European Commission, Economic and Financial Affairs, (2017), “Investment in the EU Member States: An Analysis of Drivers and Barriers”, Institutional Paper 062, October The EU is entering its fifth consecutive year of growth. GDP is now higher than before the crisis and the employment rate has increased, thanks in part to reforms in a number of Member States. However, the investment rate is still below its pre-crisis average and is …Read More

Output of economic activities in the EU Member States

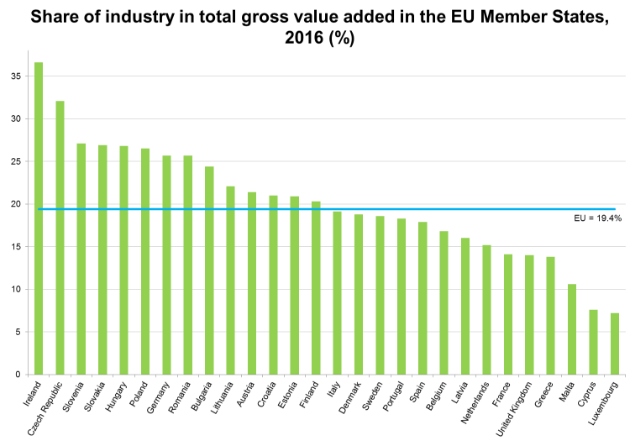

Eurostat/Output of economic activities in the EU Member States/23 October 2017 In 2016, industry was still the largest economic activity in the European Union (EU) in terms of output generated. It accounted for 19.4% of EU total gross value added (GVA), immediately ahead of the economic activities “Wholesale and retail trade, transport, accommodation and food services” (19.0%) and “Public administration, defence, education, human health and social work activities” (18.8%). “Real estate activities” …Read More

Central Bank Independence Requires Accountability

Giugliano Ferdinando, (2017), “Central Bank Independence Requires Accountability”, Bloomberg View, 23 October The appointment of Italy’s new central bank governor has turned into a depressing power struggle. But for all the elements that make this a uniquely Italian affair, it also raises broader questions about how a country should balance independence and accountability in the event of a possible central bank failure. Relevant Posts Transparency International EU, (2017), «TWO SIDES …Read More

Business cycle stabilisation in the Eurozone: Ways forward

Giancarlo Corsetti, Luca Dedola, Marek Jarocinski, Bartosz Mackowiak, Sebastian Schmidt, (2017), “Business cycle stabilisation in the Eurozone: Ways forward”, VoxEU, 23 October Business cycle stabilisation policy in the Eurozone may end up being far from optimal if member states must tighten fiscal policy amid weak economic activity while monetary policy is constrained by the lower bound on nominal interest rates. This column surveys the recent literature formulating practical lessons for …Read More

Spotting excessive regional house price growth and what to do about it

Gregory Claes, Konstantinos Efstathiou, Dirk Schoenmaker, (2017), “Spotting excessive regional house price growth and what to do about it”, Bruegel, 18 October Rapidly rising house prices are a well-known source of financial instability. This Policy Contribution examines whether there are regional differences in house price growth within European countries and, if so, whether this warrants more targeted measures to address vulnerabilities. Relevant Posts Kregel, Jan, (2017), «A Two-Tier Eurozone or …Read More

Greek Banks Face ‘Gangs’ in Bad-Loans Battle With Defaulters

Sotiris Nikas, Christos Ziotis, Stefania Spezzati, (2017), “Greek Banks Face ‘Gangs’ in Bad-Loans Battle With Defaulters”, Bloomberg, 19 October When Eurobank Ergasias SA, Greece’s third-biggest lender, recently went after a “strategic defaulter,” angry protesters stormed the courtroom to block its foreclosure attempt. The defaulter, whose name the lender won’t disclose, had not serviced its loans for the last five years and owed the bank 4.85 million euros ($5.7 million). Over the …Read More

Why it’s not so simple to make the EU simpler

Toshkov, Dimiter, (2017), “Why it’s not so simple to make the EU simpler”, LSE EUROPP, 18 October The EU’s institutional architecture is often regarded as being too complex for citizens to properly engage with, and both Jean-Claude Juncker and Emmanuel Macron have recently proposed some form of simplification such as merging the President of the European Commission with the President of the European Council, or reducing the size of the …Read More

Bail-ins and bailouts: Incentives, connectivity, and systemic stability

Bernard, Benjamin, Capponi, Agostino, Stiglitz, Joseph, (2017), “Bail-ins and bailouts: Incentives, connectivity, and systemic stability”, VoxEU, 18 October Worried about the cost of public bailouts, governments have proposed bail-ins whereby banks contribute to rescuing their debtors. This column analyses the conditions under which bail-in strategies can be credibly implemented, showing that this heavily depends on the network structure. While earlier work has suggested that denser networks are socially preferred to …Read More

Central banks: Evolution and innovation in historical perspective

Bordo, Michael, Siklos, Pierre, (2017), “Central banks: Evolution and innovation in historical perspective”, VoxEU, 17 October The role of central banks in monetary policy and financial stability has changed radically over time. This examines the similarities and idiosyncrasies of ten central banks, and also considers how inflation might have looked had the central banks been around earlier, or had they adopted different strategies. While important differences between the narrative and …Read More

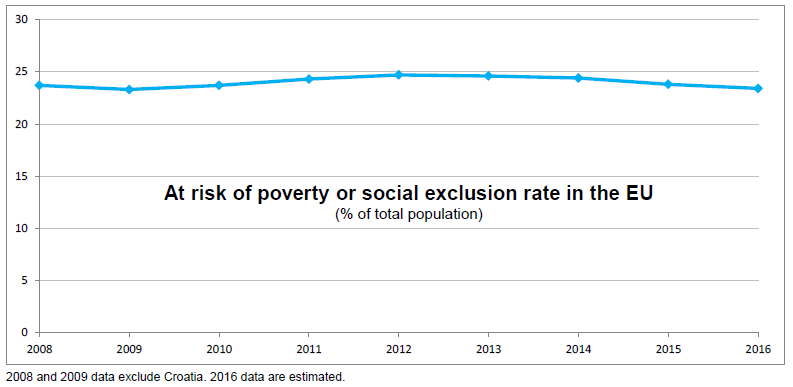

Downward trend in t he share of persons at risk of poverty or social exclusion in the EU

Eurostat/Downward trend in the share of persons at risk of poverty or social exclusion in the EU/16 October 2017 Among Member States for which data are available, the at-risk-of-poverty or social exclusion rate has grown from 2008 in ten Member States, with the highest increases being recorded in Greece (from 28.1 % in 2008 to 35.6% in 2016, or +7.5 percentage points), Cyprus(+4.4 pp), Spain (+4.1 pp) and Sweden (+3.4 …Read More