Acharya, V. & Steffen, S. (2014) “Making sense of the comprehensive assessment“, VoxEU Organisation, 29 Οκτωβρίου.

The ECB conducted a comprehensive assessment of banks and identified capital shortfalls for 25 banks, totalling €25 billion. In this column, the authors provide a number of benchmark stress tests to estimate capital shortfalls. The analyses suggest possible capital shortfalls between €80 billion and more than €700 billion depending on the model. They find a negative correlation between their benchmark estimates and the regulatory capital shortfall, and a positive one between the benchmarks and the regulatory estimates of losses. This suggests that regulatory stress test outcomes are potentially affected by the discretion of national regulators.

Motivation

The ECB has finalised its assessment of the largest banks in the Eurozone before it commences their regulatory oversight in November 2014. It has now disclosed its own assessment about the solvency of the banking sector (ECB 2014).

In an earlier piece (Acharya and Steffen 2014), we have estimated capital shortfalls of European banks that are going to be part of the Single Supervisory Mechanism (SSM) using ‘benchmark’ stress tests. We documented that the comprehensive assessment might reveal a substantial lack of capital in many peripheral and core European banks. How do our benchmark capital shortfalls compare to the regulatory shortfall estimates?

Sample

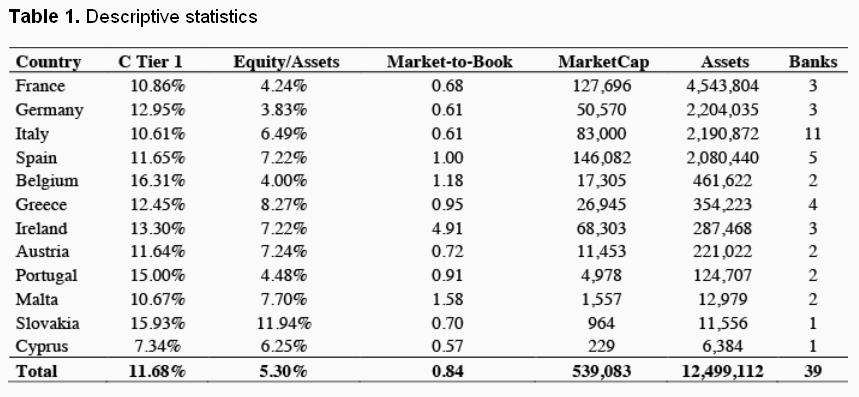

The ECB included 130 banks in the comprehensive assessment. Of these, it will eventually supervise 120 banks directly. This set of banks includes 39 publicly listed financial institutions for which supervisory as well as our benchmark stress test data are available.[1] We use balance sheet data from SNL Financial as of 31 December 2013, which is also the starting point of the comprehensive assessment.

Table 1 shows that these banks have €12.5 trillion in total assets and a market capitalisation of €539 billion. Table 1 also provides an overview of the mean regulatory capital ratio Core Equity Tier 1 (C Tier 1) as well as equity/asset and market-to-book ratios. The mean C Tier 1 capital ratio is 11.68%, the mean equity/asset ratio is 5.3% and the market-to-book ratio is 0.84 and well below 1, i.e., markets are substantially discounting banks’ assets and Cyprus, Italy, and Germany lead the table with the banks that show the lowest market-to-book ratios.

Σχετικές αναρτήσεις:

- Goodhart, C. & Schoenmaker, D. (2014) “The ECB as lender of last resort?“, VoxEU Organisation, 23 Οκτωβρίου.

- Durden, T. (2014) “The ECB Changes Its Mind Which Bonds It Will Monetize, Then It Changes It Again“, ΘZeroHedge, 20 Οκτωβρίου.

- Gilbert, M. (2014) “ECB Gets a Small Win“, Bloomberg View, 10 Οκτωβρίου.