Giugliano, Ferdinando, (2017), “Italy Is Europe’s Next Big Problem”, Bloomberg View, 2 Μαΐου Emmanuel Macron looks on course to become France’s new president, ending the threat of a euroskeptic at the Elysee. Even if Macron wins, though, it’ll be too soon to celebrate a new phase of stability in the euro zone. Across the Alps, an economic and political storm is brewing — and there’s no sign anyone can stop it. …Read More

Central Bank Legal Frameworks in the Aftermath of the Global Financial Crisis

Khan, Ashraf, (2017), “Central Bank Legal Frameworks in the Aftermath of the Global Financial Crisis”, IMF, 1 Μαΐου Central banking is subject to ongoing changes, even more so since the Global Financial Crisis. Noteworthy developments include, for instance, the usage of unconventional monetary policies in many advanced economies, which in part, led to significant expansion and diversification of central banks’ balance sheets. Moreover, discussions on the mandates of central banks, …Read More

The real economic benefits of easy central bank access: Evidence from the Great French Wine Blight

Bignon, Vincent, Jobst, Clemens, (2017), “The real economic benefits of easy central bank access: Evidence from the Great French Wine Blight”, Vox Eu, 30 Απριλίου Who should have access to central bank refinancing and which assets should be eligible for central bank operations? As the Bank for International Settlements recently noted in 2013 and 2015, the answers to these questions vary widely among central banks (BIS 2013, BIS-CGFS 2015). Some …Read More

Twenty years on: Is there still a case for Bank of England independence?

Balls, Ed, Stansbury, Anna, (2017), “Twenty years on: Is there still a case for Bank of England independence?”, Vox Eu, 1 Μαίου Twenty years ago on 6 May 1997, the Bank of England was made independent by the new Labour government. Alongside the world’s other major central banks, this independence was until recently unchallenged (and unchallengeable): a central pillar of the global consensus on macroeconomic stabilisation. But since the financial …Read More

Reprieve or Reform in Europe?

Spence, Michael, (2017), “Reprieve or Reform in Europe?”, Project Syndicate, 29 Απριλίου With the pro-EU Macron seemingly headed toward the Élysée Palace – the establishment candidates on the right and the left who lost in the first round have already endorsed him – the immediate threat to the EU and the eurozone seems to have subsided. But this is no time for complacency. Unless Europe addresses flaws in growth patterns …Read More

From EU Governance of Crisis to Crisis of EU Governance: Regulatory Failure, Redistributive Conflict and Eurosceptic Publics

Borzel, Tanja, A., (2016), ” From EU Governance of Crisis to Crisis of EU Governance: Regulatory Failure, Redistributive Conflict and Eurosceptic Publics”, Journal of Common Market Studies 54(S1), 8-31, 16 Αυγούστου Financial crisis, euro crisis, Greek crisis, Crimean crisis, Ukraine crisis, Syria crisis, migration crisis – even the greatest optimist cannot deny that Europe has been suffering through a whole series of crises ever since the Lehman Brothers bank collapsed …Read More

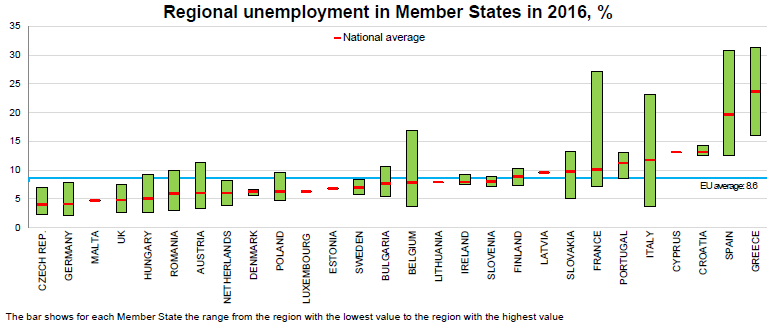

Unemployment rates in the EU regions ranged from 2.1% to 31.3%

Eurostat/Unemployment rates in the EU regions ranged from 2.1% to 31.3%/27 Απριλίου 2017 More than 80% of the NUTS 2 regions of the European Union (EU) saw their unemployment rate fall in 2016 compared with 2015, and around 60% recorded a decrease of at least 0.5 percentage points. However, regional unemployment rates continued to vary widely across the EU regions, with the lowest rates recorded in Niederbayern (2.1%) in Germany …Read More

Drivers of the post-crisis slump in the Eurozone and the US

Kollmann, Robert, Pataracchia, Beatrice, Raciborski, Rafal, Ratto, Marco, Roeger, Werner, Vogel, Lukas, (2017), “Drivers of the post-crisis slump in the Eurozone and the US “, VoxEU, 27 Απριλίου The Global Crisis led to a sharp contraction and long-lasting slump in both Eurozone and US real activity, but the post-crisis adjustment in the Eurozone and the US shows striking differences. This column argues that financial shocks were key determinants of the …Read More

Internal devaluation in currency unions: the role of trade costs and taxes

Petroulakis, Filippos, (2017), “Internal devaluation in currency unions: the role of trade costs and taxes”, European Central Bank Working Paper Series No 2049, Απριλίος This paper studies export adjustment to negative shocks in currency unions. I consider the hitherto ignored role of trade costs and taxes in internal devaluations, which have been brought to the fore of international policy during the recent euro periphery crisis. Trade costs can limit the …Read More

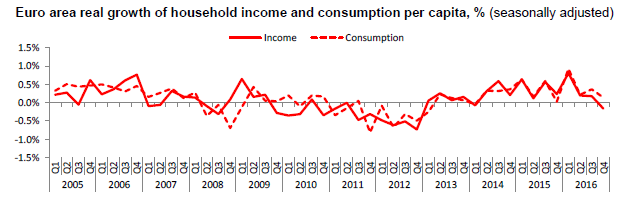

Household real income per capita down in the euro area but up in the EU28-Fourth quarter of 2016

Eurostat/Household real income per capita down in the euro area but up in the EU28-Fourth quarter of 2016/28 Απριλίου 2017 In the euro area, in real terms, household income per capita decreased by 0.2% in the fourth quarter of 2016, after an increase of 0.2% in the previous quarter. Household real consumption per capita increased by 0.1% in the fourth quarter of 2016, after an increase of 0.4% in the …Read More