Gregory Claeys, (2017), “The missing pieces of the euro architecture”, Bruegel, 26 October What are the remaining fragilities of the Euro architecture? This policy contribution assesses the institutional reforms put in place during and after the crisis and make some proposals for a coherent economic governance framework to make Europe’s monetary union more resilient. Relevant Posts Buti, Marco, Deroose, Servaas, Leandro, José, Giudice, Gabriele, (2017), «Completing EMU», VoxEU, 13 July …Read More

Economic Growth Is No Longer Enough

Manuel Muniz, (2017), “Economic Growth Is No Longer Enough”, Project Syndicate, 25 October As new technologies subject the world’s economies to massive structural change, wages are no longer playing the central redistributive role they once did. Unless the decoupling of productivity and wages is addressed, the political convulsions many countries are experiencing will only intensify. Relevant Posts Tsirigotakis, Ilias, Bakalis, Panagiotis, Ioannidis, Lazaros, Karanianni, Vasiliki, (2017), «Global growth enters Q4:2017 …Read More

A European Monetary Fund

Simon Wren-Lewis, (2017), “A European Monetary Fund”, Mainlymacro.blogspot.gr, 25 October Sapir and Schoenmaker at Bruegel have a discussion of what a European version of the IMF might look like and do. Here are my thoughts on the sovereign debt (not banking) side, which I am sure will be regarded once again as radical and will therefore be ignored.I think some new Eurozone institution is necessary, but not for the reason that …Read More

Euro-Zone Tapering Is a Delicate Task

Bloomberg View, (2017), “Euro-Zone Tapering Is a Delicate Task”, 25 Οctober On Thursday, the European Central Bank is expected to announce changes to its program of quantitative easing. The threat of outright deflation in the euro zone has eased, so changes are indeed required. The ECB should start getting monetary policy back to normal by scaling back its asset purchases.This could be a delicate task. Inflation is still well below …Read More

Two percent or not two percent? Interpreting the ECB’s definition of price stability

Maritta Paloviita, Markus Haavio, Pirkka Jalasjoki, Juha Kilponen, (2017), “Two percent or not two percent? Interpreting the ECB’s definition of price stability”,VoxEu, 24 October In 1998, the ECB’s Governing Council defined price stability as “a year-on-year increase in the Harmonised Index of Consumer Prices (HICP) for the euro area of below 2%”. In 2003, the Governing Council clarified that “in the pursuit of price stability it aims to maintain inflation rates …Read More

Elusive inflation and the Great Recession

David Miles, Ugo Panizza, Ricardo Reis, Ángel Ubide (2017), “Elusive inflation and the Great Recession”, VoxEU,25 October The chair of the Federal Reserve, Janet Yellen, recently stated that “[t]he biggest surprise in the US economy this year has been inflation” (Yellen 2017). The Federal Reserve expected that the rapid decline in unemployment – from 4.8% in January to 4.2% in September, below the Federal Reserve’s estimate of the natural rate of …Read More

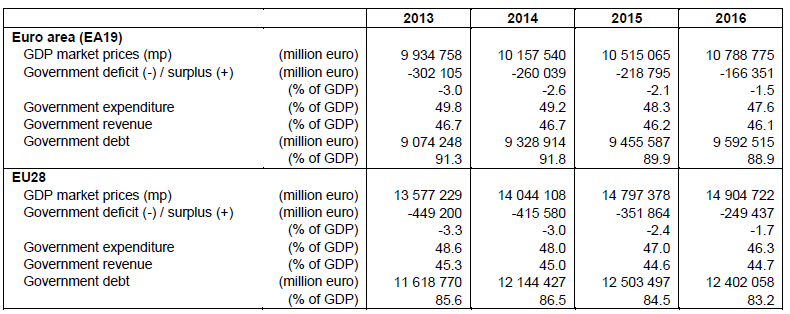

Euro area and EU28 government deficit at 1.5% and 1.7% of GDP respectively

Eurostat/Euro area and EU28 government deficit at 1.5% and 1.7% of GDP respectively/23 Οκτωβρίου,2017 n 2016, the government deficit and debt of both the euro area (EA19) and the EU28 decreased in relative terms compared with 2015. In the euro area the government deficit to GDP ratio fell from 2.1% in 2015 to 1.5% in 2016, and in the EU28 from 2.4% to 1.7%. In the euro area the government debt to GDP …Read More

