Καπερναράκου, Κατερίνα, (2017), “Η ΕΚΤ φοβάται να προαναγγείλει πότε θα σταματήσει πλήρως το QE”, Η Καθημερινή, 15 Ιουλίου Η οριστική διακοπή του προγράμματος αγοράς τίτλων προβληματίζει την Ευρωπαϊκή Κεντρική Τράπεζα (ΕΚΤ), η οποία δεν επιδιώκει να ορίσει κάποια συγκεκριμένη ημερομηνία γι’ αυτή. Προτιμά να έχει την ευελιξία να αποφασίσει, παρακολουθώντας τα οικονομικά δεδομένα. Οι μισοί από τους αναλυτές που συμμετείχαν σε δημοσκόπηση του Reuters προβλέπουν ότι τον Σεπτέμβριο η ΕΚΤ …Read More

Completing EMU

Buti, Marco, Deroose, Servaas, Leandro, José, Giudice, Gabriele, (2017), “Completing EMU”, VoxEU, 13 Ιουλίου Despite much being done to strengthen the Economic and Monetary Union, it remains incomplete and this is one of the main reasons for the Eurozone’s lacklustre economic performance in the recent years. While there are still diverging views on how to “cross the river”, there is also a political and economic window of opportunity to complete the …Read More

A macro approach to international bank resolution

Schoenmaker, Dirk, (2017), “A macro approach to international bank resolution”, Bruegel, 10 Ιουλίου As regulators rush to strengthen banking supervision and implement bank resolution regimes, a macro approach to resolution is needed that considers both the contagion effects of bail-in and the continuing need for a fiscal backstop to the financial system. This can be facilitated through the completion of a banking union in which the European Stability Mechanism (ESM) …Read More

The New Abnormal in Monetary Policy

Roubini, Nouriel, (2017), “The New Abnormal in Monetary Policy”, Project Syndicate, 10 Ιουλίου Financial markets are starting to get rattled by the winding down of unconventional monetary policies in many advanced economies. Soon enough, the Bank of Japan (BOJ) and the Swiss National Bank (SNB) will be the only central banks still maintaining unconventional monetary policies for the long term. The US Federal Reserve started phasing out its asset-purchase program (quantitative easing, …Read More

The state of trade unions, employer organisations, and collective bargaining in OECD countries

Cazes, Sandrine, Garnero, Andrea, Martin, Sébastien, (2017), “The state of trade unions, employer organisations, and collective bargaining in OECD countries”, VoxEU, 9 Ιουλίου Trade union membership has been declining since the 1980s. Recently, however, there has been renewed interest in the potential of collective bargaining to address rising wealth inequality and poor wage growth. This column presents an OECD report on collective bargaining institutions and practices across member countries and selected …Read More

Italy’s Bank Bailout Serves German Interests Too

Krauss, Melvyn, (2017), “Italy’s Bank Bailout Serves German Interests Too”, Bloomberg View, 7 Ιουλίου As Europe’s politicians digest the lessons from Italy’s recent 17 billion euro ($19.34 billion) bailout of two Venetian banks, two schools of opinion have emerged. The majority view is that the bailout, while less than ideal, at least brought greater financial stability to Italy. Σχετικές Αναρτήσεις Setser, Brad W., Smith, Emma, (2017), «Where Does Italy’s Bank …Read More

The Inflation Target Trap

Gros, Daniel, (2017), “The Inflation Target Trap”, Project Syndicate, 6 Ιουλίου Central banks have a problem: growth in much of the world is accelerating, but inflation has failed to take off. Of course, for most people, growth without inflation is the ideal combination. But central banks have set the goal of achieving an inflation rate of “below, but close to 2%,” as the European Central Bank puts it. And, at …Read More

Euro’s Short Squeeze May Just Be Getting Started

Schenker, Jason, (2017), “Euro’s Short Squeeze May Just Be Getting Started”, Bloomberg View, 7 Ιουλίου The euro has had an impressive rally since mid-April, including a surge last week that took it to its highest level against the dollar since May 2016. The logical question now is whether the run is over, especially after the currency’s softness this week in the face of some strong euro-zone economic data. Based on …Read More

The effectiveness of unconventional monetary policy on risk aversion and uncertainty. For an optimal use of economic policy framework – priority to financial union

Rompolis, Leonidas S., (2017), “The effectiveness of unconventional monetary policy on risk aversion and uncertainty. For an optimal use of economic policy framework -priority to financial union“, Bank of Greece, Working Paper 231, Ιούνιος This paper examines the impact of unconventional monetary policy of ECB measured by its balance sheet expansion on euro area equity market uncertainty and investors risk aversion within a structural VAR framework. An expansionary balance sheet …Read More

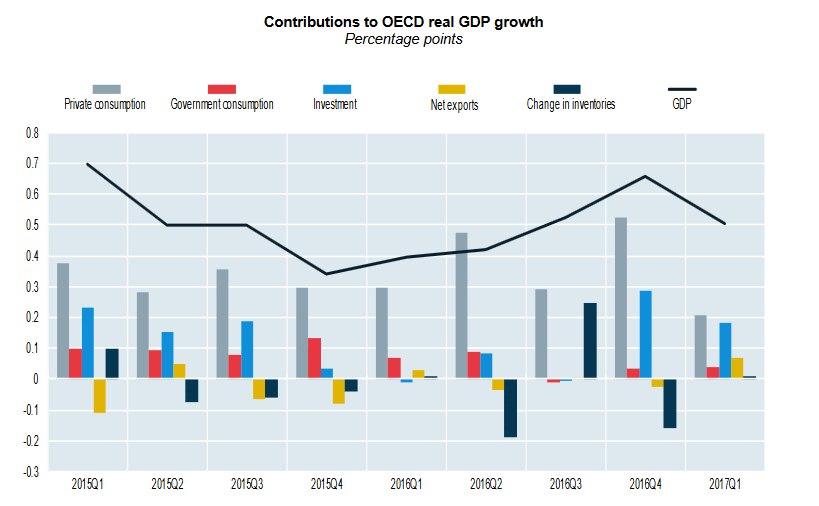

Contributions to GDP growth: first quarter 2017, Quarterly National Accounts

OECD/Contributions to GDP growth: first quarter 2017, Quarterly National Accounts/6 Ιουλίου 2017 Real GDP in the OECD area increased by 0.5% in the first quarter of 2017, compared with 0.7% in the previous quarter, according to provisional estimates, mainly reflecting reduced contributions from private consumption (0.2 percentage point against 0.5 in the previous quarter) and investment (0.2 percentage point against 0.3). Net exports provided an additional 0.1 percentage point to …Read More