Luigi Guiso, Helios Herrera, Massimo Morelli, Tommaso Sonno, (2018), “Global Crises and Populism: the Role of Eurozone Institutions”, working paper, CEPR, May Populist parties are likely to gain consensus when mainstream parties and status quo institutions fail to manage the shocks faced by their economies. Institutional constraints, which limit the possible actions in the face of shocks, result in poorer performance and frustration among voters who turn to populist movements. …Read More

Reflections on monetary policy in the euro area

ECB, (2018), “Reflections on monetary policy in the euro area”, 27 April While the recent flow of data points towards some moderation in the on-going economic expansion, growth is still expected to remain solid and broad based. Monetary policy measures introduced since 2014 have been instrumental in supporting euro area growth and employment. Underlying inflation continues to be subdued and have yet to show convincing signs of a sustained upward …Read More

Euro area economic and financial developments by institutional sector: fourth quarter of 2017

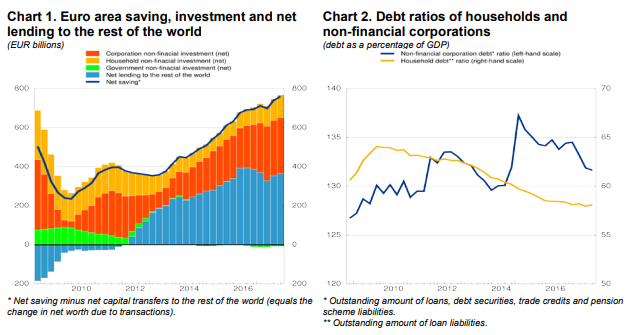

Euro area economic and financial developments by institutional sector: fourth quarter of 2017, 27 April 2018 Euro area saving (net, as a percentage of disposable income) was higher in the fourth quarter of 2017 than in the same quarter of the previous year. Total euro area non-financial investment (net) increased owing to higher investment by households and non-financial corporations (NFCs). Euro area net lending to the rest of the world …Read More

State contingent debt as insurance for euro-area sovereigns

Maria Demertzis & Stavros Zenios, (2018), “State contingent debt as insurance for euro-area sovereigns”, Bruegel, working paper, 26 April Since the financial crisis, EU countries’ economies have recovered to the point that they are exiting their adjustment programmes. Institutional stability mechanisms have been improved at the European level, with the promotion of the banking union and the establishment of a European Monetary Fund, for instance. However, the authors argue that …Read More

Deepening EMU requires a coherent and well-sequenced package

Marco Buti, Gabriele Giudice, José Leandro, (2018), “Deepening EMU requires a coherent and well-sequenced package”, 24 April The debate on EMU deepening is entering a critical stage. The contribution of 14 French and German economists (Benassy-Quéré et al. 2018) is therefore timely. It suggests ways for reconciling risk-sharing with market discipline – where the biggest divisions lie. Their initiative overlaps in spirit and with much of the substance of the …Read More

EU banks rush to ‘have cake and eat it’ with bad loan sales

Martin Arnold (2018), “EU banks rush to ‘have cake and eat it’ with bad loan sales”, Financial Times, 23 April Southern European banks have taken more than €14bn in extra provisions this year to write down the value of toxic loans they plan to sell, while taking advantage of a new accounting rule to delay the hit to capital. Analysts say the opportunity for banks to “have their cake and eat …Read More

Government debt fell to 86.7% of GDP in euro area

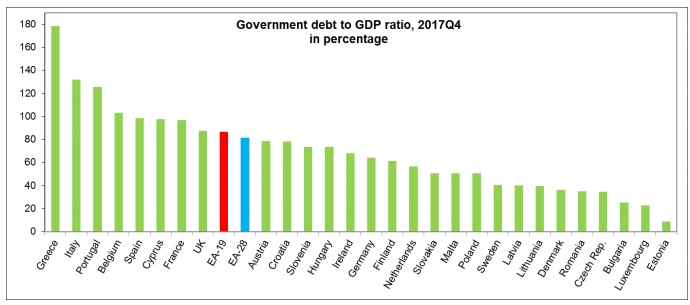

Eurostat/Government debt fell to 86.7% of GDP in euro area/24 April 2018 At the end of the fourth quarter of 2017, the government debt to GDP ratio in the euro area (EA19) stood at 86.7%, compared with 88.1% at the end of the third quarter of 2017. In the EU28, the ratio also decreased from 82.4% to 81.6%. Compared with the fourth quarter of 2016, the government debt to GDP …Read More

Government debt up to 89.5% of GDP in euro area

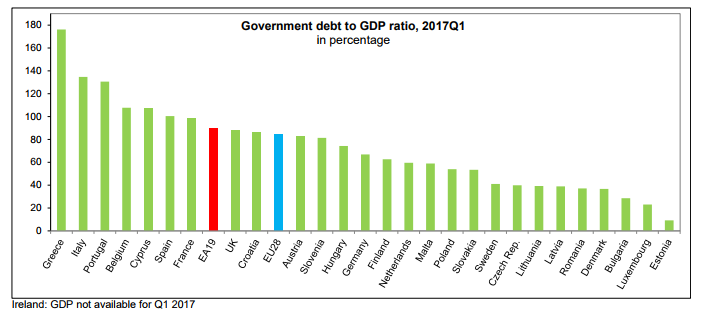

Eurostat/Government debt up to 89.5% of GDP in euro area/20 July 2017 At the end of the first quarter of 2017, the government debt to GDP ratio in the euro area (EA19) stood at 89.5%, compared with 89.2% at the end of the fourth quarter of 2016. In the EU28, the ratio also increased from 83.6% to 84.1%. Compared with the first quarter of 2016, the government debt to GDP …Read More

Change Is Coming at the ECB. Just Not Quickly.

Moss, Daniel, (2017), “Change Is Coming at the ECB. Just Not Quickly.”, Bloomberg View, 18 July The European Central Bank is wrestling with how to exit the super-accommodative policy that’s dominated Mario Draghi’s tenure as president. In trying to determine the path of this off-ramp, it might be instructive to look backward. To December of last year, to be precise. That’s when the ECB took what looks in retrospect like …Read More

The Re-Emerging Privilege of Euro Area Membership

Wiegand, Johannes, (2017), “The Re-Emerging Privilege of Euro Area Membership”, IMF Working Paper No. 17/162, 18 July When the euro was introduced in 1998, one objective was to create an alternative global reserve currency that would grant benefits to euro area countries similar to the U.S. dollar’s “exorbitant privliege”: i.e., a boost to the perceived quality of euro denominated assets that would increase demand for such assets and reduce euro …Read More