De Grauwe, P. & Ji, Y. (2015) “Quantitative easing in the Eurozone: It’s possible without fiscal transfers“, VoxEU Organisation, 15 January.

The ECB has been struggling to implement a programme of quantitative easing (QE) that would successfully target deflation. The main difficulty is political, stemming from opposition from German institutions. Their argument against is that a government bond buying programme by the ECB would mix fiscal and monetary policy. This column argues the opposite – such a programme can be structured so that it does not mix fiscal and monetary policy. It, therefore, would not impose a risk on German taxpayers.

Introduction

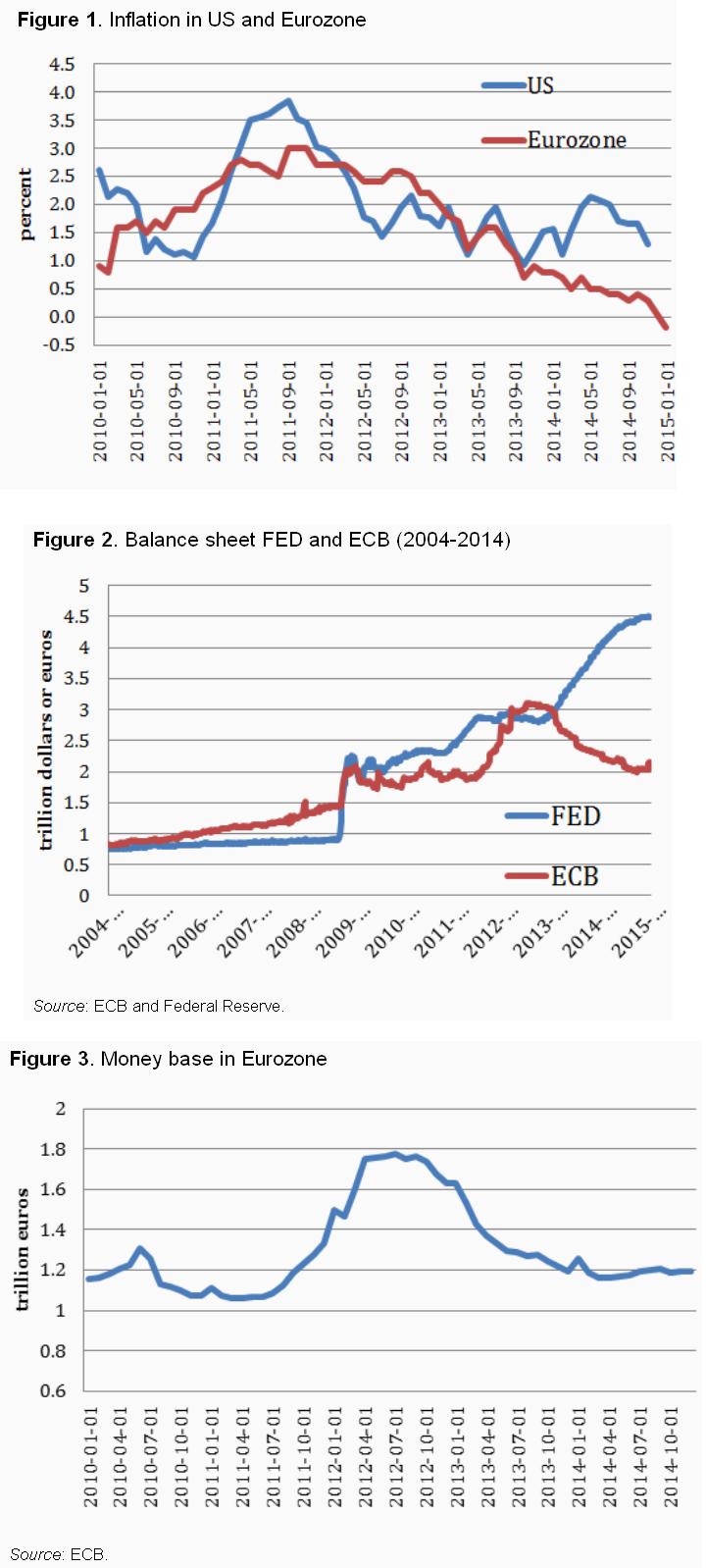

The ECB has been struggling to implement a programme of quantitative easing (QE) to counter the deflationary forces in the Eurozone. What one can say today is that it has not been very successful in stopping deflationary forces as is made vivid in Figure 1. We observe that since 2012 inflation has declined steadily in the Eurozone and became negative at the end of 2014. This trend has coincided with a spectacular decline in the balance sheet of the ECB and a concomitant decline in the money base (the liabilities side of the ECB’s balance sheet) since 2012. Figure 2 shows the balance sheets of the Fed and the ECB, and the strong contrasts in the development of the balance sheets of these two central banks. Figure 3 shows the money base in the Eurozone since 2010 and the spectacular decline in the money base since 2012.

Relevant posts:

- Muellbauer, J. (2014) “Combatting Eurozone deflation: QE for the people“, VoxEU Organisation, 23 December.

- Durden, T. (2014) “The Eurozone’s QE Problem“, ΘZeroHedge, 19 November.

- Gros, D. (2014) “Fighting Deflation: Would QE work in the euro area?“, Economic Policy, CEPS Commentaries, 09 October.