Montalvo, J.G. (2014) “Any hope that a revival of Spain’s housing market could help kick-start the country’s economy is likely to prove misplaced“, LSE EUROPP, 06 November.

Recent months have seen house prices in Spain rise for the first time in six years, after the housing sector was badly hit by the financial crisis. José García writes that one of the most damaging aspects of the crisis in Spain was that the housing bubble experienced during the 2000s was also accompanied by declining productivity. He notes that the underlying picture in the real estate sector remains fragile and that in contrast to previous economic crises in Spain, a revival of the housing market is unlikely to offer a route to economic recovery.

It is well known that one of the culprits of the Spanish economic crisis was the housing sector, as was the case in many other countries such as Ireland and the United States. The size of the Spanish housing bubble was huge: in just a few years the ratio of housing prices over household disposable income doubled from 4 to close to 8. But the worst part of the housing bubble and Spain’s “marvelous decade” was the decreasing productivity of an economy concentrated on building houses, alongside the institutional corruption tied to the development of land and the housing business. In fact, an important part of the current corruption problem in Spain stems from the easy money of the prodigious years of the housing bubble.

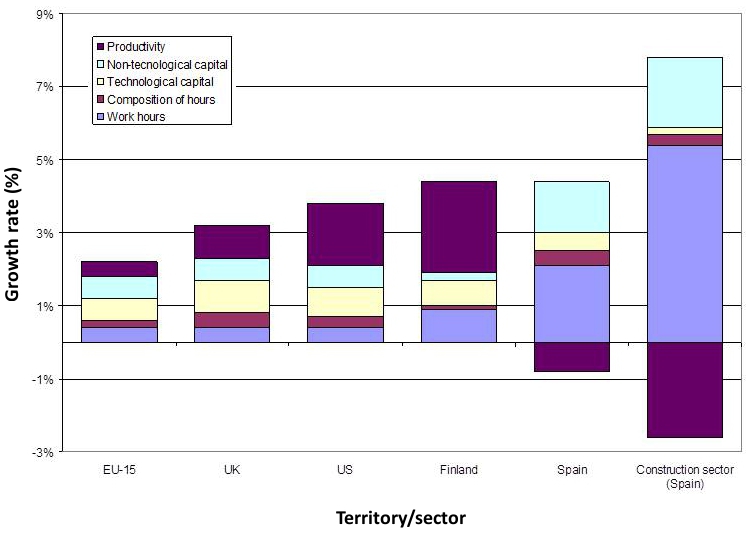

From the outset, many pundits tried to explain the Spanish crisis as the result of an international shock. The figure below shows that they are wrong. Economists disagree on almost everything, but there is one point in which we all agree: an economy in which productivity does not grow has no future. The Spanish economy grew very fast during the “marvelous decade” but with decreasing productivity. The growth was the result of more bodies working more hours with the same old tools. The figure shows that the decomposition of growth for the whole economy was a small-scale replication of the decomposition in the construction sector, which accounted for 18 per cent of GDP at the peak of the bubble and explained 20-25 per cent of the growth of the Spanish economy.

Relevant posts:

- European Commission (2014) “Market Reforms at Work in Italy, Spain, Portugal and Greece“, European Economy 5|2014, Economic and Financial Affairs, September.

- Hugh, E. (2014) “Spain and the IMF: Round the Bend or Out of the Woods?“, A Fistful of Euros-European Opinion Blog, 15 July.

- De Grauwe, P. (2014) “Revisiting the pain in Spain“, VoxEU Organisation, 07 July.