World Economic Outlook (WEO) Uneven Growth: Short- and Long-Term Factors, International Monetary Fund: World Economic and Financial Surveys, 15 April 2015.

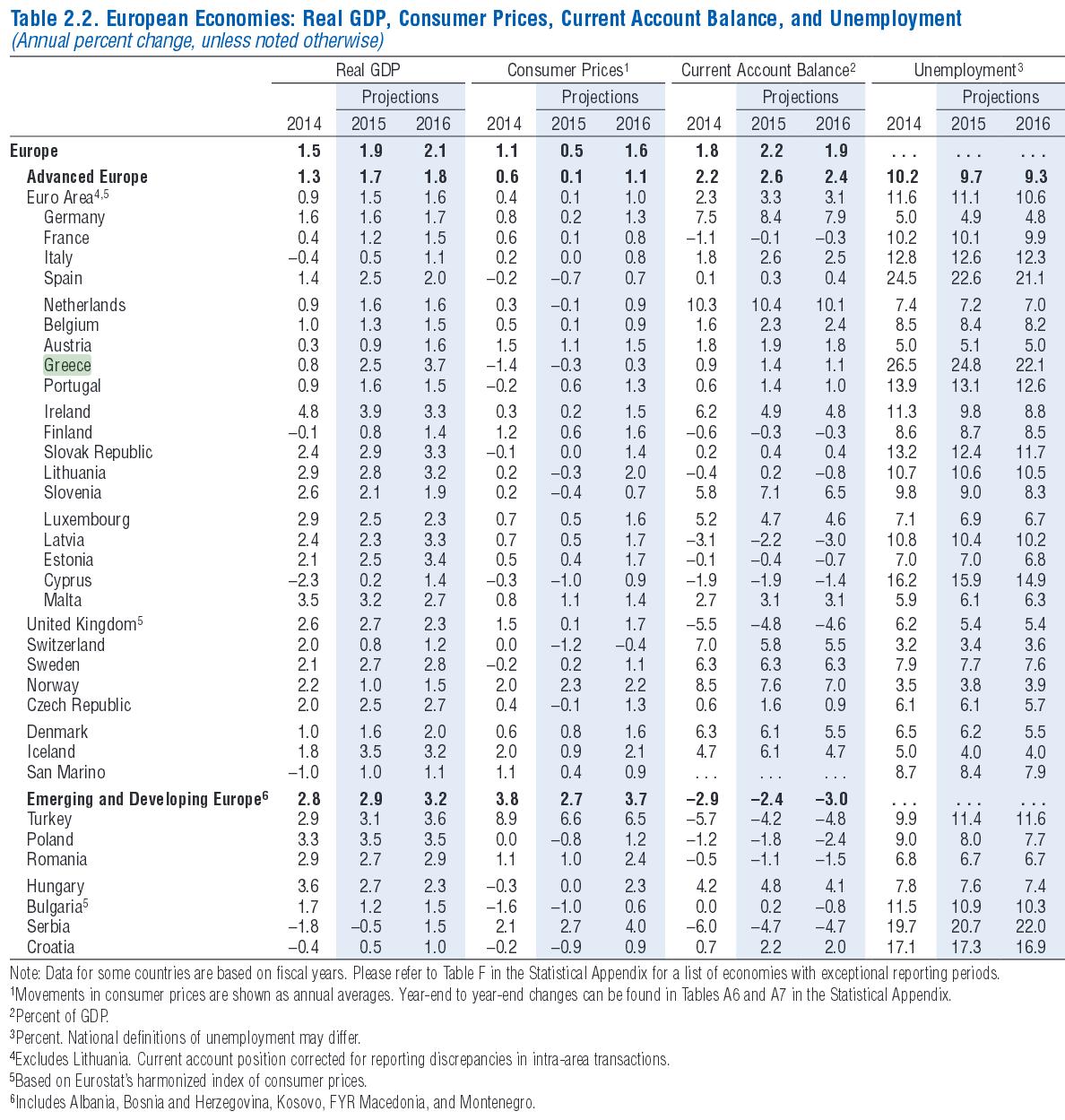

Global growth remains moderate, with uneven prospects across the main countries and regions. It is projected to be 3.5 percent in 2015, in line with forecasts in the January 2015 World Economic Outlook (WEO) Update. Relative to last year, the outlook for advanced economies is improving, while growth in emerging market and developing economies is projected to be lower, primarily reflecting weaker prospects for some large emerging market economies and oil-exporting countries.

Press Briefing with Olivier Blanchard on World Economic Outlook according to the IMF projections:

Executive Summary

A number of complex forces are shaping the outlook. These include medium- and long-term trends, global shocks, and many country- or region-specific factors:

- In emerging markets, negative growth surprises for the past four years have led to diminished expectations regarding medium-term growth prospects.

- In advanced economies, prospects for potential output are clouded by aging populations, weak investment, and lackluster total factor productivity growth. Expectations of lower potential growth weaken investment today.

- Several advanced economies and some emerging markets are still dealing with crisis legacies, including persistent negative output gaps and high private or public debt or both.

- Inflation and inflation expectations in most advanced economies are below target and are in some cases still declining—a particular concern for countries with crisis legacies of high debt and low growth, and little or no room to ease monetary policy.

