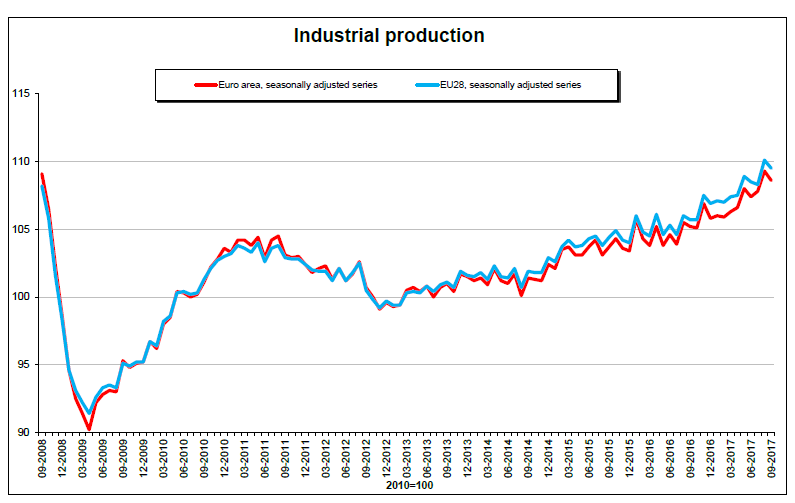

Eurostat/Industrial production down by 0.6% in euro area/14 November 2017 In September 2017 compared with August 2017, seasonally adjusted industrial production fell by 0.6% in the euro area (EA19) and by 0.5% in the EU28, according to estimates from Eurostat, the statistical office of the European Union. In August 2017, industrial production rose by 1.4% in the euro area and by 1.7% in the EU28. Relevant Posts Eurostat/Industrial production up by 0.5% …Read More

Euro area international trade in goods surplus €26.4 bn

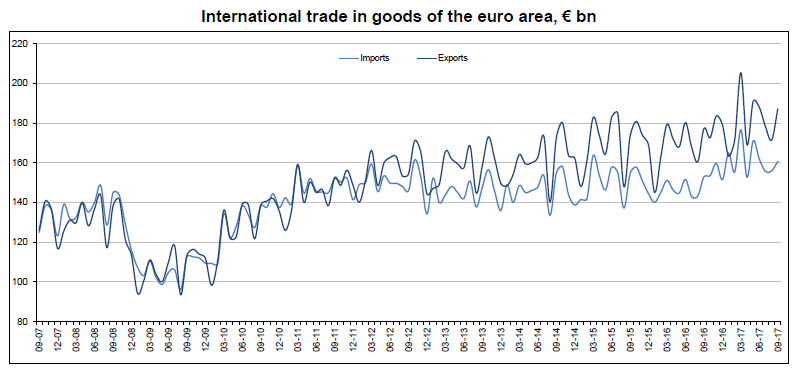

Eurostat/Euro area international trade in goods surplus €26.4 bn/15 November 2017 The first estimate for euro area (EA19) exports of goods to the rest of the world in September 2017 was €187.1 billion, an increase of 5.6% compared with September 2016 (€177.2 bn). Imports from the rest of the world stood at €160.7 bn, a rise of 5.1% compared with September 2016 (€152.9 bn). As a result, the euro area recorded a …Read More

Rescuing Economics From Neoliberalism

Dani Rodrik, (2017), “Rescuing Economics From Neoliberalism”, Social Europe, 17 November As even its harshest critics concede, neoliberalism is hard to pin down. In broad terms, it denotes a preference for markets over government, economic incentives over social or cultural norms, and private entrepreneurship over collective or community action. It has been used to describe a wide range of phenomena—from Augusto Pinochet to Margaret Thatcher and Ronald Reagan, from the …Read More

Basel III and Bank-Lending: Evidence from the United States and Europe

Sami Ben Naceur, Caroline Roulet, (2017), “Basel III and Bank-Lending: Evidence from the United States and Europe”, IMF Working Paper No.17/245, 15 November Using data on commercial banks in the United States and Europe, this paper analyses the impact of the new Basel III capital and liquidity regulation on bank-lending following the 2008 financial crisis. We find that U.S. banks reinforce their risk absorption capacities when expanding their credit activities. …Read More

Sovereign Concentration Charges: A New Regime for Banks’ Sovereign Exposures

Nicolas Veron, (2017), “Sovereign Concentration Charges: A New Regime for Banks’ Sovereign Exposures”, Bruegel, 17 November Europe’s banking union has been central to the resolution of the euro-area crisis. It has had an encouraging start but remains unfinished business. If it remains in its current halfway-house condition, it may eventually move backwards and fail. EU leaders should seize these opportunities Relevant Posts Kizys, Renatas, Paltalidis, Nikos, Vergos, Konstantinos, (2015), «Bailouts …Read More

