Theodoropoulou, S. (2014) “Structural Reforms Will Not Mitigate The Risk Of Deflation In Europe“, Social Europe Journal, 10 Νοεμβρίου.

In a speech delivered at the Central Bank of Latvia on October 17th, Benoit Coeuré, member of the executive board of the ECB and apparently one of the currently few close confidants of Mario Draghi, argued that speeding up the pace of structural reforms in the Eurozone could be key to averting the area from sliding into deflation. If the implementation of structural reforms was more akin to a ‘big bang’, he claimed, we would see stronger demand as a result, even in the short-run. This is because households and firms, assured of their future higher incomes, would immediately start consuming and investing more. This, he stated, could outweigh any short-run negative effects of reforms on inflation.

Policy-inflicted problems’

He based his propositions on three points. First, he said that his suggestion followed from the special ‘initial’ conditions that ‘we face after the crisis’: the large debt overhang in both private and public sectors, the relatively high rates of structural unemployment and the excessive rent-seeking behaviors in sectors which had long been protected from international competition. The first two of these limit the availability and effectiveness of fiscal and monetary policies in stimulating demand.

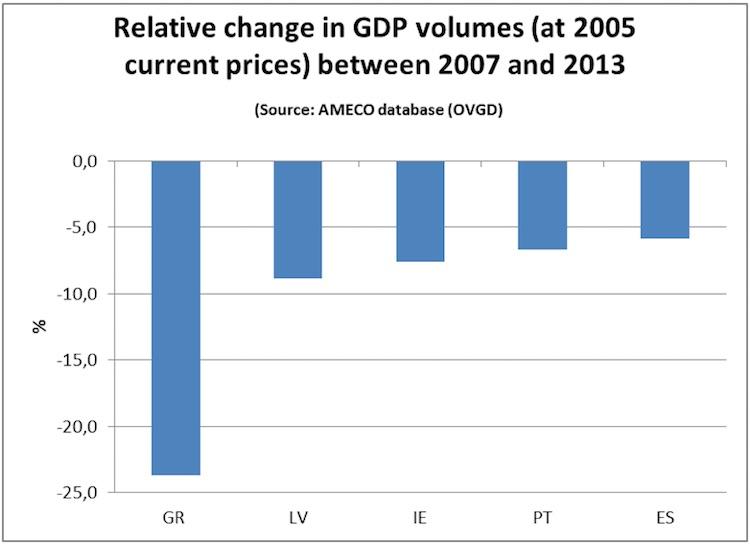

These circumstances, however, have been, to a significant extent, the results of chosen policy responses to the crisis and failing to consider them as such does not give any hope for correcting policy mistakes and avoiding them in the future. With the exception of Greece, the large public sector debt overhang has been the outcome of relentless fiscal austerity and the unnecessarily long-lasting recession it has led to. Public debt to GDP ratios shot up against any forecast or economic adjustment program assumptions; especially in those member states that received bail-outs. Fiscal austerity and its depressing effects on demand only made the paying back of private sector debt even harder.

Structural unemployment, that is, the rate of unemployment that we should expect to see when an economy produces an output level equal to its potential, has increased due to the prolonged recession which itself has by now reduced the potential output in most EU member states. Both structural unemployment and potential output growth are only likely to get worse as long as aggregate demand remains depressed due to hysteresis, a risk that even Mario Draghi has by now publicly acknowledged.

Σχετικές αναρτήσεις:

- De Grauwe, P. (2014) “Stop Structural Reforms and Start Public Investment in Europe“, Social Europe Journal, 17 Σεπτεμβρίου.

- Arestis Ph., and M. Sawyer (2014) “‘Structural Reforms’ and Unemployment”, Triple Crisis, 16 Ιανουαρίου.

- Rubio, E. (2013) “Which financial instrument to facilitate structural reforms in the euro area?“, Notre Europe – Jacques Delors Institute, Policy Paper No.104, December.