- Long-term bond yields have declined further and are at record lows in many advanced economies. To the extent that this decline reflects lower real interest rates, as opposed to lower inflation expectations, it supports the recovery.

- Lower oil prices—which reflect to a significant extent supply factors—provide a boost to growth globally and in many oil importers but will weigh on activity in oil exporters.

- Exchange rates across major currencies have changed substantially in recent months, reflecting variations in country growth rates, monetary policies, and the lower price of oil. By redistributing demand toward countries with more difficult macroeconomic conditions and less policy space, these changes could be beneficial to the global outlook. The result would be less risk of more severe distress and its possible spillover effects in these economies.

The net effect of these forces can be seen in higher projected growth this year in advanced economies relative to 2014, but slower projected growth in emerging markets. Nevertheless, emerging markets and developing economies still account for more than 70 percent of global growth in 2015.

This growth outlook for emerging markets primarily reflects more subdued prospects for some large emerging market economies as well as weaker activity in some major oil exporters because of the sharp drop in oil prices. The authorities in China are now expected to put greater weight on reducing vulnerabilities from recent rapid credit and investment growth. Hence the forecast assumes a further slowdown in investment, particularly in real estate. The outlook for Brazil is affected by a drought, the tightening of macroeconomic policies, and weak private sector sentiment, related in part to the fallout from the Petrobras investigation. The growth forecasts for Russia reflect the economic impact of sharply lower oil prices and increased geopolitical tensions. For other emerging market commodity exporters, the impact of lower oil and other commodity prices on the terms of trade and real incomes is projected to take a toll on medium-term growth. Growth in emerging markets is expected to pick up in 2016, driving an increase in global growth to 3.8 percent, mostly reflecting some waning of downward pressures on activity in countries and regions with weak growth in 2015, such as Russia, Brazil, and the rest of Latin America.

In many emerging market and developing economies, macroeconomic policy space to support growth remains limited. In oil importers, however, lower oil prices will reduce inflation pressure and external vulnerabilities, and in economies with oil subsidies, the lower prices may provide some fiscal space or, where needed, scope to strengthen fiscal positions. Oil exporters have to absorb a large terms-of-trade shock and face greater fiscal and external vulnerabilities. Those with fiscal space can allow public spending to adjust gradually to lower oil revenues. In oil-exporting countries with some exchange rate flexibility, a depreciation would facilitate the adjustment. Emerging market and developing economies also have an important structural reform agenda, including measures to support capital accumulation (such as removing infrastructure bottlenecks, easing limits on trade and investment, and improving business conditions) and raise labor force participation and productivity (through reforms to education, labor, and product markets). And lower oil prices offer an opportunity to reform energy subsidies but also energy taxation (including in advanced economies).

Advanced economies are generally benefiting from lower oil prices. Growth in the United States is projected to exceed 3 percent in 2015–16, with domestic demand supported by lower oil prices, more moderate fiscal adjustment, and continued support from an accommodative monetary policy stance, despite the projected gradual rise in interest rates and some drag on net exports from recent dollar appreciation. After weak second and third quarters in 2014, growth in the euro area is showing signs of picking up, supported by lower oil prices, low interest rates, and a weaker euro. And after a disappointing 2014, growth in Japan is also projected to pick up, sustained by a weaker yen and lower oil prices.

In an environment of moderate and uneven growth, raising actual and potential output continues to be a policy priority in advanced economies. In many of these economies, the main macroeconomic policy issues are the persistent and sizable output gaps, as well as disinflation dynamics, which, as discussed in earlier WEO reports, pose risks to activity where monetary policy is constrained at the zero lower bound. Accommodative monetary policy—including through unconventional means—remains essential to prevent real interest rates from rising, and the recent decision by the European Central Bank to expand its asset purchase program through sovereign asset purchases is welcome. A strong case can be made for increased infrastructure investment in some advanced economies and for structural economic reforms more generally. Priorities vary, but many of these economies would benefit from reforms to strengthen labor force participation and trend employment, given aging populations, as well as measures to tackle private debt overhang.

The distribution of risks to global growth is now more balanced relative to the October 2014 WEO, but still tilted to the downside. A greater lift to demand from oil prices is a significant upside risk. The most salient downside risks identified in the October 2014 WEO remain relevant, however. Geopolitical tensions could intensify, affecting major economies. Disruptive asset price shifts in financial markets remain a concern. Term and other risk premiums in bond markets are still low in historical terms, and the context underlying this asset price configuration—very accommodative monetary policies in the major advanced economies—is expected to start changing in 2015. Triggers for turmoil include changing expectations about these elements as well as unexpected portfolio shifts more broadly. A further sharp dollar appreciation could trigger financial tensions elsewhere, particularly in emerging markets. Risks of stagnation and low inflation in advanced economies are still present, notwithstanding the recent upgrade to the near-term growth forecasts for some of these economies.

Relevant posts:

- World Economic Outlook Update, International Monetary Fund, January 2015.

- World Employment and Social Outlook – Trends 2015 (full report), International Labour Organization, January 2015.

- IMF, (2013), World Economic Outlook-Update, July.