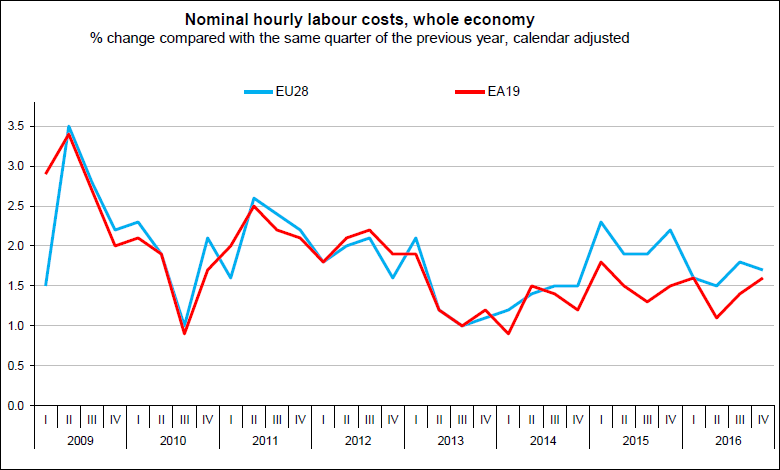

Annual growth in labour costs at 1.6% in euro area

Eurostat/Annual growth in labour costs at 1.6% in euro area, 20 March 2017 Hourly labour costs rose by 1.6% in the euro area (EA19) and by 1.7% in the EU28 in the fourth quarter of 2016, compared with the same quarter of the previous year. In the third quarter of 2016, hourly labour costs increased by 1.4% and 1.8% respectively. These figures are published by Eurostat, the statistical office of the …Read More

The inflation basket case

Merler, Silvia, (2017), “The inflation basket case“, Bruegel, 17 March ECB President Draghi highlighted that there are no signs yet of a convincing upward trend in underlying inflation. Indeed, this stands out clearly if we look more in detail at the composition of the basket. Figure 1 shows the headline and core inflation rates for the euro area, together with the share of items in the Harmonised Consumer Price Index …Read More

Governments Have Put the ECB in a Bind

Bloomberg, (2017), “Governments Have Put the ECB in a Bind”, Bloomberg, 20 March If you think it will be hard for the U.S. Federal Reserve to normalize monetary policy, spare a thought for the European Central Bank. The euro zone’s monetary guardians have said they will continue to buy 60 billion euros a month in government and corporate bonds until the end of 2017. Headline inflation is running at 2 …Read More

Mixed Signals from the Eurozone

Gros, Daniel, (2017), “Mixed Signals from the Eurozone”, Project Syndicate, 16 March What does the eurozone’s future hold? It depends where you look. Some economic indicators suggest that things are looking up for the common currency’s survival; for example, employment has returned to its pre-crisis peak, and per capita GDP growth exceeded that of the United States last year. At the same time, political risks seem to be increasing, despite the …Read More

What future for Europe?

Wolff, Guntram B., (2017), “What future for Europe?”, Bruegel, 16 March The Commission’s White Paper on the future of the EU sets out five scenarios, but misses the fundamental questions facing Europe. How should the EU interact with its neighbourhood? How can we manage the tensions created by multi-speed integration? And above all how can the Euro be made sustainable in the absence of a major step towards fiscal union? …Read More

The Role of Fiscal Policy When Private Debt is High

Batini, Nicoletta, Melina, Giovanni, Moreno Badia, Marialuz, Villa, Stefania, (2017), “The Role of Fiscal Policy When Private Debt is High”, EconoMonitor, 15 March Excessive private debt is a major headwind against the global recovery. Where fiscal space is available, a more active role of fiscal policies can facilitate an orderly private deleveraging while minimizing its output costs. However, fiscal policy cannot do it alone; it has to be supported by complementary …Read More

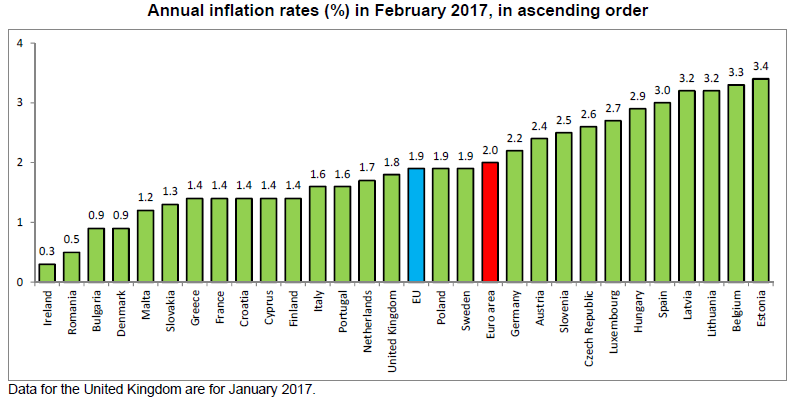

Annual inflation up to 2.0% in the euro area

Eurostat/Annual inflation up to 2.0% in the euro area, 16 March 2017 Euro area annual inflation was 2.0% in February 2017, up from 1.8% in January. In February 2016 the rate was -0.2%. European Union annual inflation was 1.9% in February 2017, up from 1.7% in January. A year earlier the rate was -0.1%. These figures come from Eurostat, the statistical office of the European Union. Relevant Posts Eurostat/ “Euro area annual …Read More

Sovereign spreads in the Eurozone on the rise: Redenomination risk versus political risk

De Santis, Roberto, (2017), “Sovereign spreads in the Eurozone on the rise: Redenomination risk versus political risk”, VoxEu, 16 March French sovereign spreads have risen in recent months, coinciding with debate over the euro ahead of the country’s presidential elections in May. Italian sovereign spreads have been rising since the beginning of 2016. This column argues that investors are not pricing a break-up of France from the Eurozone. Most likely, they …Read More