EU children at risk of poverty or social exclusion

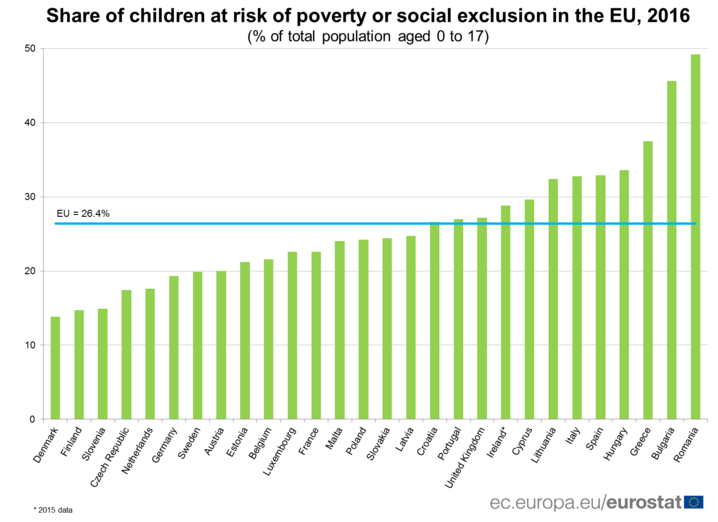

Eurostat/EU children at risk of poverty or social exclusion/20 November 2017 In 2016, 24.8 million children in the European Union (EU), or 26.4% of the population aged 0 to 17, were at risk of poverty or social exclusion. This means that the children were living in households with at least one of the following three conditions: at-risk-of-poverty after social transfers (income poverty), severely materially deprived or with very low work …Read More

Confidence in euro zone expansion strong among economists

Mumal Rathore, Shrutee Sarkar, (2017), “Confidence in euro zone expansion strong among economists”, Reuters, 17 November The euro zone economy will mark its best year in a decade and maintain solid growth well into 2018, according to economists in a Reuters poll who said the risk was that their forecasts might not be optimistic enough. Inflation, last clocked at 1.4 percent, is expected to stay below the European Central Bank’s target …Read More

Annual inflation down to 1.4% in the euro area

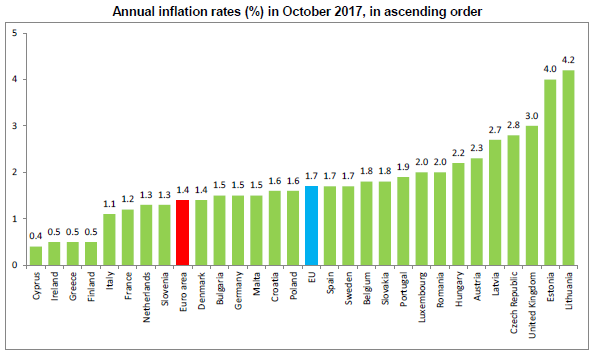

Eurostat/Annual inflation down to 1.4% in the euro area/16 November 2017 Euro area annual inflation was 1.4% in October 2017, down from 1.5% in September. In October 2016, the rate was 0.5%. European Union annual inflation was 1.7% in October 2017, down from 1.8% in September. A year earlier the rate was 0.5%. These figures come from Eurostat, the statistical office of the European Union. Relevant Posts Eurostat/Euro area annual inflation down …Read More

The Incredible Shrinkage Of The Greek Banking Sector

Kleingut, (2017), “The Incredible Shrinkage Of The Greek Banking Sector”, Observing Greece, 14 Νovember The Greek banking sector has undergone massive changes since the crisis culminated with the First Memorandum in the spring of 2010. The tables below show how the aggregated assets, liabilities and equity of all Greek banks (excluding the Bank of Greece) developed between June 2015 and September 2017. It should be noted that these are aggregated …Read More

Fiscal Spillovers in the Euro Area: Letting the Data Speak

Era Dabla-Norris, Pietro Dallari, Tigran Poghosyan, (2017), “Fiscal Spillovers in the Euro Area: Letting the Data Speak”, IMF Working Paper No. 17/241, 15 Νovember We estimate a panel VAR model that captures cross-country, dynamic interlinkages for 10 euro area countries using quarterly data for the period 1999-2016. Our analysis suggests that fiscal spillovers are significant and tend to be larger for countries with close trade and financial links as well, as for fiscal …Read More