Glover, B. & Richards-Shubik, S. (2014) “Contagion in the European sovereign debt crisis“, VoxEU Organisation, 12 November.

Understanding the probability and magnitude of financial contagion is essential for policymaking. This column applies a framework for modelling financial contagion to data on the cross-holding and credit risk of sovereign debt in Europe. Credit markets perceived little risk of contagion from these spillovers following a sovereign default. It is important for policy to assess other possible channels for contagion that could generate even bigger losses.

Fear of financial contagion was a major motivation behind the bailouts and other interventions provided during the recent sovereign debt crisis in Europe. Given the interconnected network of financial relationships among European nations, the potential for contagion seemed self-evident. But what really was – and is – the magnitude of the risk of sovereign contagion in Europe?

While the direct losses to creditors from a sovereign default can generally be observed, quantifying the spillover losses that would result from such a default is less straightforward. Understanding the potential magnitude of these spillovers is essential for evaluating the net benefits (or costs) of bailouts and other interventions designed to prevent or mitigate the impact of a default.

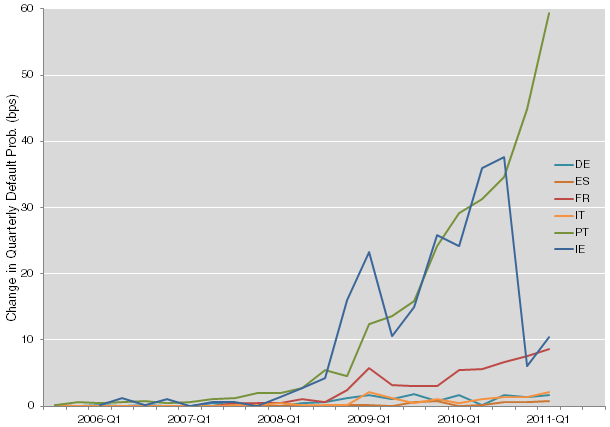

Figure 1. Simulated change in credit risk from Greece default

Relevant posts:

- Xafa, M. (2014) “Lessons from the 2012 Greek debt restructuring“, VoxEU Organisation, 25 June.

- Fuertes Α.-Μ., Kalotychou , Ε. & Saka, Ο. (2014) “ECB Policy and Eurozone Fragility: Was De Grauwe Right?“, Economic Policy, CEPS Working Documents, 20 June.

- Vassilios G. Papavassiliou (2014) “Financial contagion during the European sovereign debt crisis: a selective literature review“, Crisis Observatory, Research Paper Νο. 11, 11 June.