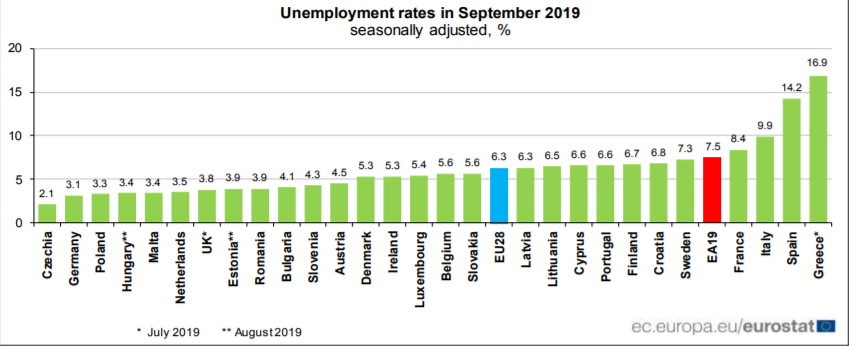

Eurostat, (2019), «Euro area unemployment at 7.5%», 31 Οκτωβρίου The euro area (EA19) seasonally-adjusted unemployment rate was 7.5% in September 2019, stable compared with August 2019 and down from 8.0% in September 2018. This is the lowest rate recorded in the euro area since July 2008. The EU28 unemployment rate was 6.3% in September 2019, stable compared with August 2019 and down from 6.7% in September 2018. This remains the …Read More

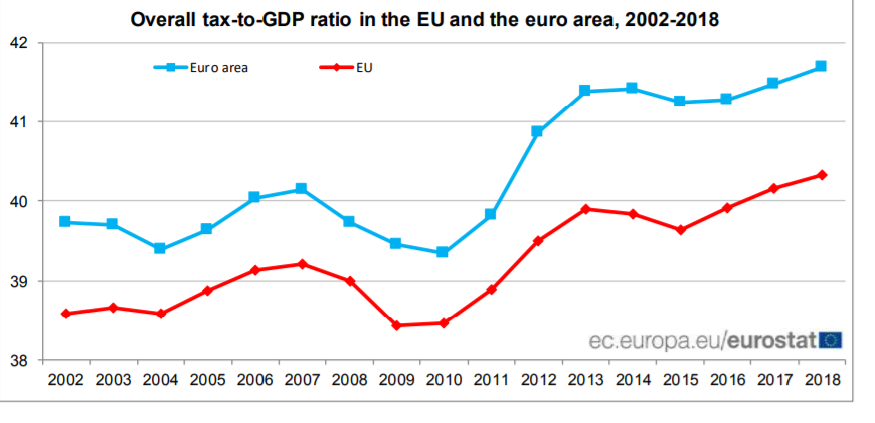

Tax-to-GDP ratio up to 40.3% in EU

Eurostat, (2019) «Tax-to-GDP ratio up to 40.3% in EU», 30 Οκτωβρίου The overall tax-to-GDP ratio, meaning the sum of taxes and net social contributions as a percentage of Gross Domestic Product, stood at 40.3% in the European Union (EU) in 2018, a slight increase compared with 2017 (40.2%). In the euro area, tax revenue accounted for 41.7% of GDP in 2018, up from 41.5% in 2017 Σχετικές Αναρτήσεις Eurostat,(2018) «Tax-to-GDP ratio up …Read More

The Single Market remains the decisive power of the EU

Jacques Pelkmans, (2019), «The Single Market remains the decisive power of the EU», Ceps, 18 Οκτωβρίου The EU’s single market should not just be one among several priorities for the new Commission and Parliament. The single market was and is the core business of the EU. Much of what goes on or is proposed under elaborate titles is actually part and parcel of the single market. The striking revelation of …Read More

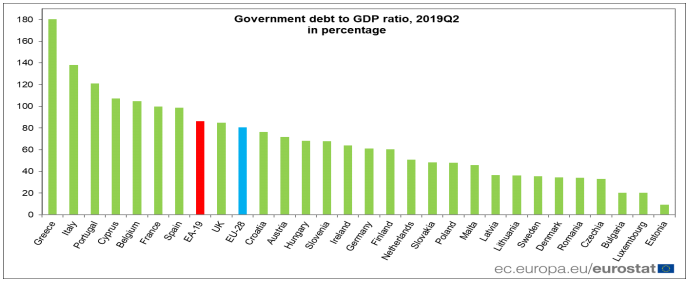

Government debt down to 86.4% of GDP in euro area

Eurostat/Government debt down to 86.4% of GDP in euro area/22 Οκτωβρίου 2019 At the end of the second quarter of 2019, the government debt to GDP ratio in the euro area (EA19) stood at 86.4%, compared with 86.5% at the end of the first quarter of 2019. In the EU28, the ratio decreased from 81.1% to 80.5%. Compared with the second quarter of 2018, the government debt to GDP ratio …Read More

