Merler, Sylvia, (2015), “Preserving the Greek financial sector: options for recap and assistance”, Bruegel publications, 13 July The draft text discussed in the Eurogroup yesterday suggests that the potential package for Greece would include 10 to 25bn for the banking sector in order to address potential recapitalisation needs. Rumours this morning suggest the banks would then become part of a new asset fund and sold off to pay down debt. …Read More

Greece: Past Critiques and the Path Forward

Blanchard, Olivier, (2015), “Greece: Past Critiques and the Path Forward”, IMF Direct, 9 July All eyes are on Greece, as the parties involved continue to strive for a lasting deal, spurring vigorous debate and some sharp criticisms, including of the IMF.In this context, I thought some reflections on the main critiques could help clarify some key points of contention as well as shine a light on a possible way forward. …Read More

Lessons for Greece: Forcible currency conversions from 1982 to 2015

Reinhart, Carmen, (2015), “Lessons for Greece: Forcible currency conversions from 1982 to 2015”, Voxeu, 9 July Contrary to the intent of the designers of what was to be an irreversible currency union, Greece may well exit the Eurozone. This column argues that default does not inevitably trigger the introduction of a new currency (or the re-activation of an old one). However, if ‘de-euroisation’ is the end game, then a forcible …Read More

Europe’s Greek Failure

Gros, Daniel, (2015), “Europe’s Greek Failure”, Project Syndicate, 9 July Narratives matter, especially when they are intertwined with hard interests. As Greece and its creditors court catastrophe, we are getting a clear picture of how conflicting narratives can lead to a lose-lose result. The facts are indisputable. In early 2010, when the Greek government could no longer finance itself, it turned to its European partners and the International Monetary Fund …Read More

A Pain in the Athens

Blyth, Mark, (2015), “A Pain in the Athens”, Foreign Affairs Journal, 7 July When the anti-austerity party Syriza came to power in Greece in January 2015, Cornel Ban and I wrote in a Foreign Affairs article that, at some point, Europe was bound to face an Alexis Tsipras, the party’s leader and Greek prime minister, “because there’s only so long you can ask people to vote for impoverishment today based …Read More

The Greek Vote and the EU Miscalculation

Friedman, George, (2015), “The Greek Vote and the EU Miscalculation“, Stratfor Geopolitical Weekly, 7 July In a result that should surprise no one, the Greeks voted to reject European demands for additional austerity measures as the price for providing funds to allow Greek banks to operate. There are three reasons this should have been no surprise. First, the ruling Coalition of the Radical Left, or Syriza party, is ruling because it …Read More

Joseph E. Stiglitz: The U.S. Must Save Greece

(2015), “Joseph E. Stiglitz: The U.S. Must Save Greece”, Time Journal, 9 Ιουλίου As the Greek saga continues, many have marveled at Germany’s chutzpah. It received, in real terms, the largest bailout and debt reduction in history andunconditional aid from the U.S. in the Marshall Plan. And yet it refuses even to discuss debt relief. Many, too, have marveled at how Germany has done so well in the propaganda game, …Read More

A Few Clarifications About Greece And ELA

Fazi, Thomas, (2015), “A Few Clarifications About Greece And ELA”, Social Europe Journal, 8 July A good part of the media (most notably in Germany) is framing the ECB’s emergency liquidity operations in Greece as ‘the ECB extending credits to Greek banks’. This is a huge misrepresentation of reality. The ECB is actually doing little more than what all central banks do (and, moreover, what it is legally bound to …Read More

The IMF’s Preliminary Draft Debt Sustainability Analysis: what does it mean?

Monastiriotis, Vassilis, (2015), “The IMF’s Preliminary Draft Debt Sustainability Analysis: what does it mean?”, LSE blog, 3 July The release of the latest analysis by the IMF on the sustainability of the Greek debt, which states loudly that Greece will need not only a hefty new bailout but also a further debt restructuring, fueled again the literature, in traditional and social media, about the motives behind the insistence of the European …Read More

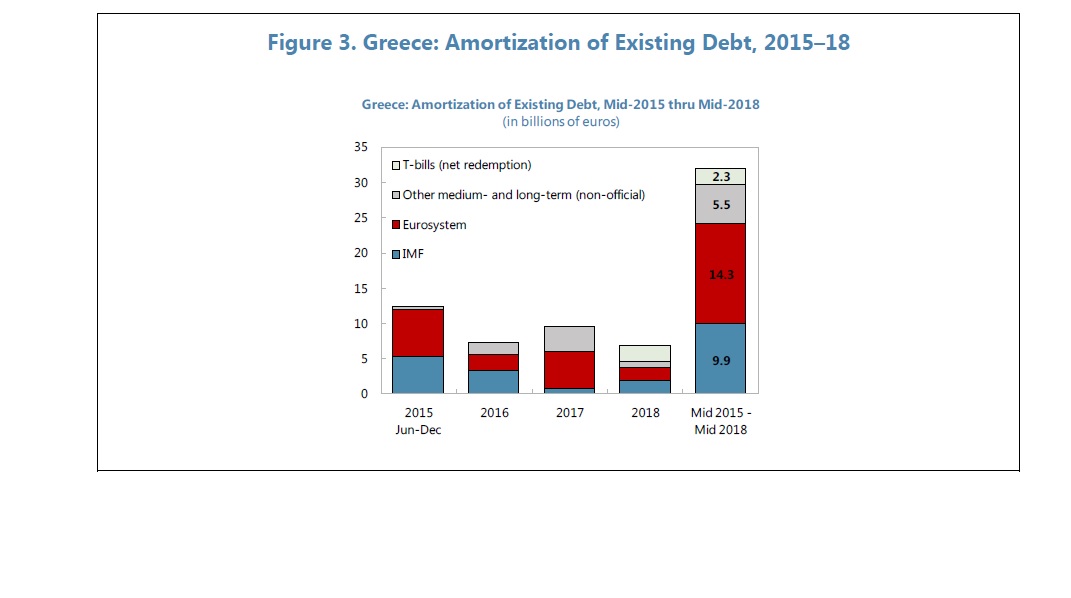

Greece-Preliminary Draft Debt Sustainability Analysis

At the last review in May 2014, Greece’s public debt was assessed to be getting back on a path toward sustainability, though it remained highly vulnerable to shocks. By late summer 2014, with interest rates having declined further, it appeared that no further debt relief would have been needed under the November 2012 framework, if the program were to have been implemented as agreed. But significant changes in policies since …Read More