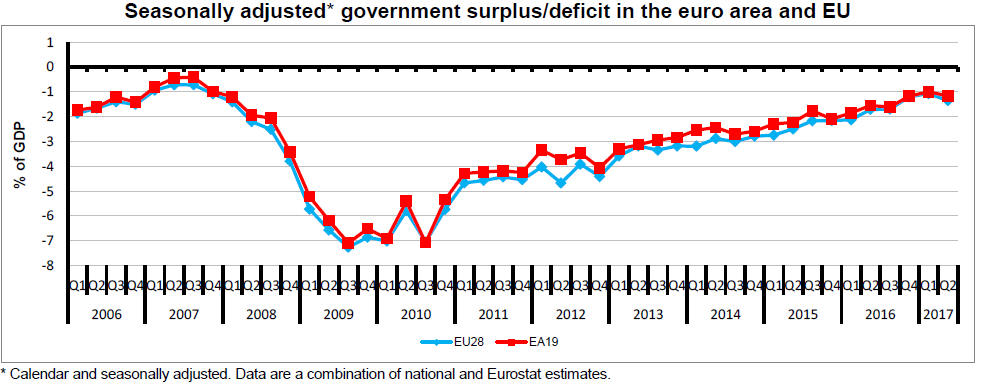

Seasonally adjusted government deficit up to 1.2% of GDP in the euro area

Eurostat/Seasonally adjusted government deficit up to 1.2% of GDP in the euro area/24 Οctober,2017 In the second quarter of 2017, the seasonally adjusted general government deficit to GDP ratio stood at 1.2% in the euro area (EA19), an increase compared with 1.0% in the first quarter of 2017. In the EU28, the deficit to GDP ratio stood at 1.3%, an increase compared with 1.1% in the previous quarter. Relevant Posts Eurostat/Seasonally adjusted …Read More

