Cournède, Boris, Denk, Oliver, Garda, Paula, Hoeller, Peter, (2016), “Enhancing Economic Flexibility: What Is in It for Workers?”, OECD Economic Policy Paper No. 19, November Reforms that boost growth by enhancing economic flexibility often meet strong opposition related to concerns that they may imply adverse consequences for categories of workers. This study investigates how making product or labour market regulation more flexible changes workers’ risks of moving out of employment …Read More

Preventing the Next Eurozone Crisis Starts Now

Pisani-Ferry, Jean, (2016), “Preventing the Next Eurozone Crisis Starts Now”, Project Syndicate, 1 Δεκεμβρίου European leaders have devoted scant attention to the future of the eurozone since July 2012, when Mario Draghi, the European Central Bank’s president, famously committed to do “whatever it takes” to save the common currency. For more than four years, they have essentially subcontracted the eurozone’s stability and integrity to the central bankers. But, while the …Read More

Nothing ventured, nothing gained: How the EU can boost growth in small businesses and start-ups

Thomadakis, Apostolos, (2016), “Nothing ventured, nothing gained: How the EU can boost growth in small businesses and start-ups”, CEPS, 30 Νοεμβρίου Venture capital can be a lifeline to innovative and growth-oriented start-ups and small businesses in need of external capital. In this ECMI Research Report, the author argues that the recently proposed changes to the Regulation on European Venture Capital Funds (EuVECA) fail to address three important issues that could …Read More

Hysteresis and the European unemployment problem revisited

Gali, Jordi, (2015), “Hysteresis and the European unemployment problem revisited”, ECB Forum on Central Banking, May The unemployment rate in the euro area appears to contain a significant non-stationary component, suggesting that some shocks have permanent effects on that variable. I explore possible sources of this non-stationarity through the lens of a New Keynesian model with unemployment, and assess their empirical relevance. Σχετικές Αναρτήσεις Fatás, Antonio, Summers, Lawrence, (2016), “Hysteresis and fiscal …Read More

Liquidity in government bonds – from the British Empire to the Eurozone

Chavaz, Matthieu, Flandreau, Marc, (2016), “Liquidity in government bonds – from the British Empire to the Eurozone”, VoxEu, 1 Δεκεμβρίου Between 1870 and 1914, 68 countries – both sovereign and British colonies – used the London Stock Exchange to issue bonds. This column argues that bond prices and spreads in this period show that the colonies’ semi-sovereignty lowered credit risk at the price of higher illiquidity risk, and further worsened …Read More

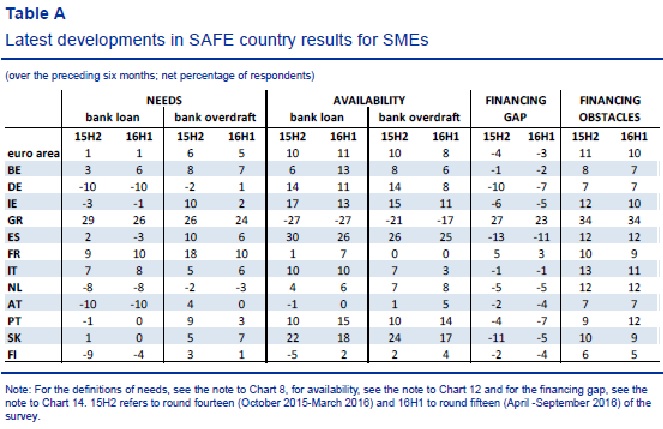

Survey on the Access to Finance of Enterprises in the euro area – April to September 2016

European Central Bank, (2016), “Survey on the Access to Finance of Enterprises in the euro area – April to September 2016“, ECB, Νοέμβριος This report presents the main results of the 15th round of the Survey on the Access to Finance of Enterprises (SAFE), which was conducted between 19 September and 27 October 2016. The total euro area sample size was 11,233 enterprises, of which 10,245 (91%) had fewer than 250 …Read More

Can public support help Europe build distressed asset markets?

Lehmann, Alexander, (2016), “Can public support help Europe build distressed asset markets?”, Bruegel, 29 Νοεμβρίου Distressed asset investors can relieve banks of their NPL overhang and offer valuable restructuring expertise, although banks will need to realise a further valuation loss. Regulators could do a lot to support the growth of this market. Σχετικές Αναρτήσεις Panagiotarea, Eleni, (2016), “The Political Economy of NPLs resolution: Ownership and conditionality”, Hellenic Observatory LSE, 13 …Read More

Globalisation fears weigh heavily on European voters

De Vries, Catherine, Hoffmann, Isabell, (2016), “Globalisation fears weigh heavily on European voters”, Bertelsmann Stiftung, 30 Νοεμβρίου Protest voters and populist politicians are shaking up the long-established political majorities in Europe and the USA. But what prompts voters to back parties who claim that they alone represent the interests of the people and are challenging the so-called establishment? A representative EU opinion poll attempts to uncover the reasons. Σχετικές Αναρτήσεις …Read More

Self-fulfilling dynamics: the interactions of sovereign spreads, sovereign ratings and bank ratings during the euro financial crisis

D. Gibson, Heather, G. Hall, Stephen, S. Tavlas, George, (2016), “Self-fulfilling dynamics: the interactions of sovereign spreads, sovereign ratings and bank ratings during the euro financial crisis”, Bank of Greece, 30 Νοεμβρίου During the euro-area financial crisis, interactions among sovereign spreads, sovereign credit ratings, and bank credit ratings appeared to have been characterized by selfgenerating feedback loops. To investigate the existence of feedback loops, we consider a panel of five …Read More

What impact does the ECB’s quantitative easing policy have on bank profitability?

Demertzis, Maria, B.Wolff, Guntram, (2016), “What impact does the ECB’s quantitative easing policy have on bank profitability?”, Bruegel, 30 Νοεμβρίου This Policy Contribution shows that the effect of the ECB’s QE programme on bank profitability has not yet had a dramatically negative effect on bank operations. Σχετικές Αναρτήσεις Hüttl, Pia, Merler, Silvia, (2016), “An update: Sovereign bond holdings in the euro area – the impact of QE”, Bruegel, 22 Νοεμβρίου S. …Read More