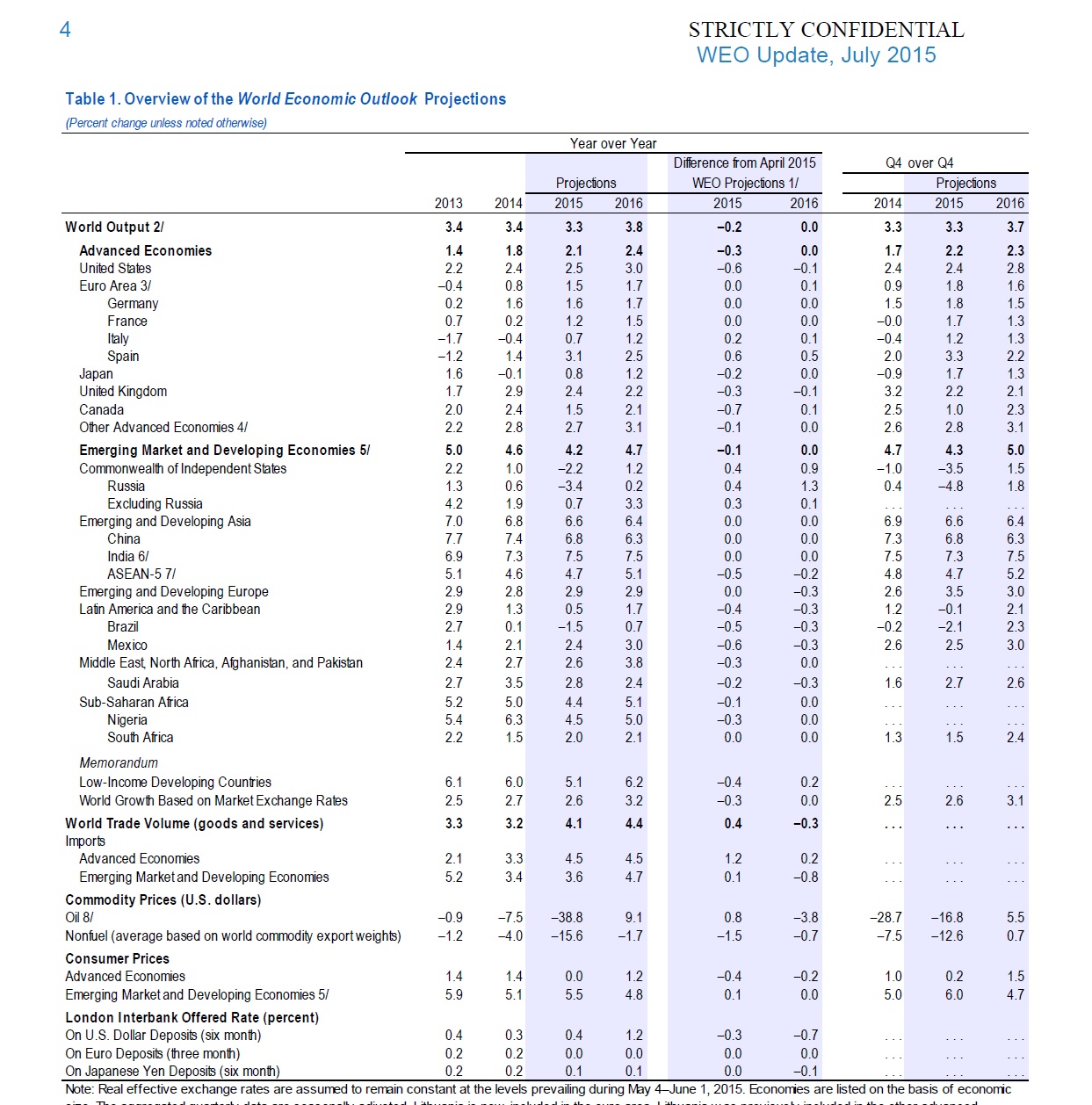

Global growth is projected at 3.3 percent in 2015, marginally lower than in 2014, with a gradual pickup in advanced economies and a slowdown in emerging market and developing economies. In 2016, growth is expected to strengthen to 3.8 percent.A setback to activity in the first quarter of 2015, mostly in North America, has resulted in a small downward revision to global growth for 2015 relative to the April 2015 World Economic Outlook …Read More

