Merler, S. (2015) “Who’s (still) exposed to Greece? – a first trace of normalisation and resume in confidence since 2013, which the present political turmoil risks to revert“, Bruegel Institute, 29 January.

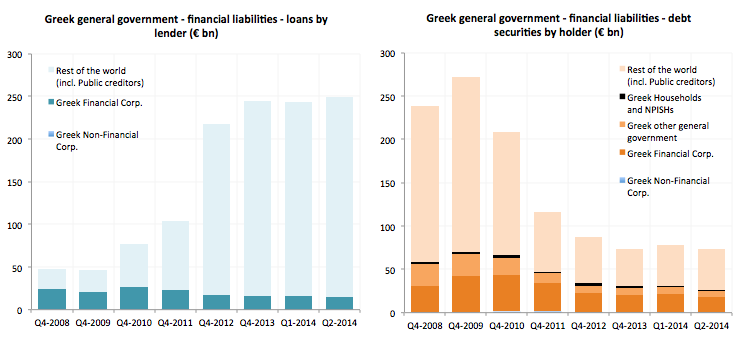

Since the start of the crisis, the structure of Greek debt has changed considerably (almost 80 percent of government financial liabilities are now accounted for by loans, against slightly less than 20 percent back in 2008). At the same time, the weight of public creditors has increased among the creditors of the government. Figure 1 shows a breakdown of the Greek general government financial liabilities across the main creditor sectors (with public creditor included in non-residents). At the end of 2013, debt due to official creditors amounted to 216 billion of loans (IMF/EU loans) and 38 billion of securities (under SMP). This means that, at the end of 2013, official creditors accounted for about 94 percent of the total loans due to non-residents and 89 percent of the total securities held by non residents.

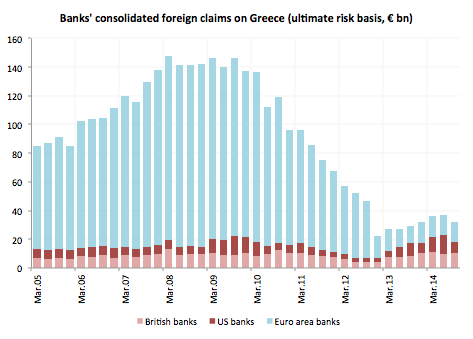

But the government is not the only Greek sector to which foreign investors are exposed, and official creditors are not the only investors in Greece. After Greece came under market pressure and eventually obtained an EU/IMF macroeconomic financial assistance programme in 2010, foreign banks started to rapidly reduce their exposure to Greece (figure 2). Euro area banks’ consolidated foreign claims on Greece – which peaked at about 128 billion euro in 2008 – reached a low of about 12 billion euro in September 2013. UK banks’ exposure reached a peak of 13 billion in March 2008 and dropped to 4.3 billion in December 2012. US banks’ exposure instead was about 14 billion in September 2009 and down to 2.5 billion at the end of 2012.

Relevant posts:

- Darvas, Z. & Hüttl, P. (2015) “How to reduce the Greek debt burden? – There are options to reduce the net present value of Greek public debt servicing costs by more than 15 percent of GDP without incurring losses on creditors, Bruegel Institute Analyses, 09 January.

- Xafa, M. (2014) “Lessons from the 2012 Greek debt restructuring“, VoxEU Organisation, 25 June.

- Wyplosz, C. (2013) “Messing up the next Greek debt relief could endanger the Eurozone”, VoxEU, 23 September.