Dirk Schoenmakert, (2016), “The impact of the legal and operational structures of euro-area banks on their resolvability”, Bruegel, 6 Δεκεμβρίου Following the financial crisis, the question of how to handle a big bank’s collapse has come to the fore. This Policy Contribution evaluates the obstacles to resolvability that the legal and operational structures of the large euro-area banks could pose to the European Union’s new resolution regime. Σχετικές Αναρτήσεις De …Read More

Banking regulatory reform: The way forward

Vives, Xavier, (2016), “Banking regulatory reform: The way forward”, VoxEu, 6 Δεκεμβρίου As with previous systemic crises, the 2007-2009 crisis has created regulatory reform, but is it adequate? This column argues that prudential regulation should consider interactions between conduct – capital, liquidity, disclosure requirements, macroprudential ratios – and structural instruments, and also coordinate with competition policy. Though recent reforms are a welcome response to the recent crisis, we do not …Read More

Harmonising Insolvency Laws in the Euro Area: Rationale, stocktaking and challenges

Valiante, Diego, (2016), “Harmonising Insolvency Laws in the Euro Area: Rationale, stocktaking and challenges”, CEPS, 1 Δεκεμβρίου There are four distinct areas where harmonising national insolvency frameworks could improve the functioning of the single market and the stability of the euro area. Early restructuring of businesses, bank resolution, cross-border insolvency and management of non-performing loans rely on common features of local insolvency frameworks, which can affect their legal certainty and …Read More

Enhancing Economic Flexibility: What Is in It for Workers?

Cournède, Boris, Denk, Oliver, Garda, Paula, Hoeller, Peter, (2016), “Enhancing Economic Flexibility: What Is in It for Workers?”, OECD Economic Policy Paper No. 19, November Reforms that boost growth by enhancing economic flexibility often meet strong opposition related to concerns that they may imply adverse consequences for categories of workers. This study investigates how making product or labour market regulation more flexible changes workers’ risks of moving out of employment …Read More

Ιταλία: Τα επικρατέστερα σενάρια μετά το «όχι» στο δημοψήφισμα – την παραίτησή του υποβάλλει σήμερα ο Ματέο Ρέντσι

Bασιλοπουλου, Θεοδωρα, Tσουγκα, Aναστασια, (2016), “Ιταλία: Τα επικρατέστερα σενάρια μετά το «όχι» στο δημοψήφισμα – την παραίτησή του υποβάλλει σήμερα ο Ματέο Ρέντσι”, Καθημερινή, 5 Δεκεμβρίου «Στα χέρια» του Ιταλού Προέδρου Σέρτζιο Ματαρέλα βρίσκεται πλέον το μέλλον της Ιταλίας μετά την ανακοίνωση του Ματέο Ρέντσι ότι θα υποβάλει τη Δευτέρα την παραίτησή του στον απόηχο της ήττας του στο δημοψήφισμα για την συνταγματική μεταρρύθμιση. Πρωταρχικός στόχος άλλωστε του Ματαρέλα, όπως επισημαίνουν οι …Read More

Preventing the Next Eurozone Crisis Starts Now

Pisani-Ferry, Jean, (2016), “Preventing the Next Eurozone Crisis Starts Now”, Project Syndicate, 1 Δεκεμβρίου European leaders have devoted scant attention to the future of the eurozone since July 2012, when Mario Draghi, the European Central Bank’s president, famously committed to do “whatever it takes” to save the common currency. For more than four years, they have essentially subcontracted the eurozone’s stability and integrity to the central bankers. But, while the …Read More

Nothing ventured, nothing gained: How the EU can boost growth in small businesses and start-ups

Thomadakis, Apostolos, (2016), “Nothing ventured, nothing gained: How the EU can boost growth in small businesses and start-ups”, CEPS, 30 Νοεμβρίου Venture capital can be a lifeline to innovative and growth-oriented start-ups and small businesses in need of external capital. In this ECMI Research Report, the author argues that the recently proposed changes to the Regulation on European Venture Capital Funds (EuVECA) fail to address three important issues that could …Read More

Hysteresis and the European unemployment problem revisited

Gali, Jordi, (2015), “Hysteresis and the European unemployment problem revisited”, ECB Forum on Central Banking, May The unemployment rate in the euro area appears to contain a significant non-stationary component, suggesting that some shocks have permanent effects on that variable. I explore possible sources of this non-stationarity through the lens of a New Keynesian model with unemployment, and assess their empirical relevance. Σχετικές Αναρτήσεις Fatás, Antonio, Summers, Lawrence, (2016), “Hysteresis and fiscal …Read More

Liquidity in government bonds – from the British Empire to the Eurozone

Chavaz, Matthieu, Flandreau, Marc, (2016), “Liquidity in government bonds – from the British Empire to the Eurozone”, VoxEu, 1 Δεκεμβρίου Between 1870 and 1914, 68 countries – both sovereign and British colonies – used the London Stock Exchange to issue bonds. This column argues that bond prices and spreads in this period show that the colonies’ semi-sovereignty lowered credit risk at the price of higher illiquidity risk, and further worsened …Read More

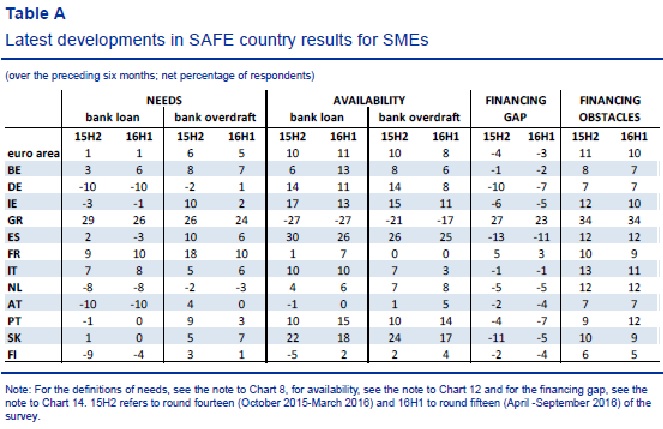

Survey on the Access to Finance of Enterprises in the euro area – April to September 2016

European Central Bank, (2016), “Survey on the Access to Finance of Enterprises in the euro area – April to September 2016“, ECB, Νοέμβριος This report presents the main results of the 15th round of the Survey on the Access to Finance of Enterprises (SAFE), which was conducted between 19 September and 27 October 2016. The total euro area sample size was 11,233 enterprises, of which 10,245 (91%) had fewer than 250 …Read More