The non-independent ECB

Wren Lewis, Simon, (2015), “The non-independent ECB”, Mainly Macro, 10 Ιουλίου Imagine that the Scottish National Party (SNP) had won the independence referendum. The SNP starts negotiating with the remaining UK (rUK) government over issues like how to split up national debt. On some issue the negotiations get bogged down. Rumours start circulating that this might mean that rUK will not form a monetary union with Scotland, and that Scotland …Read More

The political economy of financial crisis policy

Terzi, Alesio, O’ Keeffe, Michael, (2015), “The political economy of financial crisis policy”, Bruegel publications, 8 Ιουλίου Government intervention to stabilise financial systems in times of banking crises ultimately involves political decisions. This paper sheds light on how certain political variables influence policy choices during banking crises and hence have an impact on fiscal outlays. We employ cross-country econometric evidence from all crisis episodes in the period 1970-2011 to examine …Read More

Lessons for Greece: Forcible currency conversions from 1982 to 2015

Reinhart, Carmen, (2015), “Lessons for Greece: Forcible currency conversions from 1982 to 2015”, Voxeu, 9 Ιουλίου Contrary to the intent of the designers of what was to be an irreversible currency union, Greece may well exit the Eurozone. This column argues that default does not inevitably trigger the introduction of a new currency (or the re-activation of an old one). However, if ‘de-euroisation’ is the end game, then a forcible …Read More

Causes and Consequences of Income Inequality : A Global Perspective

Dabla-Norris, Era, Kochhar, Kalpana, Suphaphiphat, Nujin, Ricka, Frantisek, Tsounta, Evridiki, (2015), “Causes and Consequences of Income Inequality : A Global Perspective”, IMF Publications, 15 Ιουνίου This paper analyzes the extent of income inequality from a global perspective, its drivers, and what to do about it. The drivers of inequality vary widely amongst countries, with some common drivers being the skill premium associated with technical change and globalization, weakening protection for labor, and lack of financial inclusion in developing countries. …Read More

Don’t Blame the Euro: Historical Reflections on the Roots of the Eurozone Crisis

Mourlon-Druol, E., (2014), “Don’t Blame the Euro: Historical Reflections on the Roots of the Eurozone Crisis”, West European Politics, Vol. 37, Issue 6, pp. 1282-1296. The article argues that many of the issues that are causing trouble in the eurozone today had long been debated, but not solved, prior to the beginning of the so-called euro crisis. Three thematic examples are used to show this: the decade-long discussion surrounding economic …Read More

The Economy Strikes Back: Support for the Eu during the Great Recession

Gomez, R., (2015), “The Economy Strikes Back: Support for the Eu during the Great Recession”, Journal of Common Market Studies, Vol.53, Issue 3, pp. 577-592. This article looks at the role of economic conditions in shaping people’s attitudes to the EU during the Great Recession. In contrast with previous research, findings suggest that in this particular instance support for the EU across Member States was affected by economic factors. In …Read More

The Euro Crisis’ Theory Effect: Northern Saints, Southern Sinners, and the Demise of the Eurobond

Matthijs, M. & McNamara K., (2015), “The Euro Crisis’ Theory Effect: Northern Saints, Southern Sinners, and the Demise of the Eurobond”, Journal of European Integration, Vol. 37, Issue 2, pp. 229-245. Of the multiple narratives EU policymakers could have chosen at the onset of the euro crisis, why did austerity and structural reform win out over other plausible cures for member states’ problems? Arguably, sovereign debt pooling or more federalized …Read More

Germany and the Eurozone Crisis: Between Hegemony and Domestic Politics

Βulmer, S., (2014), “Germany and the Eurozone Crisis: Between Hegemony and Domestic Politics”, West European Politics, Vol. 37, Issue 6, pp. 1244-1263. This paper explores Germany’s centrality to the outcome of the eurozone crisis. It argues that the eurozone crisis has led Germany’s ordo-liberal principles to trump its other longstanding commitment – i.e. to European integration. These two principles are explored in order then to shed light on how they …Read More

The QE Placebo

Gros, D., (2015), “The QE Placebo”, Project Syndicate, 9 Ιουνίου. BRUSSELS – It has now been nearly half a year since the European Central Bank declared its intention to buy some €1.1 trillion ($1.3 trillion) worth of eurozone bonds. When it first announced the so-called “extended asset-purchase program” in January, the ECB emphasized that it was only expanding an existing program, under which it had been buying modest quantities of …Read More