Gauti Eggertsson, Ragnar Juelsrud, Ella Getz Wold, (2018), “Monetary policy with negative nominal interest rates”, Vox, 31 Ιανουαρίου Economists disagree on the macroeconomic role of negative interest rates. This column describes how, due to an apparent zero lower bound on deposit rates, negative policy rates have so far had very limited impact on the deposit rates faced by households and firms, and this lower bound on the deposit rate seems …Read More

Disagreement about Future Inflation: Understanding the Benefits of Inflation Targeting and Transparency

Steve Brito, Yan Carriere-Swallow, Bertrand Gruss, (2018), “Disagreement about Future Inflation: Understanding the Benefits of Inflation Targeting and Transparency”, IMF Working Papers, 25 Ιανουαρίου We estimate the determinants of disagreement about future inflation in a large and diverse sample of countries, focusing on the role of monetary policy frameworks. We offer novel insights that allow us to reconcile mixed findings in the literature on the benefits of inflation targeting regimes and central …Read More

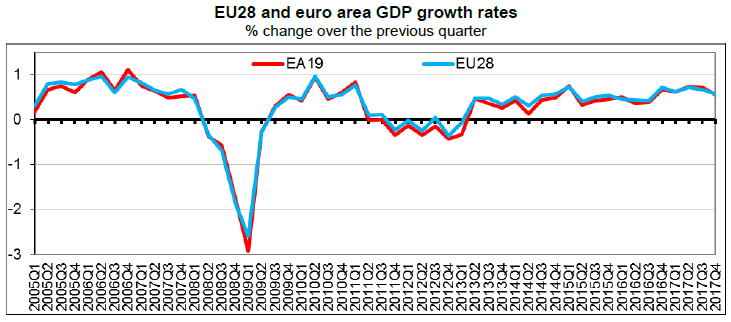

GDP up by 0.6% in both the euro area and the EU28

Eurostat/GDP up by 0.6% in both the euro area and the EU28/30 Ιανουαρίου 2018 Seasonally adjusted GDP rose by 0.6% in both the euro area (EA19) and in the EU28 during the fourth quarter of 2017, compared with the previous quarter, according to a preliminary flash estimate published by Eurostat, the statistical office of the European Union. In the third quarter of 2017, GDP had grown by 0.7% in both zones. Compared with the …Read More

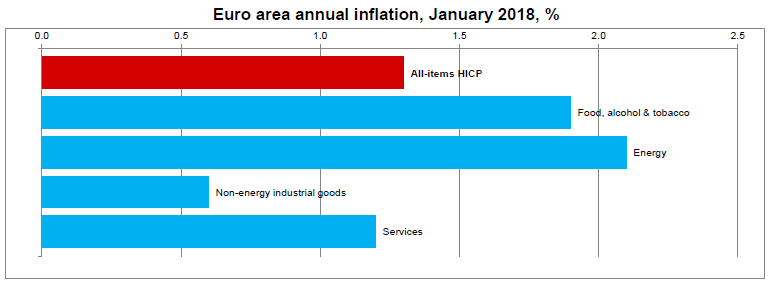

Euro area annual inflation down to 1.3%

Eurostat/Euro area annual inflation down to 1.3%/31 Ιανουαρίου 2018 Euro area annual inflation is expected to be 1.3% in January 2018, down from 1.4% in December 2017, according to a flash estimate from Eurostat, the statistical office of the European Union. Looking at the main components of euro area inflation, energy is expected to have the highest annual rate in January (2.1%, compared with 2.9% in December), followed by food, alcohol & tobacco …Read More

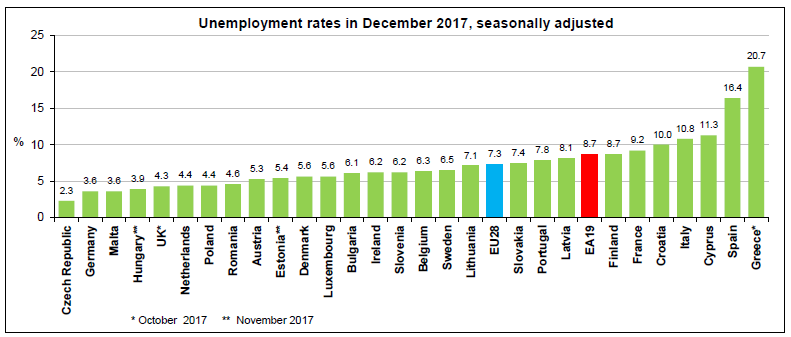

Euro area unemployment at 8.7%

Eurostat/Euro area unemployment at 8.7%/31 Ιανουαρίου 2018 The euro area (EA19) seasonally-adjusted unemployment rate was 8.7% in December 2017, stable compared to November 2017 and down from 9.7% in December 2016. This remains the lowest rate recorded in the euro area since January 2009. The EU28 unemployment rate was 7.3% in December 2017, stable compared to November 2017 and down from 8.2% in December 2016. This remains the lowest rate …Read More

Banking crisis, bail-ins and money holdings

Martin Brown, Ioanna S Evangelou and Helmut Stix, (2018), “Banking crisis, bail-ins and money holdings”, VoxEU, 1 Φεβρουαρίου A cornerstone of new bank resolution policies across the world is the introduction of bail-ins to redistribute the costs of bank failures from taxpayers to bank creditors. This column uses the bail-in of two banks in Cyprus to examine how bank depositors react to this way of resolving a crisis. In the …Read More

Economic crisis and structural reforms in Southern Europe: Policy lessons

Paolo Manasse, Dimitris Katsikas, (2018), “Economic crisis and structural reforms in Southern Europe: Policy lessons”, Vox, 1 Φεβρουαρίου The basic ingredients of the policy prescriptions in response to the euro area debt crisis were quite similar across Southern Europe. This column explores the economic, political, and institutional factors that differentially affected the success of these prescriptions from country to country. Policy timing and sequencing, the balance between fiscal consolidation and …Read More

Why Economic Recovery Won’t Defeat Populism

Andres Velasco, (2018), “Why Economic Recovery Won’t Defeat Populism”, Project Syndicate, 25 Ιανουαρίου During the last few years, a lively debate has taken place between advocates of economic and political/social explanations of populism. The issue is far from settled, but even if the economic explanation is right, it does not follow that the current global recovery will make much of a political difference. Σχετικές Αναρτήσεις Dani Rodrik, (2018), «In Defense …Read More

Reserve Currency Blocs: A Changing International Monetary System?

Camilo E Tovar Mora, Tania Mohd Nor, (2018), “Reserve Currency Blocs: A Changing International Monetary System?”, IMF, 24 Ιανουαρίου What is the extent of currency diversification in the international monetary system? How has it evolved over time? In this paper, we quantify the degree of currency diversification using regression methods of currency co-movements to determine the extent to which national currencies across the world belong to a reserve currency bloc. We …Read More

The ever-rising labour shortages in Europe

Zsolt Darvas, Ines Goncalves Raposo, (2018),“The ever-rising labour shortages in Europe”, Bruegel, 25 Ιανουαρίου Historically high labour shortages in most central-eastern and north-western EU countries suggest that the immigration of central Europeans to north-west EU countries did not take away jobs from local workers on a significant scale. But as labour shortages now exceed their pre-crisis peak, several urgent measures must be considered to help to combat the problem. Σχετικές …Read More