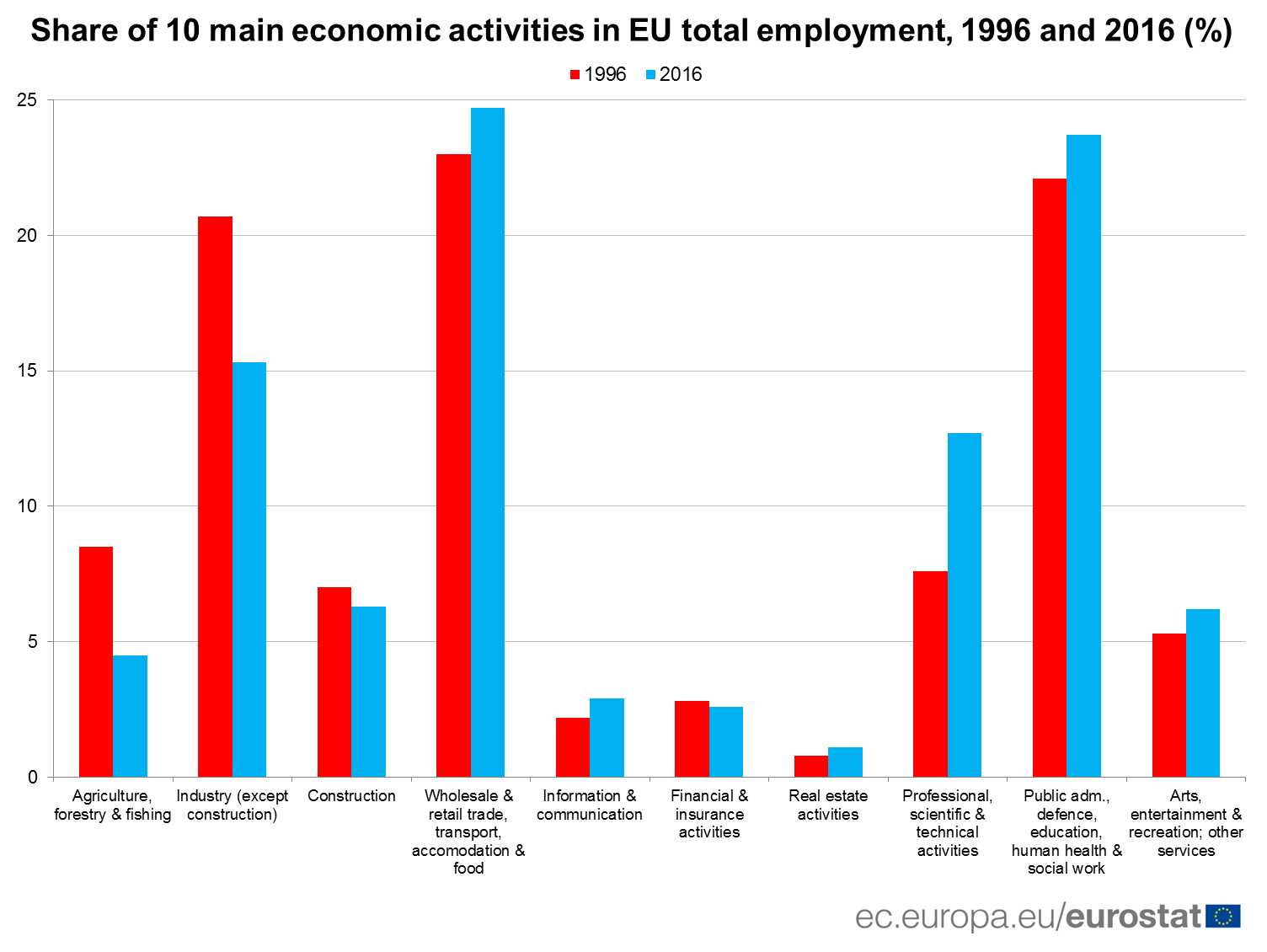

Which sector is the main employer in the EU Member States?

Eurostat/”Which sector is the main employer in the EU Member States?”/24 October,2017 In 2016, almost half of employment in the European Union (EU) was concentrated in two economic activities: “Wholesale and retail trade, transport, accommodation and food services” (24.7%) and “Public administration, defence, education, human health and social work activities” (23.7%). Both activities have seen their respective share in total employment increase slightly over the last 20 years. In contrast, …Read More

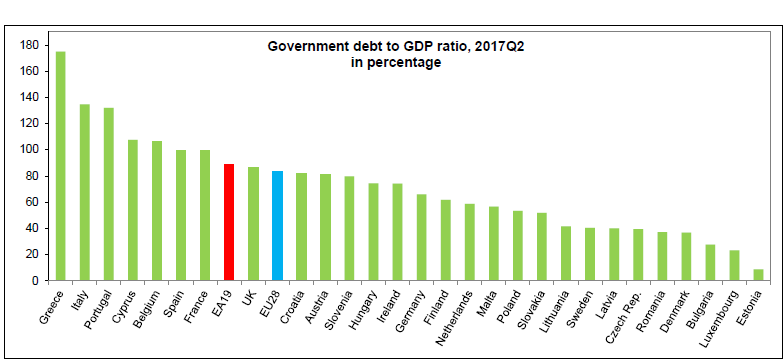

Government debt slightly down to 89.1% of GDP in euro area

Eurostat/Government debt slightly down to 89.1% of GDP in euro area/24 October,2017 At the end of the second quarter of 2017, the government debt to GDP ratio in the euro area (EA19) stood at 89.1%, compared with 89.2% at the end of the first quarter of 2017. In the EU28, the ratio also decreased, from 83.6% to 83.4%. Compared with the second quarter of 2016, the government debt to GDP …Read More