Isabel Schnabel, Nicolas Veron, (2018), “Breaking the Stalemate on European Deposit Insurance”, Bruegel, 5 Μαρτίου In the wake of the European financial and sovereign debt crisis, the euro area embarked in 2012 on establishing a banking union. Its aim was to elevate parts of banking sector policy from the national to the European level, particularly bank supervision and resolution. Successive EU-level reports, including the Four Presidents’ Report of 2012 and …Read More

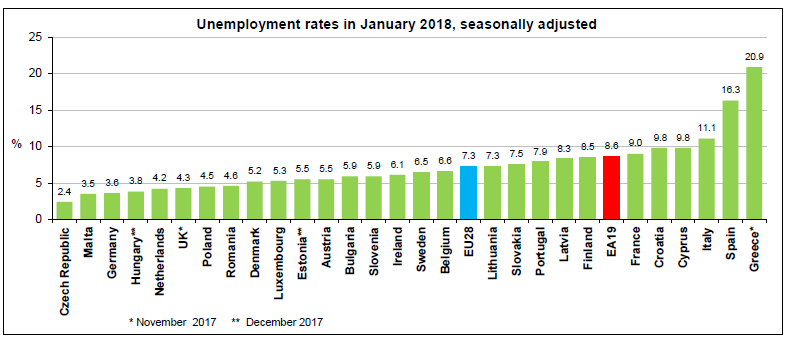

Euro area unemployment at 8.6%

Eurostat/Euro area unemployment at 8.6%/1 Μαρτίου 2018 The euro area (EA19) seasonally-adjusted unemployment rate was 8.6% in January 2018, stable compared to December 2017 and down from 9.6% in January 2017. This is the lowest rate recorded in the euro area since December 2008. The EU28 unemployment rate was 7.3% in January 2018, stable compared to December 2017 and down from 8.1% in January 2017. This remains the lowest rate recorded in the …Read More

The parental home as labour market insurance for young Greeks during the crisis

Rebekka Christopoulou, Maria Pantalidou, (2018), “The parental home as labour market insurance for young Greeks during the crisis”, GreeSE Papers, Hellenic Observatory Discussion Papers on Greece and Southeast Europe, Paper No. 122, Φεβρουάριος Labour market conditions in Greece have severely deteriorated during the crisis, affecting youths the most. Using the Greek crisis as a case-study, this paper examines the role of the family as a social safety net for its young members. Specifically, we test the …Read More

Digital revolutions in public finance

Sanjeev Gupta, Michael Keen, Alpa Shah, Geneviève Verdier, (2018), “Digital revolutions in public finance”, Vox, 7 Μαρτίου Digitalisation has vastly increased our ability to collect and exploit the information that governments use to implement macroeconomic policy. The column argues that the ability of governments to use the vast amounts of information held in the private sector on financial transactions are already making fiscal policy more efficient and effective. Problems of …Read More

Rethinking the governance of economic and monetary union: Should rules continue to rule?

Iain Begg, (2018), “Rethinking the governance of economic and monetary union: Should rules continue to rule?”, LSE EUROPP, 28 Φεβρουαρίου Although the EU economy has returned to a period of stable growth since the Eurozone crisis, several key issues in the governance of economic and monetary union remain unresolved. Drawing on results from the Firstrun project, Iain Begg provides an overview of current concerns and outlines five recommendations to help …Read More

Βάιντμαν: Η ΕΚΤ μπορεί να σταματήσει τις αγορές ομολόγων φέτος

Η Καθημερινή/Reuters, (2018), “Βάιντμαν: Η ΕΚΤ μπορεί να σταματήσει τις αγορές ομολόγων φέτος”, 27 Φεβρουαρίου Η Ευρωπαϊκή Κεντρική Τράπεζα μπορεί να σταματήσει τις αγορές ομολόγων φέτος, αν συνεχισθεί η οικονομική ανάπτυξη, κάνοντας ένα ακόμη βήμα στον μακρύ δρόμο για την απόσυρση της μη συμβατικής νομισματικής στήριξης, δήλωσε σήμερα ο πρόεδρος της γερμανικής κεντρικής τράπεζας (Μπούντεσμπανκ) Γενς Βάιντμαν. Ο ίδιος υποστήριξε ότι η ευρείας βάσης και ταχεία ανάπτυξη θα διασφαλίσουν την …Read More

The Italian elections

Silvia Merler, (2018), “The Italian elections”, Bruegel, 26 Φεβρουαρίου Italy goes to the polls on March 4, with a new electoral law that is largely viewed as unable to deliver a stable government. We review recent opinions and expectations, as well as economists’ assessment of the cost/coverage of parties’ economic promises. Σχετικές Αναρτήσεις Marco Bertacche and Chiara Albanese, (2018), «Berlusconi May Be Closer to a Majority in Italy Than Polls …Read More

Uncovering the profound effects that pension and health care reforms have had in post-crisis Greece

Marina Angelaki, (2018), “Uncovering the profound effects that pension and health care reforms have had in post-crisis Greece”, LSE EUROPP, 23 Φεβρουαρίου Pension and health care reforms introduced in Greece following the 2009 crisis, and the bail out agreements signed with the Troika of the European Commission, the European Central Bank and the International Monetary Fund, have attracted attention because of the significant cuts they entailed. Drawing on recent research, …Read More

The feasibility of sovereign bond-backed securities for the euro area

Philip Lane and Sam Langfield, (2018) “The feasibility of sovereign bond-backed securities for the euro area”, VoxEU, 28 Φεβρουαρίου The euro area’s macro-financial framework is incomplete and fragile. This column highlights how a market for sovereign bond-backed securities could help to enhance financial stability by providing automatic stabilisation. Drawing on a recent feasibility study published by a High-Level Task Force of the European Systemic Risk Board, it outlines how to pave …Read More

Positive Signs in European Labor Markets in 10 Charts

Jacob Funk Kirkegaard, (2018), “Positive Signs in European Labor Markets in 10 Charts”, 20 February The European Commission estimates the euro area economy grew at 2.5 percent in 2017, an upward revision of its previous estimates, suggesting that the pattern will continue in 2018. This trend is at least one percentage point above reasonable estimates of the euro area’s potential growth rate. The still subdued levels of headline (and core) …Read More