Nelson, Β., Pinter, G. & Theodoridis, K. (2015) “Does a surprise tightening of monetary policy expand shadow banking?“, VoxEU Organisation, 16 March.

There has been an extensive debate over whether central banks should raise interest rates to ‘lean against’ the build-up of leverage in the financial system. This column reports on empirical evidence showing that, in contrast to the conventional view, surprise monetary contractions have tended to increase shadow bank asset growth, rather than reduce it in the US. Monetary policy had the opposite effect on commercial bank asset growth. These findings cast some doubt on the idea that monetary policy could be used to “get in all the cracks” of the financial system in a uniform way.

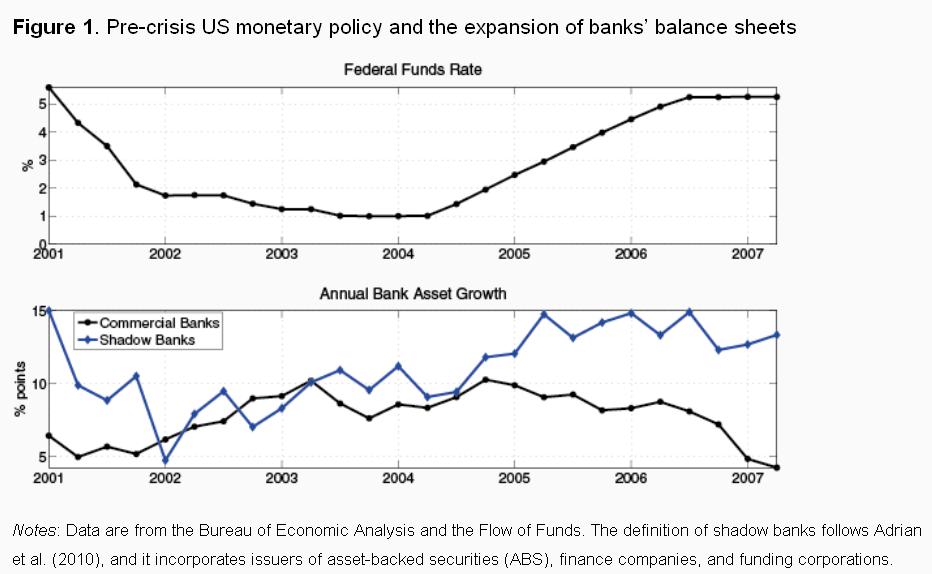

Was monetary policy an important driver of financial intermediaries’ balance sheet dynamics in the run-up to the global financial crisis? Should monetary policy have been ‘leaning against the wind’ of the rapid build-up in financial sector leverage that preceded the crisis – including that in the shadow banking sector? A popular narrative is that low US interest rates post-2001 fuelled leverage growth and prepared the ground for the global calamity of 2007–2008. It is therefore argued that monetary policy should have been tighter, particularly because its effects extend beyond the reach of more targeted regulatory tools, “get[ting] in all of the cracks” (Stein 2013).

Relevant posts:

- Gertler, M. & Karadi, P. (2015) “Monetary policy and credit costs“, VoxEU Organisation, 10 March.

- ECB (2015) Update on Economic and Monetary Developments, Economic Bulletin Issue 1/2015, European Central Bank, February.

- Niepelt, D. (2015) “Reserves for everyone – towards a new monetary regime?“, VoxEU Organisation, 21 January.