Orsi, R. (2014) “Why Italy Will Not Make It“, LSE EUROPP, Eurocrisis in the Press, 01 Οκτωβρίου.

Three articles by prestigious commentators (Ambrose Evans-Pritchard and Roger Bootle for The Telegraph, Wolfgang Münchau for Financial Times) have recently appeared in the financial press about the economic situation of Italy and the (in)stability of its national debt. The arguments and wording of these pieces deserve special attention, as their appearance may signal a new turn in the way in which market operators and policy makers are re-positioning themselves in relation to the Italian sovereign debt and the implications of its current trajectory, for the Eurozone and beyond.

In its essence, such turn consists in an at least partial embracing of parts of an admittedly “pessimistic” narrative already articulated by many, including by previous posts on this very blog. All three articles wonder what would happen if the Italian economy continues to stagnate or contract not only this year (which is certain), but also in 2015 and 2016.

In this respect, Bootle puts forward the view that

“Italy is very close to the situation that economists call a ‘debt trap’, that is to say when the debt ratio rises exponentially. From this the only escape is through inflation or default. Italy cannot inflate while it has no separate currency. So, unless something big starts to change pretty soon, Italy is on course for the mother and father of sovereign default.”

There are indeed technical discussions on the maximum sustainable level of public debt for any country, the threshold beyond which some sort of default becomes mathematically unavoidable. Japan’s national debt stands currently over 230% of GDP, but Tokyo is still regarded as a solvable creditor, in essence because Japan’s debt is expressed in the national currency. The case of Italy is notoriously difficult, since the Euro can effectively be considered as foreign currency. Evans is clear in stating that

“[…] Italy’s public debt will spiral to dangerous levels next year, even further beyond the point of no return for a country without its own sovereign currency and central bank.”

Münchau’s article is the most explicit of the three, and adopts what the establishment may consider alarmist tones, which are however pretty much adequate to capture the situation. The associate editor and European economic columnist for the Financial Times writes:

“Italy’s economic position is unsustainable and will result in eventual debt default unless there is a sudden and durable change in economic growth. At that point, Italy’s future in the Eurozone will be in doubt and – and indeed the future of the euro itself.”

These three pieces can be interpreted in several ways. At face value, they address the now very apparent question of Italy’s bleak financial future, pointing at possible risk and remedies. However, they can also be seen as (the beginning of) a media offensive directed at the ECB to force the adoption of monetary policies similar to those of the American FED, the Bank of Japan, and the Bank of England, a point for action which all three authors advocate, alongside the rapid introduction of sweeping reforms in the Italian economic and political system.

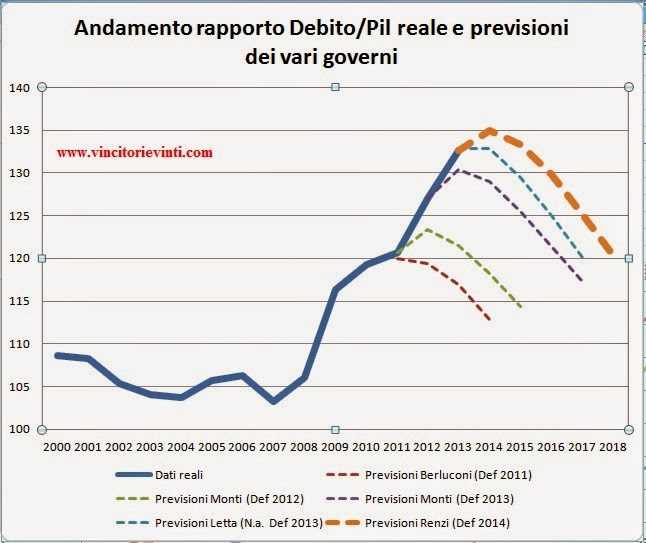

This graph has been produced by the www.vincitorievinti.com blog. It shows the projected public debt of Italy as forecast by the various Italian governments since 2011, and the skyrocketing real trend. 2014 debt levels, now over the 135% mark, show a colossal forecast error of about 20-25% of GDP in comparison to the 2011-2012 official projections.

Σχετικές αναρτήσεις:

- European Commission (2014) “Market Reforms at Work in Italy, Spain, Portugal and Greece“, European Economy 5|2014, Economic and Financial Affairs, Σεπτέμβριος.

- Mody, Α. & Riley, Ε. (2014) “Why does Italy not grow? – The Italian economy has barely grown since it joined the euro area in 1999“, Bruegel Institute, 09 Σεπτεμβρίου.

- Bossone, B., Cattaneo, M. & Zibordi, G. (2014) “Which Options for Mr. Renzi to Revive Italy and Save the Euro?“, Economonitor – A Rubini Global Economics Project, 03 Ιουλίου.