Danisewicz, Ρ., Reinhardt, D. & Sowerbutts, R. (2015) “Macroprudential spillovers: The role of organisational structure“, VoxEU Organisation, 05 March.

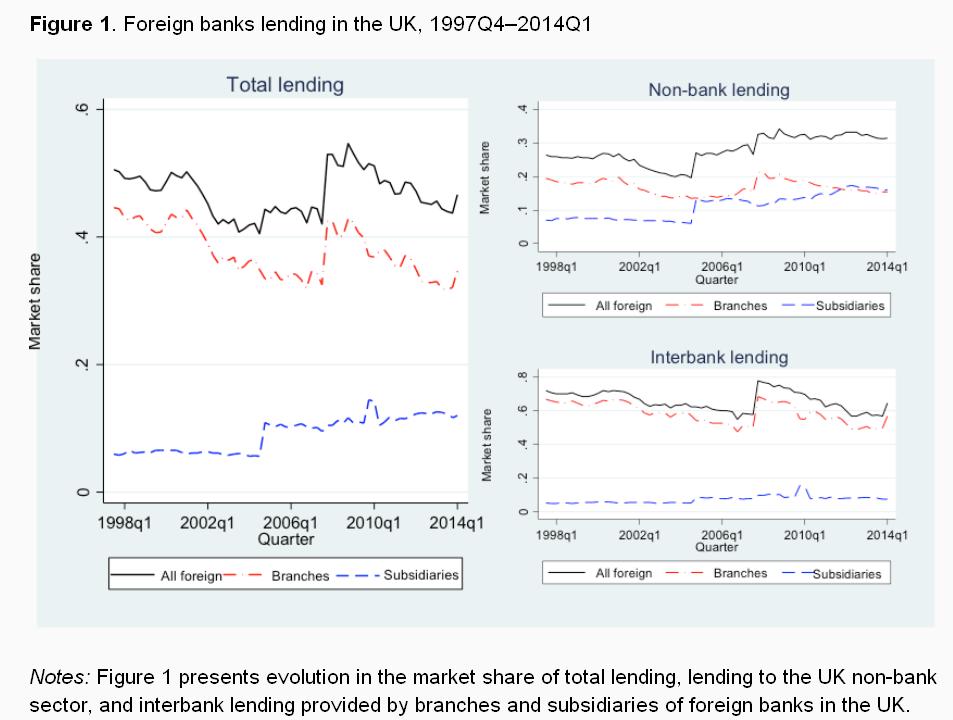

In a global financial system, macroprudential policies may create international spillovers. This column presents new evidence on how the organisational structure of a bank affects the magnitude of these spillovers. An increase in capital requirements at home causes foreign branches to reduce their lending growth to other banks operating in the UK more than foreign subsidiaries do. Seemingly, this is because branches are an integral part of the parent company.

Macroprudential policy has been described as the missing link in the broader monetary and financial policy framework (Schoenmaker 2014). Following the global financial crisis there has been considerable regulatory change, and macroprudential policies have become part of many central banks’ toolkits. The tools are being used actively – a recent IMF survey revealed over 40 countries had used some kind of macroprudential instrument already. But so far the focus of macroprudential policy has largely been domestic – we have examined the notifications and press reports that countries have made about macroprudential measures, and found that cross-border effects barely get a mention.

But a large body of research on the effects of regulatory changes shows that the spillover effects of policy can be substantial, and these effects can occur via multinational banks. Peek and Rosengren (1997, 2000) show that multinational Japanese banks retrenched their commercial, industrial, and real estate lending in the US to comply with new tighter capital regulation, with negative effects on the real economy. Aiyar et al. (2014) examine the effect of bank-specific capital requirements on foreign banks’ credit supply, and find that an increase in capital requirements of 100 basis points reduces lending abroad by 5.5 percentage points. And Houston et al. (2012) show that cross-country differences in regulation affect international bank flows as banks transfer funds to markets with fewer regulations.

Relevant posts:

- Kashyap, K. A., Tsomocos, D. & Vardoulakis, A. (2014) “Making macroprudential regulation operational“, VoxEU Organisation, 18 July.

- Mink, M. & de Haan, J. (2014) “Spillovers from systemic bank defaults“, VoxEU Organisation, 24 May.

- Houben, A., Kakes, J., (2013), “Unity in diversity: Protecting the common market with divergent macroprudential policies”, www.voxeu.org , 30 July.