European economic democracy: a path out of the crisis

Lorena Lombardozzi and Neil Warner, (2019), «European economic democracy: a path out of the crisis», Social Europe, 21 Οκτωβρίου The crisis of purpose in European social democracy is not for want of attempts to propose policy solutions. On one level, reforms which need to take place at the European level—from a eurozone fiscal union to the expansion of protection for workers—are well acknowledged. On the other, especially in the British …Read More

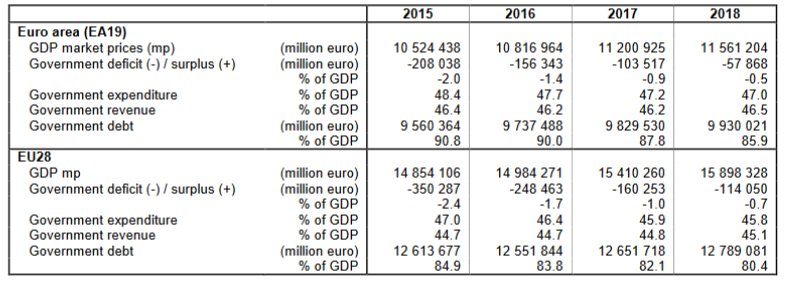

Euro area government deficit at 0.5% and EU28 at 0.7% of GDP

Eurostat/Euro area government deficit at 0.5% and EU28 at 0.7% of GDP/21 Οκτωβρίου 2019 In 2018,the government deficit and debt of both the eur oarea(EA19)and the EU28 decreased in relative terms compared with 2017.In the euro area the government deficit to GDP ratio fell from 0.9% in 2017to 0.5% in 2018,and in the EU28 from1.0%to 0.7%. In the euro area the government debt to GDP ratio declined from 87.8% at …Read More

Brexit and Finance: Brace for No Impact?

Nicolas Veron, (2019), «Brexit and Finance: Brace for No Impact?», Bruegel, 14 Οκτωβρίου Amid the daily high drama of Brexit, it is easy to lose track of the structural shifts, or lack thereof, that may be associated with the UK’s possible departure from the European Union. One of them, and not the least, is the potential impact on the European and global financial system. London is currently the undisputed financial hub of …Read More

Πράσινο φως από Κομισιόν στον προϋπολογισμό του 2020

Ειρήνη Χρυσολώρα, Ελένη Βαρβιτσιώτη, (2019), «Πράσινο φως από Κομισιόν στον προϋπολογισμό του 2020», Η Καθημερινή, 17 Οκτωβρίου Μικρές αλλαγές σε σχέση με το προσχέδιο προϋπολογισμού που κατατέθηκε στις 7 Οκτωβρίου στη Βουλή περιλαμβάνει το κείμενο του προσχεδίου που υπεβλήθη προχθές στην Κομισιόν, αλλά, όπως φαίνεται, εξασφαλίζει το πράσινο φως από τις Βρυξέλλες.Το προσχέδιο, εξάλλου, ξεκαθαρίζει ότι θα υπάρξει εφάπαξ φορολογική ελάφρυνση των επιχειρήσεων φέτος, με μείωση κατά 5% της προκαταβολής …Read More

With or without you: are central European countries ready for the euro?

Zsolt Darvas, (2019), «With or without you: are central European countries ready for the euro?», Bruegel, 10 Οκτωβρίου Southern European euro-area members suffered from unsustainable developments after they joined the euro in 1999 and up to 2008, and have had great difficulties since. Inadequate national policies were the main causes of these unsustainable developments, but euro membership played a role before 2008 by leading to low real interest rates (which …Read More

Η Κομισιόν έδωσε και επισήμως την έγκριση στο σχέδιο «Ηρακλής»

naftemporiki.gr,(2019), «Η Κομισιόν έδωσε και επισήμως την έγκριση στο σχέδιο ‘Ηρακλής’», 10 Οκτωβρίου Με σημερινή ανακοίνωσή της η Ευρωπαϊκή Επιτροπή επιβεβαιώνει ότι άναψε το πράσινο φως στο σχέδιο «Ηρακλής» για την αντιμετώπιση των κόκκινων δανείων. Δίνεται έτσι ώθηση στην προσπάθεια των τραπεζών να απαλλαγούν από ένα μεγάλο βάρος και να εξυγιάνουν τους ισολογισμούς τους. Στην ανακοίνωσή της η Κομισιόν αναφέρει πως διαπίστωσε ότι τα σχέδια που κατάρτισε η Ελλάδα για να στηρίξει …Read More