Krauss, Melvyn, (2017), “Italy’s Bank Bailout Serves German Interests Too”, Bloomberg View, 7 July As Europe’s politicians digest the lessons from Italy’s recent 17 billion euro ($19.34 billion) bailout of two Venetian banks, two schools of opinion have emerged. The majority view is that the bailout, while less than ideal, at least brought greater financial stability to Italy. Relevant Posts Setser, Brad W., Smith, Emma, (2017), «Where Does Italy’s Bank …Read More

The Inflation Target Trap

Gros, Daniel, (2017), “The Inflation Target Trap”, Project Syndicate, 6 July Central banks have a problem: growth in much of the world is accelerating, but inflation has failed to take off. Of course, for most people, growth without inflation is the ideal combination. But central banks have set the goal of achieving an inflation rate of “below, but close to 2%,” as the European Central Bank puts it. And, at …Read More

Euro’s Short Squeeze May Just Be Getting Started

Schenker, Jason, (2017), “Euro’s Short Squeeze May Just Be Getting Started”, Bloomberg View, 7 July The euro has had an impressive rally since mid-April, including a surge last week that took it to its highest level against the dollar since May 2016. The logical question now is whether the run is over, especially after the currency’s softness this week in the face of some strong euro-zone economic data. Based on …Read More

The effectiveness of unconventional monetary policy on risk aversion and uncertainty. For an optimal use of economic policy framework – priority to financial union

Rompolis, Leonidas S., (2017), “The effectiveness of unconventional monetary policy on risk aversion and uncertainty. For an optimal use of economic policy framework -priority to financial union“, Bank of Greece, Working Paper 231, June This paper examines the impact of unconventional monetary policy of ECB measured by its balance sheet expansion on euro area equity market uncertainty and investors risk aversion within a structural VAR framework. An expansionary balance sheet …Read More

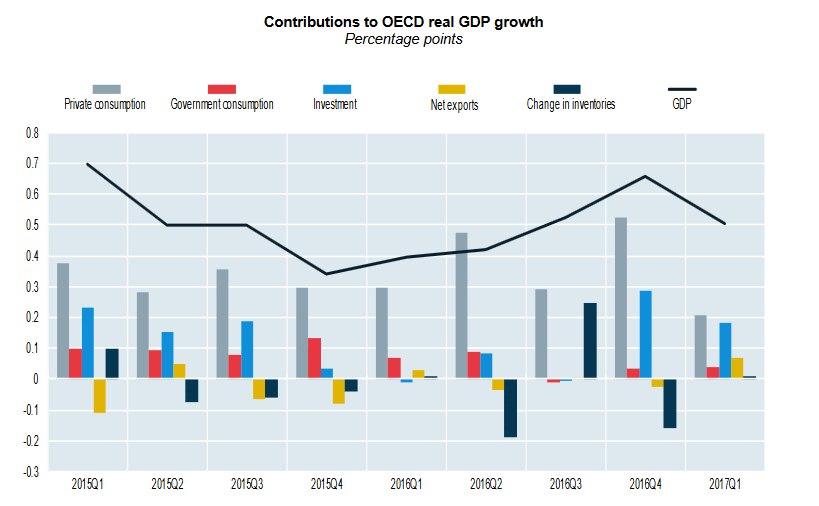

Contributions to GDP growth: first quarter 2017, Quarterly National Accounts

OECD/Contributions to GDP growth: first quarter 2017, Quarterly National Accounts/6 July 2017 Real GDP in the OECD area increased by 0.5% in the first quarter of 2017, compared with 0.7% in the previous quarter, according to provisional estimates, mainly reflecting reduced contributions from private consumption (0.2 percentage point against 0.5 in the previous quarter) and investment (0.2 percentage point against 0.3). Net exports provided an additional 0.1 percentage point to …Read More

The Art of the Surplus

Schmidt, Christoph M., (2017), “The Art of the Surplus”, Project Syndicate, 5 June Germany’s persistently high current-account surplus may not be on the official agenda of this week’s G20 summit in Hamburg, but it is bound to provoke tensions among the assembled leaders. After all, that surplus, which has long been a bone of contention for many of Germany’s trade partners, hit a new high of 8.3% of nominal GDP …Read More

The international role of the euro

European Central Bank (ECB), (2017), “The international role of the euro”, Annual Review, July This report covers developments in 2016 and early 2017. This period was characterised by heightened non-economic risks stemming in particular from geopolitical developments, elections in some euro area countries, economic policy uncertainty in the wake of the outcome of the United Kingdom’s referendum on EU membership and the arrival of a new US administration, as well …Read More

Growing, shrinking, and long-run economic performance

Broadberry, Stephen, Wallis, John Joseph, (2017) “Growing, shrinking, and long-run economic performance”, VoxEU, 5 July Most analysis of long-run economic performance abstracts from short-run fluctuations and seeks to explain improved performance through an increase in the rate of growth. Using data on annual rates of change of per capita income reaching back to the 13th century for some countries, this column show that improved long-run performance has actually occurred primarily …Read More

European Safe Bond: Handle With Care

Baglioni, Angelo, Hamaui, Rony, (2017), “European Safe Bond: Handle With Care”, Social Europe, 5 July In the Euro Area there is a scarcity of risk-free securities; these are issued today only by a few sovereigns with a very high rating, but not by any European institution given strong German opposition. This situation creates huge capital flows in stress periods (flight-to-quality) and it contributes to the diabolic loop between bank and sovereign …Read More

The rise of redistributive politics in the EU is setting limits on the completion of Economic and Monetary Union

Vilpišauskas, Ramūnas , (2017), “The rise of redistributive politics in the EU is setting limits on the completion of Economic and Monetary Union”, LSE EUROPP, 24 June One of the key areas of controversy in responses to the Eurozone crisis has been the notion of transferring financial resources from prosperous economies in the North to struggling economies in the South. Ramūnas Vilpišauskas argues that this issue has effectively put redistributive politics …Read More